Advocates of the Department of Labor's fiduciary standard are pushing back against the Trump administration's bid to potentially revise or repeal the rule, launching a campaign to highlight the financial toll that investors saving for retirement could face as the regulation is delayed.

The campaign comes a day after the

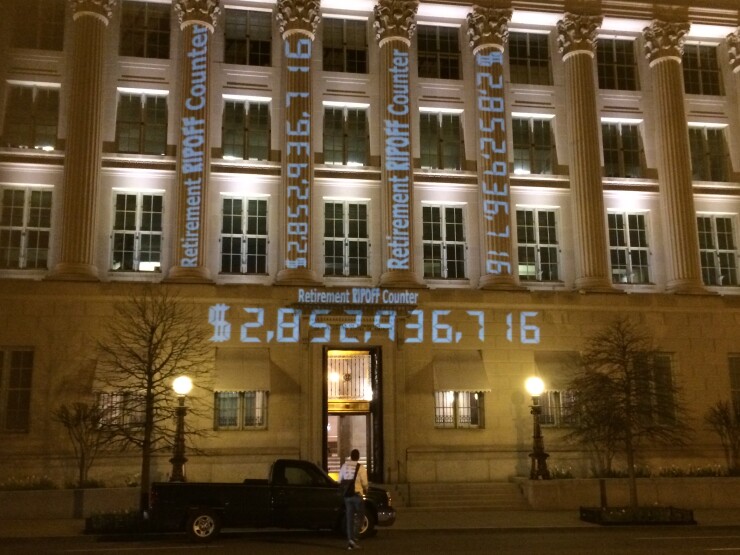

Supporters chose a dramatic visual in the form of a

Conflicts of interest around retirement planning and products cost retirement savers $17 billion annually, according to Obama administration calculations.

"The Department of Labor's fiduciary rule was written to stop those losses, but the Trump administration painted a target on the rule," Lisa Donner, executive director of the advocacy group Americans for Financial Reform, told reporters at a news conference on Capitol Hill.

-

The Labor Department will now conduct a review with an eye toward amending or rescinding it.

April 4 -

One planner says there's no reasonable basis for a delay, while another says he can't afford all the compliance costs.

March 16 -

A higher standard of client care can still be enforced in the marketplace, fiduciary supporters say.

March 23

The clock, with its fast-ticking digits, is the visual centerpiece of a campaign that seeks to put the costs of blocking the rule "on a slightly more human scale," Donner said.

Organizers said that the clock, in various forms, will show up in locations around Washington and in other parts of the country in a bid to pressure lawmakers to oppose attempts to further delay, water down or kill the fiduciary rule.

In addition to that grass-roots initiative, fiduciary proponents are trying to marshal advocacy efforts at all three branches of the government. That work begins at the Labor Department with meetings, the submission of comment letters and other efforts to preserve the rule, said Stephen Hall, legal director and securities specialist at non-profit financial reform organization Better Markets.

"That's important not just to try to influence what the agency decides ultimately to do, it also helps create the record — the record for purposes of judicial review," Hall said at the press conference. "One of the critical battlegrounds on this effort is going to be in the courts."

Already, the regulation has come under scrutiny in a variety of lawsuits seeking to overturn the measure.

Hall also called on fiduciary supporters to "keep vigilant eyes out on the Hill" as legislative efforts to derail the rule emerge or resurface.

UNDER FIRE

The regulation has come under fire from leading trade groups representing the financial services sector, including SIFMA and the Insured Retirement Institute, which both praised the delay but also expressed disappointment that the DoL did not go further to slow the rule.

Under the department's announcement, certain provisions, such as aspects of the so-called best interest contract exemption that provides a mechanism for delivering conflicted advice, would become applicable June 9, while the industry groups were hoping for a longer delay that would push the applicability date out to next January.

Supporters of the fiduciary regulation see it the other way. The announcement of a 60-day delay called for further study on the regulation’s impact, which Sen. Elizabeth Warren (D-Mass.) called a "sham" in light of the voluminous comment record the DoL amassed, along with four days of open hearings and a lengthy report it issued on the matter.

Moreover, Warren noted that many firms had changed their fee structures or retirement advice policies ahead of the rule's implementation date, arguing that the issue is gaining traction among Main Street investors who have been surprised to learn that not all advisers are held to a standard requiring them to provide advice in the best interests of their clients.

"Many companies have already started to comply and actually made this one of their selling features," Warren said. "So the way I see it is the toothpaste is out of the tube, the world has already changed, and there's not going to be any going back."