With the dust settling after the news that a

Clayton, Dubilier & Rice set an enterprise valuation for Focus — a New York-based acquirer that is parent to 88 registered investment advisory firms — at more than $7 billion as part of an agreement to purchase a controlling interest in the publicly traded firm for $53 per share,

Two other RIA acquirers and a pair of investment bankers and consultants said going private could help Focus take a longer-term view and become more valuable. As a private firm, Focus can take on more debt that will give it capital to deploy for future acquisitions of RIAs and tuck-in deals among existing partners, according to David DeVoe, the founder of DeVoe & Company, a consulting firm and investment bank.

"It's just another indicator of the independent wealth management space and how attractive it is to smart investors," he said in an interview, adding that the Focus deal represents "another vote with the checkbook that this is the optimal model."

While most observers expect the deal to be completed on its existing terms, what's not immediately clear is how the firm's 5,800 financial advisors and other employees spread across 300 offices in five countries view the agreement. Of four Focus partner RIAs contacted by Financial Planning, one said they couldn't comment on the deal, and another said they were refraining from discussing it with the press on the advice of counsel. The two others didn't respond to emails. Neither Focus nor Clayton, Dubilier responded to inquiries, either.

Focus CEO Rudy Adolf and other company executives haven't spoken publicly about the deal beyond prepared statements from Adolf calling the transaction "an important evolution in the resources we will have to invest" and from George LeMieux, the chairman of the board's special committee, describing it as offering "the best path forward for Focus and all its stockholders."

"Partner firms and their clients rely on Focus to meet their core objectives, and Focus will remain well-positioned to serve these constituents," LeMieux said.

DeVoe

Focus

Despite the smaller figures, the existing partners' growth pushed up the firm's earnings fivefold to $125.3 million and its revenue by 19% to $2.14 billion. At the end of 2022, Focus had cash and equivalents on hand of $140 million and debt outstanding of $2.6 billion.

The amount of debt, as well as a competitive bidding process revolving around "what is in the 'eyes of the beholder,'" explains the difference of nearly $3 billion between the reported enterprise value of the firm and the equity value reflected in the purchase price, according to Daniel Seivert, CEO of investment bank and consulting firm Echelon Partners.

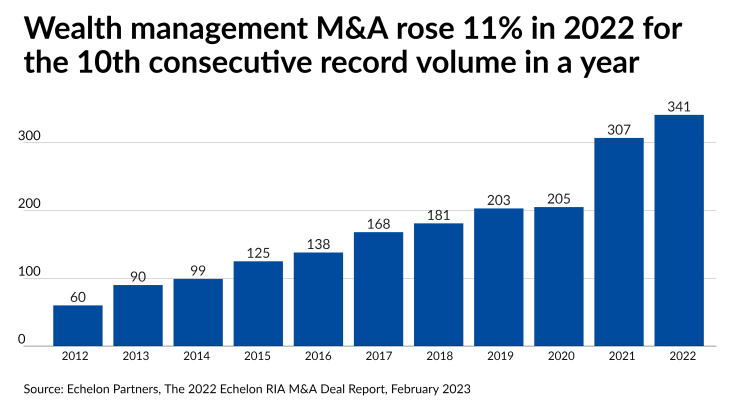

In his firm's

Regardless of whether Focus is public or private, its volume is falling because its "valuations and deal structures are less competitive with other buyers," Seivert said in an email. Adolf's prepared remarks

"While we will continue to grow our partnership and add additional scale, we remain highly selective in our M&A process and disciplined in our capital allocation to ensure we execute transactions that generate incremental value for our shareholders," Adolf said. "2022 was another year in which the value of prudent fiduciary advice was evident, particularly in the unique challenges presented by markets and economies last year."

Asked his thoughts on the key takeaways for RIAs about Focus being set to go private less than

"Being public is difficult as the priority is growth and quarterly earnings," he added. "Those don't necessarily line up with what is good for employees or customers."

As a publicly traded firm, Focus is trading at a multiple of about 12 times its earnings, according to Beacon Pointe Advisors President Matt Cooper. As a private firm, it could garner as much as 20x simply because of the "breakup value" of the RIAs in its network, Cooper said in an interview. Focus has "a lot of options to create value in the private space," he said.

His Newport Beach, California-based firm purchased five RIAs

"We're early in our evolution, and we've got a long way to go in the private markets before we have to consider any other type of situation," Cooper said.

Torrance, California-based EP Wealth Advisors

"The positive of the private markets is taking that long-term approach," he said. "Clients are asking for more and more from their advisory teams, and so you're seeing a lot more firms doing more."