Traditional wealth management business models are "dead," but their replacements are only just emerging.

"Everything people thought was cool in 2014 is table stakes in 2017," said Kendra Thompson, head of Accenture’s global wealth management practice, at SourceMedia's InVest Conference in New York.

Robo advisers may have gotten most of the hype in recent years, but they don't represent a new channel, she said. "Robo is a platform capability. It enables you to scale your advice [offering]."

Robos are just one way of addressing what Thompson sees as three central questions for the future of wealth management: What do investors really want? What will they actually pay for? And how will today's or tomorrow's players deliver at scale for a profit?

Thompson compares the current state of the industry to a game of musical chairs, where traditional business models are falling to wayside.

"You don't win by defending the chair that has been removed from the game," she said.

The three models of the future: digital wealth management, adviser-led digital and ultrahigh-net-worth scaled. Accenture's advice to firms is not to try to do all three; few players have the scale and ability to effectively compete in each category. Instead, many firms would be wise to focus on one specialty.

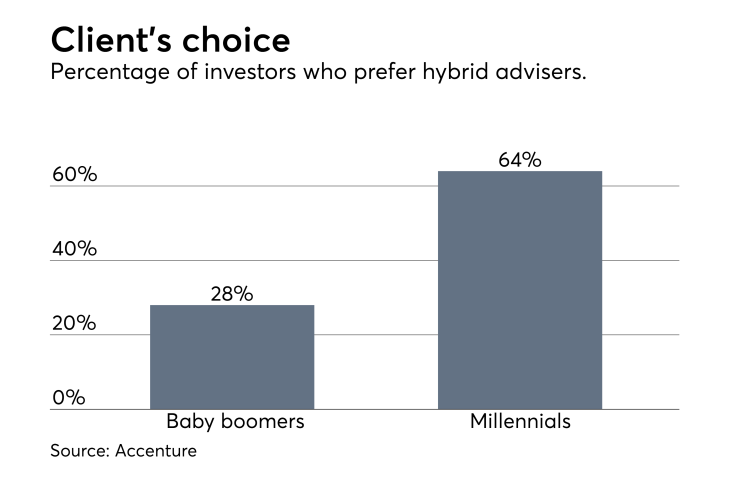

Firms will also have to recognize clients are the driving force behind the new models. A future hybrid robo-human adviser platform will not operate like an on/off switch. Clients want to "be able to dial up or dial down the advice," Thompson said.

For her part, Thompsons thinks that many digital startups won't survive.

"My money is on incumbents. Not all of them, but a subset of them that are taking this seriously and are putting their capital to work," she said.

But to have a successful future, they'll need to reorient their strategies to take into account changing client preferences, particularly among women and millennial investors.

"Millennials actually feel empowered to challenge big industries like us," she said.

Thompson stresses that firms will need to reorient resources and strategies. Service and compensation models might need to change too.

"If the stumbling block is that you are afraid to upset your financial advisers, I would advise against that because at the end of the day clients will vote with their dollars," Thompson said.