The SEC may be refining its approach to spurring good cybersecurity practices in advisers, but its expectations aren't slackening.

There's been "a conscious decision" at the agency to lead through the exam process, rather than enforcement, said David Glockner, regional director of the SEC's Chicago office.

"There've been a handful of enforcement cases in this area," Glockner said, "but if you step back and think about it, there are way more incidents, way more issues that pop up in exams than there are enforcement referrals or enforcement actions."

But even if the commission will discipline advisers sparingly and bring actions in the

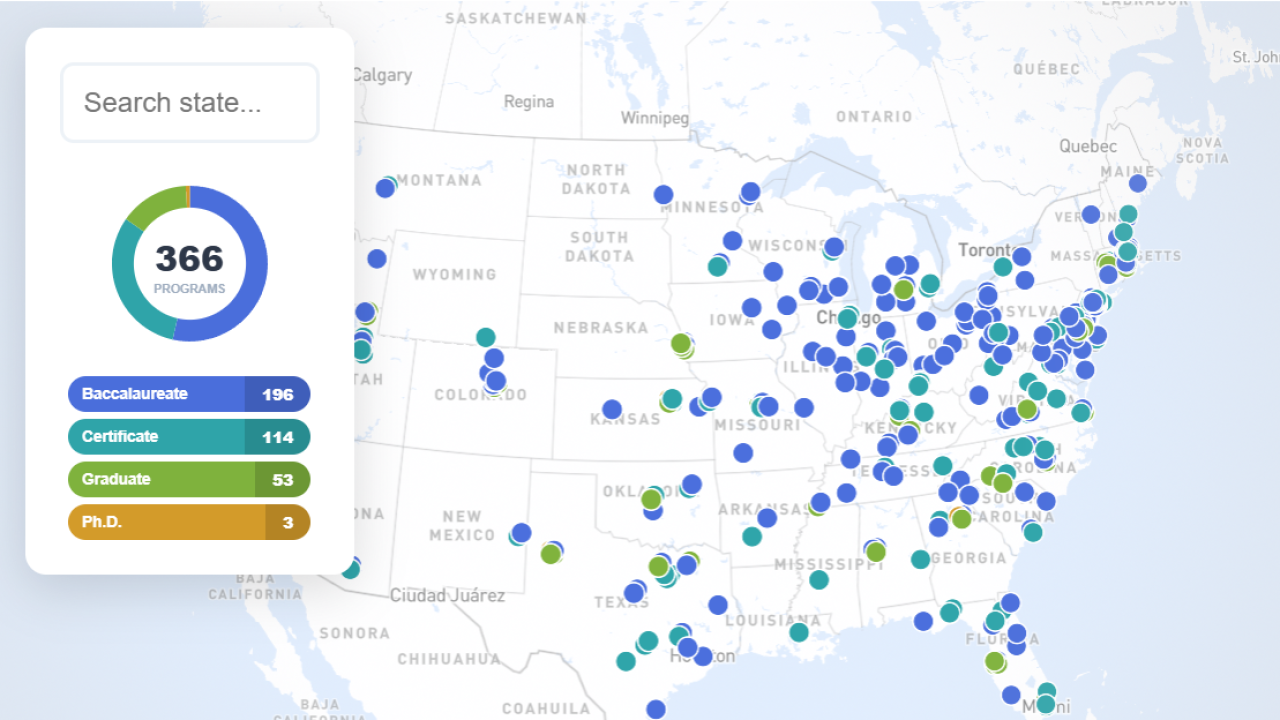

The revamped platform will be available by late summer and feature several upgrades, including a greater ability to be discovered by artificial intelligence search results.

Graduate students at the University of Texas at Austin are using advanced analytics and AI to examine Wealthtender's client reviews — and create a new data metric for the industry.

Co-founder Shannon Eusey will step into the role of board chair as Matthew Cooper becomes the firm's second CEO.

As a starting point, officials recommend advisers take an inventory of their digital assets to determine the various entry points that hackers could take to infiltrate their systems, including a thorough vetting of all the outside vendors a firm contracts with.

Regulators have revealed what kind of issues advisors must address if faced with a review.

To ensure that personnel throughout the firm are cognizant of the myriad cyber threats, the SEC urges firm leaders to elevate the issue as a business priority, appealing for a tone at the top that prevents cybersecurity issues from being marginalized as simply a matter for the IT department.

But in some firms, there remains a tension between business and cybersecurity concerns, according to Steven Levine, an associate regional director at the SEC's Chicago office.

Levine has

Often, branch managers look to bring in high-producing industry veterans who might resist the firm's cybersecurity policies and procedures, which puts additional onus on the chief compliance officer to lay down the law, Levine says.