The planning industry will soon have a big demographic problem on its hands. But it’s not the one it has actively been preparing for.

While many firms are investing thousands of dollars in technology to appeal to millennial investors and keep clients, few have invested as much into efforts to expand their roster of minority planners, even as the country becomes more diverse.

Enter, then, an emerging set of financial planning programs at historically black colleges and universities, and the aspiring planners they are beginning to produce. Delaware State University and Prairie View A&M University are two such institutions that are working to make the career more accessible to students of color and help change the face of the industry.

Distinguishing features of undergraduate and graduate programs for advisors offered by leading colleges and universities.

Part of that effort, though, involves acknowledging that existing industry outreach programs have not been sufficient. Even as the prospective client base gets increasingly diverse, a majority of advisors remain male, white and over the age of 50.

“One of the reasons that the industry needs or wants diversity is the connection point with consumers,” says Danny Harvey, the financial planning program director at Prairie View A&M in Prairie View, Texas. “Individuals have natural inclinations to want to do business or attract people they can connect with.”

What has been missing is an understanding about the lives and goals of minority would-be-advisors, says Delaware State student Cassidy Little. She came to Delaware State, in Dover, to study social work, but after learning about financial planning, she decided to minor in the subject.

WHAT PLANNING CAN DO

“A lot of people need to be educated on what financial planning is, and what it can do,” Little says. “When I first mentioned it to my mom, she said, ‘Well, I would love to sit down with a planner when I get some money or extra cash.’ That’s not what financial planning is for. A lot of people aren’t aware of the value of financial planning — period.”

One of her fellow students, Jabari Wells, says his introduction to the career has been, at times, like learning a different language.

“Now that I’ve learned it, I’m not just playing catch-up,” says Wells, a junior who is majoring in accounting and minoring in planning. “I’m above the game for it. If you take the time to learn your craft and hone those skills, you can help people of all demographics.”

Indeed, what her school’s program has done for her, Little says, is demonstrate that financial planning is not just a career path but a way to help people build wealth for their future.

Educators at colleges featured in Financial Planning's annual schools list offer up their favorite titles for young and prospective planners.

“I think that can appeal to every demographic,” she says. “The more people know about it, the more people can be interested.”

Guiding the efforts at Del State is Nandita Das, an advisor who emigrated from India to the United States.

Das’ message about culture and planning should relate to students and professional planners alike. She teaches her students to avoid a one-size-fits-all approach to managing wealth. Background and upbringing, she says, are other important layers affecting attitudes toward finances.

She recalls a client couple that has prioritized saving for their children’s education.

“The normal advice would be retirement first and then education,” she says. “If I tell them they should not be planning for education, but retirement first, that’s insulting their culture,” she says.

“Financial planning is very much tailor-made,” she says. “Every client is different. Every culture is different.”

A DEMOGRAPHIC SHIFT

More than half of all American children will be part of “a minority race or ethnic group” by 2020, according to data from the U.S. Census Bureau’s data.

Yet across the country today, less than 3.5% of the 80,000 CFPs are black or Latino, according to the CFP Board Center for Financial Planning. (The data didn’t track the number of planners who identify with other racial or ethnic groups).

The lack of diversity in the traditional RIA model is a weakness that challengers are already exploiting: According to a 2017 study by the industry consultancy Corporate Insight, customers seeking financial advice online are more likely to be younger and nonwhite (identifying as African-American, Latino or Asian) when compared with other investors.

Changing the face of the planning industry starts at the college level.

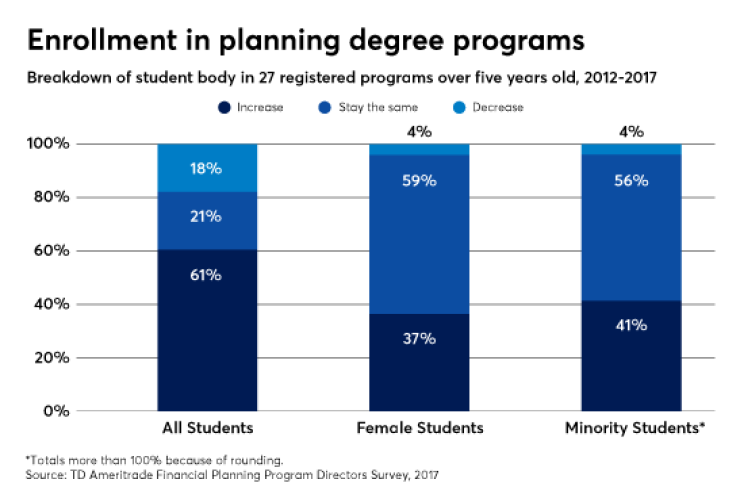

But even there, stubborn barriers remain. While nonwhite students overall have increased participation in CFP Board-registered programs, they remain underrepresented; only 31% of financial planning students are minorities, according to a 2018 TD Ameritrade study surveying program directors at these schools.

