Since taking the chief executive role at Personal Capital in April, there’s been little to disrupt Jay Shah’s honeymoon period.

The firm has bounced back from stagnant growth, with assets under management gaining 66% from 2016 to now top $5 billion. Thanks to the patronage of Canadian conglomerate Power Corp., which has

Shah, who has been with Personal Capital since its inception, says the market will begin to discern between hybrid digital offerings, with the quality of advice imparted by advisors on platforms being the key differentiator.

In the first of two parts, Shah discusses how he views competing platforms and hints that Personal Capital may expand its offerings beyond wealth management. An edited transcript follows.

Personal Capital pioneered hybrid digital advice. That’s now considered the model for bringing advice online. Do you see that consensus as a vindication of the concept?

When I started working with Bill Harris at the outset on the design of Personal Capital, it was really philosophical: Where do we think financial services is going at large, not just what the opportunity is in digital wealth management. We started with the consumer application in order to surround consumers with their information and let them connect all of their entire financial life. Then and only then can you offer sound analysis and provide counsel and enter the realm of offering a financial service.

By way of history and also very purposeful design, the hybrid model is what we deemed to be the winning model from day one. And the way I would characterize it is, imitation is the sincerest form of flattery in what we’re seeing within the industry. Hybrid is part technology, part people, it’s in the middle, between retail and ultrahigh-net-worth. It’s in the middle between other new digital entrants that are not adding people and traditional, 100-year-old global wealth management and advisory firms that are now adding technology. We’re kind of right there in the middle and I think we feel good about the original design. It’s not pivoting because of a business model need or a consumer need. We think this is actually the right design for a firm and for the consumer.

Many firms say that they are consumer centric but they are really product centric. That’s what the reality is. When you talk about offering sophisticated financial solutions, how can you do that without surrounding the consumer with all their information? It’s very important to be able to show people, not tell them. It’s not a brochure, it’s not, ‘I’m the smart one and you’re the pupil.’ Let’s have a conversation about all of this information. Here’s a snapshot of all of your assets and all your liabilities so you can calculate net worth on, but then really, what’s your life plan? What’s your path for spending and savings, and how does that track over your arc of life all the way from now through retirement and beyond. And what does that mean now that you have a family and how do they see and understand money?

You can’t do everything through connecting data and algorithms; you also need to connect with people to have a conversation in order to understand life and financial choices in their arc of life. That’s part of it, and there is also an emotional part. You shouldn’t make bad emotional financial decisions, and all the research shows that people do that all the time. Having this hybrid model as part of that path is very important, then. So this design, I can’t think of a better way to do it. We could be in the advisory business for a multitude of financial solutions for these customers, it just so happens that our initial deployment is in wealth management. I think there’s an opportunity here to do more.

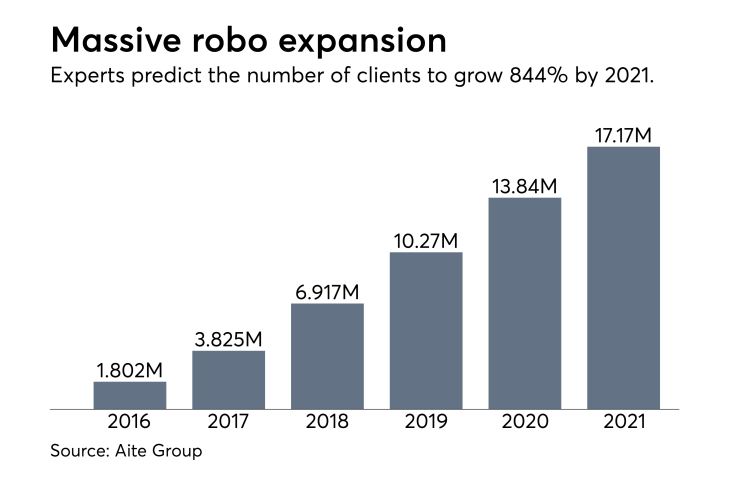

Young investors are expected to primarily drive growth in digital advice over the next five years. How will Personal Capital reach this generation of investor?

We have a million and a half users of our free software that come from all different walks of life. But we have elected to serve families with complex financial needs. The bell shaped curve of our client is folks in their 30s, 40s and 50s, on average in the mid-40s. We are mass affluent and lower high net worth, that’s the band. The average client we manage now is in the upper $300,000 range. It’s people that are accumulating. That’s where we have really found we can add an extreme amount of value with the personalized solutions that we’re providing for our clients.

Do I think by virtue of our free tools that as more people will use them, we will be top of mind for them as a firm that can manage their finances when they reach that complexity inflection point? Yes, I think that’s really going to help our cause and again, build an effective consumer solution.

There are a lot of other solutions that are out there and I would call them retail-oriented solutions. The average size of their client, the number of accounts that they manage, the nature of the investment solution they put them in, it is all very appropriate for that type of investor. I’m thinking of the traditional robos, those of us who have been around for a few years now, but new ones too like Acorns and Stash.

"You can’t do everything through connecting data and algorithms; you also need to connect with people."

Each has an interesting business model. I do think those solutions and other new entrants are effective in some ways. But we also ask questions about how these firms are constructed. They may have great utility and connectivity and beautiful apps, but the app is only part of it. The other aspect is, what’s the design of the firm?

What I’ve seen and what concerns me about some of the other new entrants that are latching on to consumers and engaging with them in a digitally forward way is that unfortunately many are using the broker-dealer vehicle as a means for monetizing that client. Some of them have very lucrative business models. You can go on double margin, I’m going to charge you a fee for what it is you’re doing, but when you actually peel it back and look at the effective interest rate that’s being paid on some of the borrowing, and it’s not good for consumers.

