Touted as the most significant update to the Internal Revenue Code in decades, the

In practice, the tax law changes didn’t quite achieve its goal of broad and sweeping reform — at least for individual households — but it did substantially alter the landscape of claiming various types of itemized deductions

The key change under the new legislation was the consolidation of what was previously a personal exemption of $4,050 per household with a then-standard deduction of $6,350 for individuals for a total of $10,400 for individuals (or $4,050 x 2 = $8,100 plus $12,700 in standard deductions = $20,800 for married couples), into a combined grossed-up standard deduction of $12,000 for individuals and $24,000 for married couples.

Yet while the elevated standard deductions were only slightly higher than the prior combination of personal exemption(s) plus the standard deduction, the impact on itemized deductions was more significant. From the perspective of itemizing, it only makes sense to do so when deductions would exceed the standard deduction, without any consideration for personal exemptions that weren’t included in that part of the equation.

Consequently, while the new standard deduction represented only a slight increase in total deductions, it was a big increase in the threshold to itemize deductions.

In addition to the significant increase in the threshold to itemize, the tax legislation also reduced the number and size of available itemized deductions as well, including placing a $10,000 cap on state and local tax, or SALT, deductions; a reduction in the maximum debt balance

SIX CORE TYPES

Notwithstanding the curtailment of itemized deductions, there remain six core types of itemized deductions that remain available for households to claim.

Per the delineation of

Medical expenses:

Taxes paid to other governmental entities:

In practice, the deduction for taxes paid applies broadly to real estate, personal property and income taxes, whether paid to a state or local municipality, or even to a foreign government. That said, under the tax legislation and

Interest paid: Under the general principle that borrowing money to make money should be treated as a cost of generating income — i.e., a deductible expense/cost of producing that income —

Charitable giving: Under

Casualty and theft losses: Akin to allowing tax deductions for interest paid to generate income,

Such personal casualty losses are subject to additional limitations though, including that only losses above $100 for each incident are deductible; total casualty and theft losses must exceed 10% of AGI; and, from 2018 through 2025,

Miscellaneous deductions: While the tax legislation eliminated the category of “miscellaneous itemized deductions [subject to the 2%-of-AGI floor]” under

This includes gambling losses to the extent of gambling winnings; Ponzi scheme losses and other similar casualty/theft losses of income-producing property; income with respect to a decedent deduction for pre-tax assets inherited from someone who paid estate taxes; investment-related deductions for amortizable bond premiums and certain losses on contingent-payment or inflation-indexed debt instruments, e.g., TIPS; the unrecovered portion of basis in a pension or lifetime annuity that isn’t recovered when payments cease, e.g., due to death before life expectancy; and certain types of

If not addressed, the client may see a higher tax bill than was planned. That won't go over well at tax time next year.

Ultimately these six categories of itemized deductions are totaled on Schedule A, and in order for a household to actually itemize, the total across all six after accounting for the various limitations that apply to several must exceed the threshold of the standard deduction.

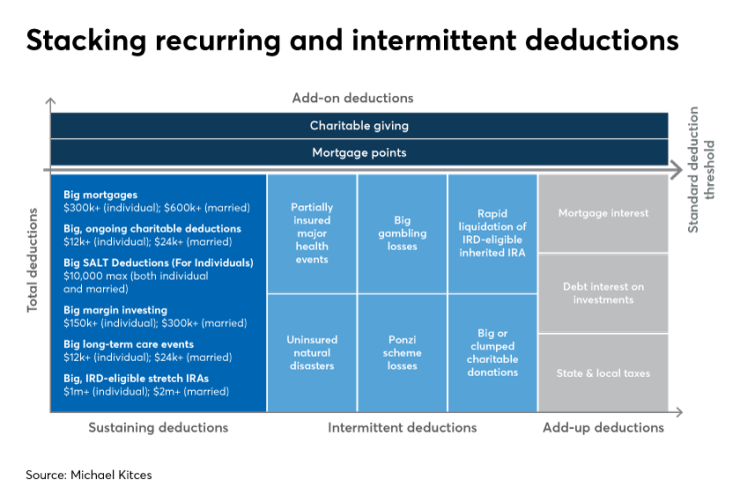

The significance of the fact that there are only a limited number of itemized deductions still available, and that the threshold to itemized deductions at all is much higher than it once was, is that in practice not only will just 10% of households itemize deductions going forward, but only a subset of the available itemized deductions are ever likely to be a trigger to itemize in the future, and even fewer on a sustaining basis.

