Don’t get caught in the weeds.

From managing clients and their assets to hunting for new prospects, it’s easy to get caught up in the “doing” and lose sight of what it takes to run your practice.

Most advisors rightly focus on their clients’ best interests, but running a profitable business requires practical analysis.

“Spend a day understanding what your real costs are,” says Mike Greene, senior vice president of the Advisor Business Development Group and Financial Planning for Ameriprise Financial Services. “Most practitioners built their practices on their own, and kept their costs on their own,” he says.

As costs become more difficult to manage, profit margins may be at risk. To avoid unsustainable growth, take the time to understand the cash flow in your business operations -- where the money comes in and where it goes out, Greene says.

“Compare yours to a benchmark, so you have some idea of where you stand,” he says.

Looking for Ways to Improve Your Profits? Check Out:

-

The Financial Services Institute is pressing the Securities and Exchange Commission to adopt formal procedures to prevent what it deems the sometimes capricious enforcement of industry rules.

10h ago -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

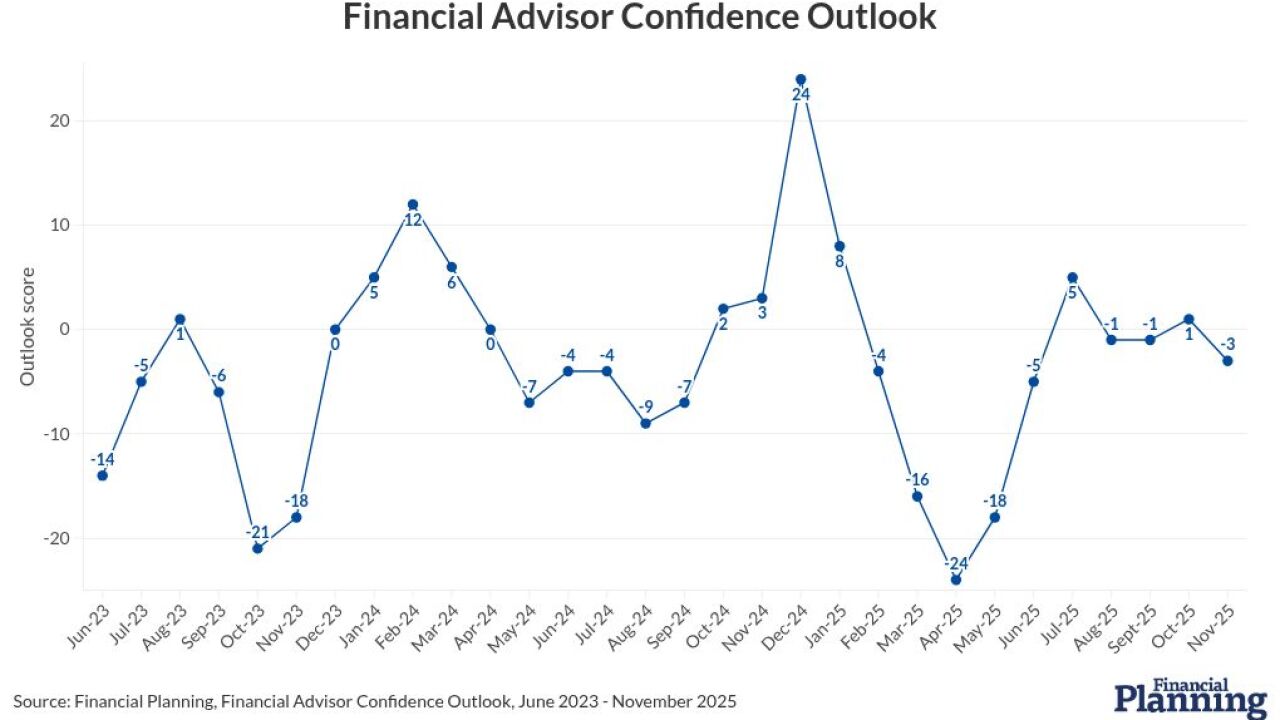

Political instability and other pressures are feeding some clients' portfolio fears, advisors say in this month's Financial Advisor Confidence Outlook.

November 12 -

Minority transactions are increasingly appealing to sellers who are wary of giving up the full control of their firms. But experts say the deals do come with strings.

November 11 -

Matthew Madera has become the latest former JPMorgan private client advisor to be sued after leaving for another firm. In a recent stipulated order, he agreed to stop soliciting former clients until the dispute can be resolved.

November 11 -

Americans tend to be overly pessimistic about their own life expectancy — a fact with major implications for retirement planning. But new research shows that certain interventions can help.

November 11