So, on the one hand there are some very good solutions out there that are cost effective and offer a diversified investment strategy. But there are also some things that are really bad and people are using old financial services tricks in order to engineer products that aren’t in the best interest of clients. They might be slick and they might be fast, and they might give access to money, but they are not in the best interests of their clients.

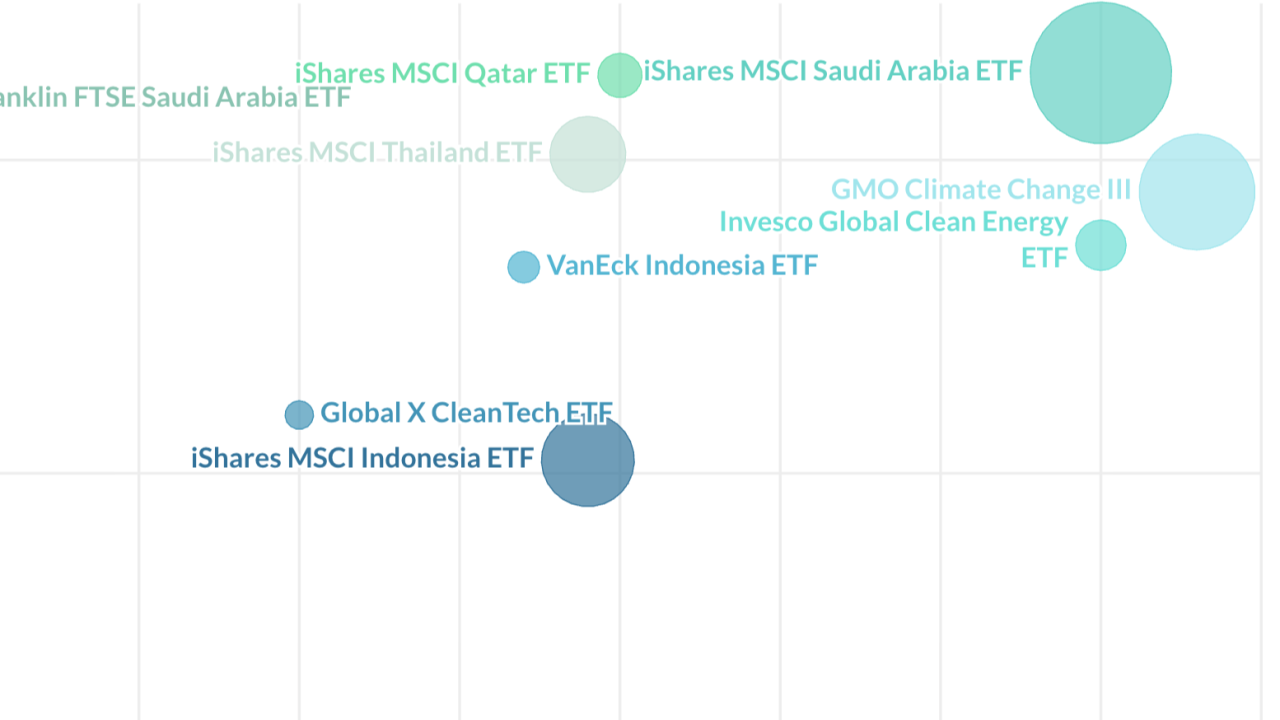

What’s your perspective then on Vanguard and Schwab’s digital advice offerings, which have amassed a large amount of assets in a short period of time?

I think investors need to do their due diligence and should ask, ‘Who am I, what do I need right now and what is the solution that I should be using?’ Some of our clients come to us with multiple advisors in the rearview mirror and having managed hundreds of thousands of dollars. When you’re approached by a new digital wealth management firm you need to go look at what you’re getting for the service. You need to understand, are they a fiduciary and how are they making money?

Schwab and Vanguard also have broker-dealers. They’re monetizing a free portfolio that has a lot of cash, or selling their own proprietary products. There’s a lot of that stuff going on that needs to be examined. When you look at the architecture of what they’re moving assets in, a lot of times it’s answering a few short questions, then blowing out of the entire portfolio and implementing it into an ETF wrap program of proprietary funds. What is not considered, for example, is the tax liability that was just incurred for that portfolio being blown out. Sometimes, it’s the price of admission.

But how we approach that differently is we’ll move securities in kind, we’ll actually wrap a personalized strategy around existing low cost basis point positions. We’re in the game of personalization, one-on-one solutions with our clients. And our use of technology and our use of advisory affords us the opportunity to be able to do that.

When you are approaching this realm and you don’t have that capability of building a personalized strategy, you are more in the business of mass production. You’re going to do this at high velocity, have the client answer a few short questions and then put them into a blend of pooled products. Oh, by the way, I have somebody you can talk to. What exactly are the topics that they’ll help you with? Is it really broad advice? Are they talking about estate and trust planning, tax strategy? Are they talking to you about what are you doing with your 529 and with your education savings? Your insurance needs, and where are you putting your next dollar?

With a lot of this, you’ve got to really peel back the onion. There are very profound differences in what we do in building personal solutions versus mass produced solutions. We’re able to do things in a leveraged way by virtue of our technology, but we’re definitely in the game of one-on-one personal advice. I question the depth and rigor [of the offerings] the other firms are doing.

People talk about tax optimization quite a bit and usually that means pairing off gains and losses. We will put dividend-yielding securities in a tax deferred account and capital gain and loss bearing accounts in taxable accounts. We are rebalancing and trying to stay diversified, not just in fixed income and equity and alternative asset classes, but with individual securities, and we balance the entire portfolio out in an equal way across style, sector and size. I think it’s very differentiated when you go look at the other call center-based digital wealth management firms that are out there. Contrast our approach with some of those other hybrid mass produced solutions, I mean there’s a massive difference. But in the media we get lumped together, we’re just all new entrants.