THE BIG SIX

The $12,000/$24,000 standard deduction hurdle — for individuals and married filing jointly, respectively, increasing to $12,200 and $24,400 in 2019 — presents a significant challenge to itemize deductions because only a few deductions in practice are capable of sustaining such a large deduction annually on an ongoing basis.

Accordingly, the so-called big six itemized deductions that can actually sustain ongoing itemized deductions include:

Big mortgages: Homeowners with a sizable mortgage used to acquire, build or substantially improve their primary residence or a second home can generate enough in ongoing interest deductions to exceed the standard deduction thresholds.

Notably though, in an environment where mortgage interest rates have long hovered around 4%, it still takes a very sizable mortgage balance to actually generate enough interest to trigger itemized deductions, especially since it’s only the interest portion of the mortgage payment, not the entire mortgage payment, that is deductible. For an individual, generating a $12,000 mortgage interest deduction at 4% would require at least a $300,000 mortgage; for a married couple the trigger is a $600,000-plus mortgage.

Big, ongoing charitable deductions: For higher income individuals it’s not uncommon for annual charitable giving to top the $12,000/$24,000 standard deduction thresholds. And at higher income levels the charitable deduction AGI thresholds are not an impediment to exceeding these targets. Of course, giving away money just to get a tax deduction isn’t necessarily a net positive, as the household still gives more away than it receives back in tax benefits. Still, for those who already engage in sizable, ongoing charitable giving, sustained charitable giving alone can support ongoing itemized deductions.

Big SALT deductions: One of the unique peculiarities of the current tax planning environment is that when TCJA imposed a maximum cap on SALT deductions, it imposed the same cap of $10,000 for both individuals and married couples. This is significant because the standard deduction threshold for individuals is only $12,000, while it is $24,000 for married couples.

This means maxing out the $10,000 SALT deduction is at best only part of the way to the $24,000 threshold for married couples, but gets an individual almost all the way to their $12,000 threshold. Still, it takes a sizable income with the associated tax deductions or a big home with substantial property taxes to reach the individual threshold. Assuming an average state income tax rate of 5% and a 1% property tax rate, reaching the SALT cap still typically requires around a $100,000-plus annual income and a $500,000-plus property, or for those who rent, a $200,000-plus annual income.

Big margin investing: While mortgage deductions are limited as to the amount of debt principal on which interest can be deducted, investment interest is limited only by the amount of interest and dividends generated by the investments themselves and that the interest be taxable — i.e., no investment interest deductions for municipal bonds.

As with the mortgage interest deduction though, generating sufficient interest requires a substantial amount of debt principal. On the other hand, since margin interest rates tend to be higher — currently averaging around 8% — it doesn’t take quite as much debt principal, potentially just on the order of $150,000 for individuals or $300,000 for married couples.

Big long-term care events: Most medical events are covered by health insurance, and while individuals may still have to pay a non-trivial deductible, coverage is usually sufficient to prevent medical expenses alone from triggering the $12,000/$24,000 thresholds, particularly on an ongoing basis.

However, long-term care insurance is adopted far less often than health insurance, and tends to have much larger annual expenditures, whereas

Big, IRD-eligible stretch IRAs: One of the largest and most commonly overlooked itemized deductions is the

This means the IRD deduction is only available to those who inherit a pre-tax asset like an IRA from someone who actually paid a Federal estate tax — which isn’t many, given the sizable Federal estate tax exemption. Nonetheless, with a top Federal estate tax rate of 40%, those for whom the IRD deduction is available effectively receive an itemized deduction for 40% of their inherited IRA withdrawals.