“The demographics of this country are changing rapidly. Advisors need to talk about what they need in a context of meeting their client needs in the future,” says Kate Healy, managing director of Generation Next at TD Ameritrade Institutional, a position the firm created to ensure “the sustainability of independent RIAs.”

Healy notes one the biggest challenges facing financial planning education is a lack of awareness of the profession itself.

PLANNING AS A CAREER PATH

Even on campuses with financial planning programs, 44% of minority students aren’t aware that it’s a career possibility, according to the TD Ameritrade Financial Planning Program Directors Survey.

“People are still trying to figure out what financial planning is and what a financial planning career might look like,” says advisor Frank Paré of PF Wealth Management, the national board president of the FPA. “I think giving that understanding to someone coming out of college and really articulating that to students at an academic level is key.”

For would-be planners, the career offers healthy financial incentives. The median pay for financial advisors is estimated to be just over $90,000 annually, according to 2017 data from the U.S. Bureau of Labor Statistics. Also, the field is open for candidates, growing at a rate of 15%, which the bureau notes “is much faster than average.”

Meeting the industry’s need for a diverse body of advisors doesn’t necessarily mean altering the message for people of color, Paré says.

“It’s about encouraging these individuals to take these courses,” he says. “I think you need to engage young adults in terms of what the opportunities are, and have a support network that can mentor them through the process.”

CONSUMER CONNECTION

Another recruiting key lies in recognizing that many young people, regardless of racial background, want to own businesses and be self-sufficient, says Prairie View’s Harvey.

“A lot of young people want to be their own boss,” he says. “There is flexibility over time to build your business and career. Those are the things to highlight. But the sense of community and having an impact is also very important.”

Both Prairie View and Delaware State offer minors in financial planning, which Das and Harvey believe allow them to reach students from various academic backgrounds.

“I chose to market this program as a minor, and I’m not necessarily going straight to business students. I’m just saying you can educate in a different way,” Harvey says. “A major doesn’t say what your career is. If you had a minor with that, whether you’re studying education, social work, you can set yourself to be a great planner.”

The programs coming out of historically black colleges and universities like Delaware State, Healy says, are particularly well-positioned to help RIAs address the need for a more diverse workforce. TD Ameritrade granted two out of three of its emerging program grants to HBCUs: Del State won in 2016 and Prairie View A&M won in 2017.

“The HBCUs, they realize what their mission is,” Healy says. “We’re seeing them really rise to the top.”

That mission is at the center of getting the program started at Prairie View A&M. “As wealth is changing in America, firms want advisors to look like consumers,” Harvey says.

“The predominant population at an HBCU is African-American. That’s a great breeding ground for financial planning professionals,” he says.

Even with an increasingly diverse prospective client base, the industry can do more to be fully inclusive, Healy says. For example, firms need to abandon the attitude that they should hire diverse candidates simply to meet a quota.

“Advisors come up to me and say, ‘I need [to hire] a 35-year-old woman.’ Twenty years ago, they would be asking me to prove to them why they need a woman on their team,” Healy says. “They now understand the why when it comes to age and gender diversity. They’re starting to understand the why from a racial diversity perspective, but they’re not quite there yet.”

CHANGING PERCEPTIONS

Part of making the industry more inclusive requires changing the general perception of what an advisor might look like, Das says.

“This is talking from a minority perspective — it’s ingrained in me that white means good, brown means not that good, black means not that good. ... If I behave like that, I cannot expect others to understand if I myself don’t understand this,” Das says. “Do I expect [white people] to understand my culture more than I do? Check your thoughts, what you are thinking. That’s probably the starting part of acceptance.”

Establishing a multicultural perspective within financial planning at the college level is a huge step toward catalyzing change, Das says.

“Every little change starts in the classroom,” she says. “The academic industry is the industry where everyone can see clearly without fear. Once you build in that thinking with students, these are the change agents that will go and make the industry also more vibrant, more accepting.”

Das’ students say they are ready to make it happen.

“Once you go deeper into studies you realize it’s not as intimidating as you thought,” says Wells, the Delaware State undergraduate. “It’s not impossible, but it’s upon the students ourselves. If I can make it, all of us can make it. You have to be that beacon of light for other students.”