Fiduciary Network is expanding its presence in the New York and mid-Atlantic markets with its first M&A deal of the year.

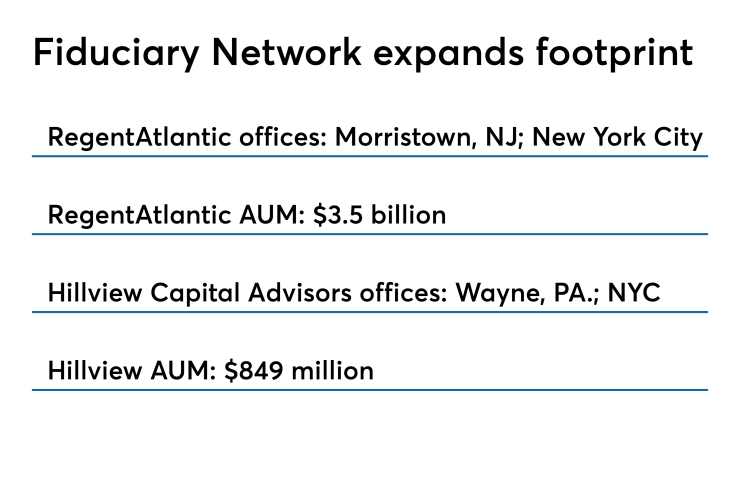

RegentAtlantic, the Morristown, New Jersey, wealth management firm backed by the RIA aggregator, has acquired New York-based Hillview Capital Advisors. Hillview, which also has offices in suburban Philadelphia, has nearly $850 million in assets under management, according to its latest SEC Form ADV.

Combined, RegentAtlantic and Hillview will have around $4.4 billion in client assets.

“The merger immediately provides RegentAtlantic scale in the Philadelphia market,” says Karl Heckenberg, Fiduciary Network’s CEO. “Hillview also brings a depth of expertise in the alternative asset space that will expand Regent’s investment offering.”

The deal is a “regional consolidation play,” according to Steve Levitt, managing director of Park Sutton Advisors, the M&A investment banking firm that represented Hillview in the deal. “RegentAtlantic is looking to grow and adding Hillview gives them a boost in a big way.”

Founded in 1999, Hillview is led by CEO David Spungen and the firm’s president, Jonathan Hochberg. Both will remain in senior leadership roles. The RIA has a client roster that includes restaurateurs, Levitt says, which makes for a good match with Regent Atlantic’s niche-oriented practice.

“We’ve long known the Hillview team and have always thought that our firms would fit well together,” said George Stapleton, CEO of RegentAtlantic, who will lead the combined firm.

RegentAtlantic joined Fiduciary Network, which is backed by New York Private Bank & Trust, in 2007. The aggregator has minority stakes in 14 RIAs around the U.S. with around $41 billion in combined AUM.

Emigrant Bank became the sole owner of Fiduciary Network in 2018,

Leading the Fiduciary Network deal team in 2018 was industry pioneer Mark Hurley, who founded Fiduciary Network and built it into one of the first RIA aggregators.

Hurley and Milstein had a longstanding feud however, and Hurley filed a