Economic fallout from the coronavirus pandemic has many Americans questioning their financial security. Worries about the need to postpone retirement or tap into savings to pay for basic expenses are some of their top concerns, according to Financial Planning's latest Financial Wellness Report.

"I am more anxious about my goals for the future," says one consumer surveyed for the report. "I am more frequently checking the balance of my accounts and talking with my spouse about our future."

Respondents to the survey, conducted in June, reported job losses, furloughs and having to work reduced hours.

"Clients are feeling anxious," says Tucker Braddock, senior wealth advisor with Keel Point, an RIA and broker-dealer based in Vienna, Virginia. Braddock says his clients are experiencing emotional — and financial — whiplash as economic woes caused by the U.S. shutdown dissolve their previous optimism about previous rosy year-end 2019 forecasts.

"The bottom fell out of their confidence," Braddock says.

Financial Planning’s Financial Wellness Report is based on results from our online survey conducted June 17-27, 2020, among 504 consumers age 21+ that have some knowledge of their household's financial planning and investment activities. The sample is nationally representative and balanced on age and gender.

More to lose

Perhaps counterintuitively, the survey found that the higher a respondent’s income level, the bigger the setback toward achieving their financial goals.

Nearly a third of all respondents (32%) say the pandemic set back their financial goals by one to two years.

Yet 43% of respondents with annual household incomes of $100,000 or more say COVID-19 delayed their financial goals by a year or two, compared to 24% respondents with incomes between $50,000 and $99,999. For those earning less than $50,000, 32% say the coronavirus caused a setback.

Parsing further by income level, 40% of millennials and Gen Xers making less than $50,000 express significant concern about losing their home. In the middle-income bracket, that figure drops to 27%.

Among those making more than $100,000 a year, the proportion who are highly concerned about home security spikes to 37%, with a full quarter of high earners saying they are "extremely concerned."

Advisors step up

The fallout from COVID-19 has "reduced my saving reserves — a huge setback [of] about three to four years," says one respondent. "When I get back on my feet, I'll have to play catch up!"

Clients are increasingly turning to their advisors to help navigate economic hardships, the survey showed. That also suggests planners are offering more services to meet heightened demand.

One third of respondents (34%) reported having worked with a financial advisor over the past year, while 16% say that they have engaged with a robo advisor or an advisor app.

A whopping 36% of respondents report their financial goals have shifted since the onset of the pandemic. Of those who work with an advisor, 33% say that they are relying on them to a greater extent than before the pandemic.

Advisors have begun offering new guidance in the past few months, respondents say, addressing areas like budgeting and financial planning (29%), holding regularly scheduled calls or meetings (27%) and answering questions about the CARES Act (16%).

At the outset of the pandemic, every conversation seemed "emotionally driven," Braddock says. But, in time, the initial panic will pass, he adds. "Advisors should review the client’s goals — where are they in the process, and what changes need to be made to adjust the trajectory?"

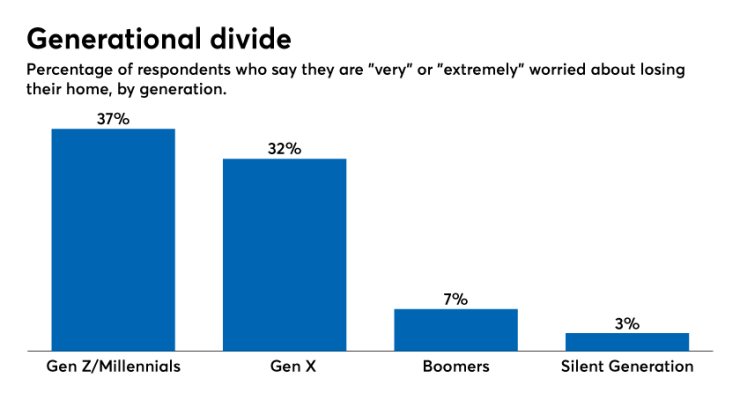

That’s a tall order. Financial anxiety reigns on a number of fronts. Almost a quarter of respondents say they are "extremely" or "very concerned" about losing their home. That’s up from just 16% in the February 2019 study.

Those concerns are more pronounced among younger respondents: 37% of consumers in the Gen Z/millennial cohort report high levels of worry about losing a home, compared to lower rates of anxiety among older respondents (7% among boomers).

‘Non-essential’ groceries

Increasing uncertainty about financial security, coupled with rising prices at the grocery store and elsewhere, has dramatically curtailed respondents’ spending habits.

"I don't spend money on anything that is not considered to be essential," one respondent says, summing up the responses of many others.

In all, 32% of respondents say that hardships from the COVID crisis have made it more difficult to make their monthly household expenses.

"Clients … are in survival mode," Braddock says. "They are thinking less of the consequences of using the money outside how they had planned — i.e. using retirement money now to pay expenses — and more of the consequence of not paying their expenses."