This in turn means inheriting a big IRA from a big estate can trigger a big IRD deduction and, therefore, ongoing itemized deductions. It will still take an IRA of $1 million or more for an individual, or of $2 million or more for a married couple to generate enough in IRD deductions to claim ongoing sustained itemized deductions — assuming the stretch IRA

Advisors may be able to shift taxable income and potentially save on employment taxes, as well.

Some of the big six are more likely to be relevant in producing ongoing big deductions than others. For instance, sizable mortgages are still fairly common, especially in metropolitan areas where real estate overall remains relatively expensive, and will likely be the most common trigger for sustaining itemized deductions by far. As noted, sizeable charitable contributions are relatively common for high-income individuals as well, but potentially just for the top 5% of households whose income is high enough to sustain such charitable giving, earning $150,000-plus annually, which makes the donations less triggering overall.

Big stretch IRAs — large enough to produce sizable IRD deductions and from someone who paid Federal estate taxes — are even less common, given that

INTERMITTENT ITEMIZED DEDUCTIONS

While only certain itemized deductions are capable of generating a sufficient ongoing, sustaining level of deductions to exceed the standard deduction threshold, a different set of itemized deductions are more likely to create intermittent years where a concentrated burst of deductions allows a taxpayer to itemized that year (but not necessarily the year before or after).

Potential intermittent itemized deductions include:

Underinsured major health events: Even with a high-deductible health insurance plan to facilitate HSA eligibility, it’s difficult to generate enough medical expenses in a single year to exceed the standard deduction, with maximum limits in 2019 of $7,900 for individuals and $15,800 for families — especially since only the excess of those amounts above the 10%-of-AGI limitation would qualify for itemization in the first place.

However, not everyone is insured, and sometimes extreme health events can occur that aren’t fully covered by insurance, or have ancillary health-related expenses outside the scope of traditional health insurance coverage. In such years, a major health event can create a burst of medical expenses that triggers itemizing.

Uninsured hurricane, wildfire or similar natural disasters: In the past, casualty losses could produce a significant deduction, as major events — e.g., a house burning down and not being fully insured — could cause losses and create deductions in the $10s or even $100s of thousands of dollars.

Such casualty losses will only be deductible in the event that they are tied to a Federal disaster area, which most commonly are established after hurricanes, wildfires or similar, wide-scale natural disasters. Of course such losses, even in the event of a natural disaster, will ideally still be covered by insurance — and to the extent the losses are covered by insurance, they are not deductible because they were reimbursed by insurance. But in the event of a major natural disaster, the associated casualty losses not covered by insurance may produce a sizable single-year itemized loss.

Big gambling losses: In general gambling losses are treated as non-deductible personal losses. However, to the extent that an individual has already earned

Yet because gambling winnings are reported immediately as above-the-line income, and gambling losses are only deductible as itemized deductions, the deduction for gambling losses is sometimes a moot point, as the losses may not be big enough to exceed the standard deduction threshold. Nonetheless, when big gambling losses occur in the same year as big gambling winnings, a major loss can end out being large enough to claim itemized deductions.

Ponzi scheme losses: While theft losses were greatly curtailed by the tax legislation due to the limitation that it must tie to a Federal disaster area, which is almost impossible to be relevant in the context of theft in particular, theft and casualty losses of income-producing property remain deductible as a miscellaneous itemized deduction. This includes theft losses of investments made into a Ponzi scheme.

Notably, the exact timing of when a Ponzi loss actually becomes deductible is dictated by

Once the deduction for the Ponzi loss is triggered — which under Revenue Ruling 2009-20 may be as early as once the lead figure(s) are indicted for fraud, embezzlement or a similar crime — a substantial deduction may become available. Note, however, that

Rapid liquidation of an IRD-eligible inherited IRA: As discussed earlier, when an IRA or other pre-tax asset like a non-qualified annuity is inherited from someone who paid Federal estate taxes, a potentially substantial income tax deduction becomes available to the beneficiary — often as large as 40% of the taxable income associated with the pre-tax asset.

