For some of the few Black and Latino executives in the financial services, the added work of boosting representation and mentoring is simply “a practical reality,” says Northern Trust’s president of asset management.

“You have a whole other job, different than your majority counterparts,” Shundrawn Thomas said during a panel discussion at the Association of African American Financial Advisors’ Vision conference.

Thomas says he was the first non-white member of Northern Trust’s all-white male executive team when he joined in 2008. Today, nine of the 15 executive committee members in asset management are either women, Black or Asian American.

It’s a welcome sign of progress in an industry that has experienced little of it.

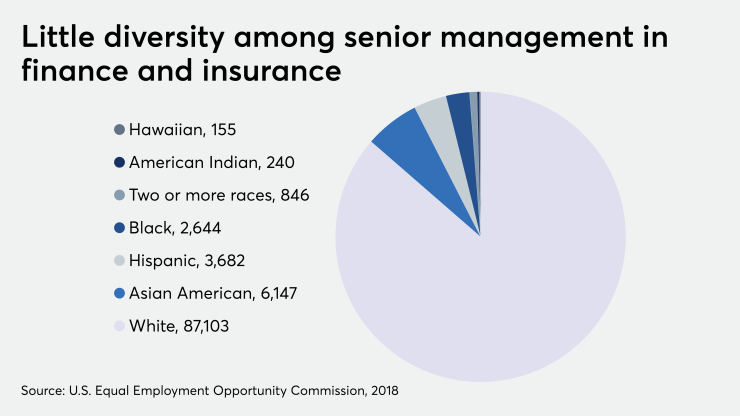

The demographics of the roughly 100,000 executives, senior-level officials and managers in finance and insurance have remained largely the same over the past decade,

Such figures are “startling,” said Quad-A Chair Lazetta Braxton. “I say ‘startling.’ We know it's not really startling, but it is startling because things have really not changed.”

Thomas, executives from PNC Financial Services Group and JPMorgan Chase and representatives of the two largest organizations for Black professionals in wealth management — Quad-A and the National Association of Securities Professionals — pledged to meet regularly to assess the industry’s advancement in an area where it’s been spotty at best.

Underrepresented groups and those aiming to support them should change the lexicon and metrics of diversity and inclusion, according to Ron Parker, CEO of NASP.

“Our D&I practitioners got seduced into looking at metrics based upon the number of rubber chicken dinners that they attended and the rankings on certain diversity or national scorecards, as opposed to a metric that talks about, how do you examine all of your systems and all of your processes that speaks to those core values that you want to strengthen?” Parker said.

Besides connecting Black and Latino representation with larger values, firms can find ample links with their businesses as well, according to the executives. At PNC, evaluations of managers include assessments of whether they’re boosting minority representation, according to Carole Brown, the firm’s head of asset management.

“We do a really good job with the entry-level associates in our diversity numbers,” Brown said. “It's that mid-level career and senior career where we're actually trying to double our efforts, triple our efforts to make sure we not only identify the talent, but we retain the talent.”

Kristin Lemkau, who

“I need all the help I can get in improving the representation of the advisors who I have and making sure those who are here feel like they are part of a community,” Lemkau said. “I hear all the time from them. They often feel like they're ‘the only, the only, the only,’ and in Quad-A, they're not.”