When InvestCloud revealed the latest iteration of its cloud-based technology suite for financial advisors, CEO John Wise took a few moments to flex.

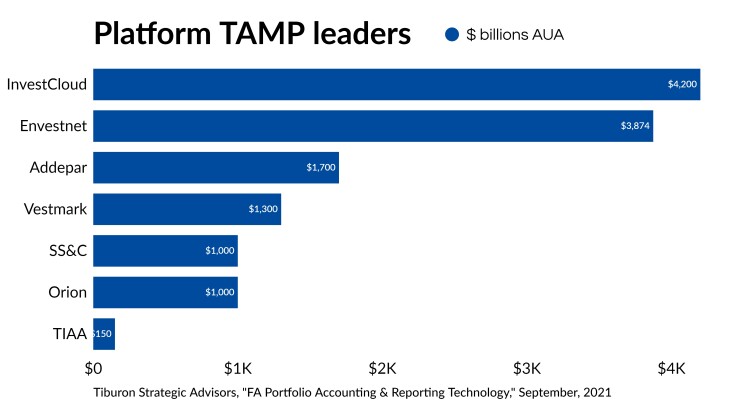

After 11 years, the startup is used by wealth management firms that collectively manage $6.3 trillion in assets across 20 million investor accounts. Though the company wouldn’t specify just how many of those assets are actually on InvestCloud’s technology, a report from Tiburon Strategic Advisors estimates the turnkey asset management platform (TAMP) has around $4.2 trillion in assets under administration.

That nudges out Envestnet, which has $3.8 trillion in assets on its comparable TAMP platform, according to Tiburon. Envestnet declined to comment.

While Envestnet is a much larger company with other business verticals, its dominance as a “platform TAMP” (which Tiburon defines as providing advisors technology to access third-party investment strategists, as opposed to product tamps, which focus on proprietary investment strategies) was

InvestCloud has not only caught Envestnet’s assets; it has pulled ahead. But Tiburon managing partner Chip Roame isn’t shocked.

“InvestCloud has made serious progress, especially in reporting and workstations,” Roame said in an email.

Much of InvestCloud’s growth has come via M&A. As part of

Then in May,

The latest version of the technology, InvestCloud X, showcases Wise’s vision for solving the puzzle. The cloud-based suite combines digital client communication tools, NaviPlan’s cash flow, trust and tax planning capabilities; and a digital supermarket of investment products powered by Tegra118’s software, which connects broker-dealers and RIAs with a network of asset managers.

By combining these traditionally distinct processes into a single user experience, advisors can build plans for investors of any age or life moment, said Wise. With a plan in place, advisors can go directly into selecting the proper investments and use the same interface for ongoing monitoring, reporting and communication.

"Combining three products into one is a game-changer,” Wise said in a statement.

While InvestCloud’s strong technology and connections to large firms (via Tegra118) have helped it quickly become a leading TAMP, it’s unfair to label any one firm a clear leader, Roame said. Addepar is well-positioned in the high-end market and with non-tradable securities; Orion also has strong technology and is popular among fast-growing RIAs; and Vestmark has made the most progress in the wirehouse channel.

And Envestnet remains strong among companies serving the mass affluent market, like insurance and bank broker-dealers, Roame added. Envestnet also has arguably the most comprehensive tech stack and a large asset management business, which InvestCloud doesn’t offer.

Even new entrants are achieving significant growth. GeoWealth, a TAMP that has grown AUM to $7.3 billion and total platform assets to $16.7 billion since launching in 2018, closed a Series B funding round of $19 million led by Kayne Partners Fund, the private equity division of Kayne Anderson Capital Advisors. The company is also backed by J.P. Morgan Asset Management.

GeoWealth is primarily a software company, building a tech stack for RIAs in-house rather than integrating with third party vendors.

“Whether it’s flexible investment solutions, a modern back office, or an elevated client experience, GeoWealth stands apart from legacy providers by combining the best of SaaS and an outsourced investment platform,” said Robert Shilton, managing director of growth equity at Kayne Anderson Capital Advisors, in a statement.

As advisors increasingly look to outsource technology and investment management, the TAMP market will continue to grow. TAMPs had $14 trillion in AUM and AUA in 2020, up from $2.3 trillion in 2010, according to Tiburon’s data. The market is expected to surpass $16 trillion in 2025, and InvestCloud’s sudden rise shows there is room for new players to disrupt the established hierarchy.

“The TAMP market is evolving very quickly, and business models are diverging,” Roame said.