The

Big charitable donations: While sizable ongoing charitable giving can produce sustained charitable deductions, for those who do not give away $10s of thousands of dollars per year charitable contributions may still become an intermittent itemized deduction when a sizeable one-time donation occurs.

Notably though, even for those who don’t plan to make a big charitable contribution, it’s feasible to group ongoing contributions into a single-year sum by

For those who don’t have sustaining itemized deductions, one of the biggest challenges to deduction planning is that if the standard deduction threshold isn’t reached, there is no value to any itemized deductions at all — as they literally don’t add up enough to count. Accordingly, the significance of intermittent itemized deductions is that in years where they do occur, every other potential itemized deduction becomes far more valuable because 100% of such additional deductions will actually be deductible, as the standard deduction threshold has already been exceeded).

Add-on/Add-up deductions: Because itemized deductions produce no tax benefits until they actually add up to more than the standard deduction threshold, a wide range of common itemized deductions only create tax value effectively as an add-on atop other, larger sustaining or intermittent itemized deductions.

In practice, the most common add-on/add-up deductions are simply the most common versions of various itemized deductions, at levels that simply aren’t large enough to be sustaining. For instance, the interest deductions from a modest mortgage, ongoing property taxes from a modest house, annual state and local income taxes for an average salary, a moderate level of ongoing annual charitable giving, etc.

Of course the whole point of a substantially higher standard deduction is that it’s easier — and more gracious for tax purposes — to give taxpayers one simple deduction rather than putting them through the trouble of adding up a smaller series of ongoing deductions. After all, while itemized deductions that don’t reach the standard deduction threshold don’t move the needle, that’s only because the standard deduction has already provided an even more generous tax benefit.

Example No. 1: Joseph and Rachel are married and file a joint tax return. Their deductions include $8,000 of mortgage interest, $3,000 of property taxes, $5,000 in state income taxes and $2,000 in charitable contributions, for a total of $18,000 in itemized deductions. They are wondering what tax savings they might see if they were to donate another $1,000 toward a big charity drive.

Unfortunately though, because the itemized deduction threshold for them is $24,000, increasing Joseph and Rachel’s deductions from $18,000 to $19,000 produces no tax savings at all. On the other hand, a series of small deductions can, in the aggregate, add up to enough, even if no one standalone itemized deduction line item does.

The key significance of add-on/add-up deductions is that their value varies greatly depending on whether they can, in fact, sufficiently add up, or stack on top of other sustaining or intermittent itemized deductions. To the extent a household can clear the standard deduction threshold, it becomes especially valuable to lump other deductions together on top — where at the margin they’ll all be valuable – even and especially if it means pulling deductions forward or delaying them out of years that would not have generated a tax benefit.

Example 2. Joseph and Rachel get a significant raise and decide to buy a larger house, which results in both a bigger mortgage and $3,000 in deductible points due at closing. Consequently, this year their total deductions will instead be $12,000 in mortgage interest, $4,000 in property taxes, $7,000 in state income taxes, $2,000 in charitable contributions and $3,000 in deductible points, bringing their total itemized deductions to $28,000.

Given their itemized deductions now exceed their standard deduction, any additional deductions this year will produce a tax savings. As a result, not only would Joseph and Rachel’s additional donation at the charity drive produce a tax deduction, but the couple might consider a donor-advised fund contribution to pre-donate $10,000 of additional charitable giving for the next five years in the current year, when they can fully take advantage of the tax benefits. That’s because come next year, when deductible mortgage points are no longer available, the couple will fall below the standard deduction threshold again.

For the existence of all these strategies, it’s important to remember that there is still a wide range of above-the-line deductions claimed directly against income and not as itemized deductions. This means they’re available regardless of whether they exceed the standard deduction at all, from self-employed deductions for retirement plans and health insurance and even self-employment taxes, to

Nonetheless, for many of the most common deductions that households have historically claimed, receiving any tax benefits for those itemized deductions now requires more careful planning than ever, or at least a clear understanding of whether the household can feasibly itemize at all.