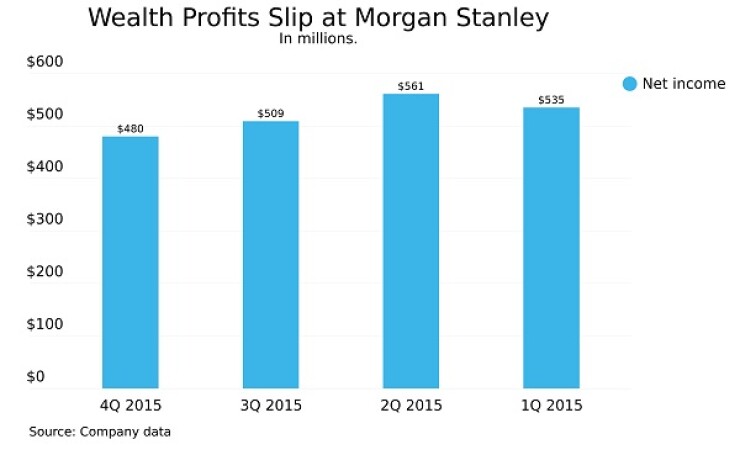

Buffeted by difficult markets during the fourth quarter, profits for Morgan Stanley's wealth management fell $480 million from $509 million for the prior quarter.

The firm reported on Tuesday that its closely watched pretax margin fell to 20% for the quarter, down from 23% from the prior quarter, but up from 19% for the year-ago period.

CEO James Gorman, speaking to analysts, said the firm aims to achieve a profit margin for the unit of 23% to 25%, and he unveiled plans to streamline costs across the company.

Gorman said the firm can achieve that ratio for the wealth management unit through greater expense discipline as well as additional growth of its lending business and digital opportunities.

In its earnings, the firm said that total non-interest expenses fell 3% year-over-year to $2.983 billion. However, that figure was up 6% from the prior quarter.

The firm's results come only a week after Greg Fleming, president of Morgan Stanley Wealth Management, quit. A person familiar with the matter said that Fleming, 52, departed after it was clear that Gorman, 57, would be staying on for a number of years.

Last week, Gorman appointed Colm Kelleher, 58, president of Morgan Stanley, and named Shelley O'Connor and Andy Saperstein as co-heads of wealth management.

On a call with analysts, Gorman thanked Fleming for his work at the firm, where he had been for the past six years.

"Our bench in wealth management is particularly strong. Andy and Shelly both have deep experience. Colm will help oversee wealth management, and it is of course a business that I have deep experience in. I look forward to stability with this team. Our entire focus is now on results," Gorman said.

LENDING GROWTH

Gorman told analysts that lending and banking services remain a key growth opportunity for the wealth management business. Like its rivals, Morgan Stanley has been making a bigger push to cross sell banking and lending products to its numerous wealth management clients.

The firm's bank deposit program continued to grow, with deposits rising 9% year-over-year to $149 billion. Wealth management loans soared 31% to nearly $50 billion.

"We remain substantively under-penetrated [with clients] relative to our peers," Gorman said.

Morgan also said that advisor headcount rose 1% from the prior quarter to reach 15,889. Productivity increased to $947,000 per advisor from $944,000 for the year-ago period.

Client assets fell 2% to almost $2 trillion. Similarly, Merrill Lynch also reported on Tuesday that client balances at the firm dropped to $1.985 trillion. At the start of 2015, both wirehouses had reported more than $2 trillion in client assets.

Morgan Stanley reported fee-based asset flows of $11.4 billion, up from $7.7 billion for the prior quarter, but down from $20.8 billion for the year-ago period.

Fee-based assets as a percentage of total client assets remained stable from the prior quarter at 40%.

COMPANYWIDE RESULTS

Morgan Stanley rose in New York trading after reporting profit and revenue that exceeded analysts' estimates and plans for cutting at least $1 billion in costs by next year.

Shares of the company jumped 2.5% to $26.62 by late morning, compared with a 0.8% increase in the 88-company Standard & Poor's 500 Financials Index. Excluding accounting adjustments, fourth-quarter earnings were 43 cents a share, beating the 32-cent average estimate of analysts surveyed by Bloomberg.

Gorman is emphasizing cost-cutting as the firm struggles to achieve profitability targets. He's also attempting to strike the right balance in Morgan Stanley's bond-trading business amid the industry's years-long slide in revenue. The firm said last month that it was taking a $150 million severance charge as it pared its fixed-income trading business. The cuts affected 1,200 employees, including about a quarter of its fixed-income trading staff, a person briefed on the matter said.

The firm set a target for return on equity of 9% to 11% for 2017, compared with Gorman's longstanding goal of at least 10%. Last year's ROE was 7.8%, excluding accounting adjustments.

"We still have a target ROE of 10% or higher," CFO Jonathan Pruzan said in an interview. "We did put for the first time a timeline on that, and we did put a range in light of just the volatile and uncertain times that we live in."

Morgan Stanley could achieve its target in part by cutting expenses: The firm announced a new efficiency plan, "Project Streamline," which should reduce at least $1 billion in costs by 2017, assuming flat revenue, according to a presentation that accompanied the earnings statement. The firm promised to consolidate processes and real estate and lean more heavily on outsourcing.

Fourth-quarter net income was $908 million, or 39 cents a share, compared with a loss of $1.6 billion, or 91 cents, a year earlier, when the firm booked costs tied to settling mortgage- related matters, the New York-based company said.

With reporting from Bloomberg.

Read more: