Assessing investor risk tolerance is all about determining the client’s willingness to take investment risk — and their financial capacity to bear it. Most commonly, this is done with a risk tolerance questionnaire that posits a series of questions about time horizon and need for income, and attitudes about risk and market volatility, to calculate a risk score and determine the portfolio that matches it.

The caveat to this approach, however, is that by averaging together risk tolerance and risk capacity scores, the adviser can unwittingly create disconnects between the client’s risk tolerance and the investments he/she is placed in.

How to remedy this disconnect? Luckily there are tools to guide advisers on the path most appropriate for their client. But first, we need a fundamental breakdown of the factors that contribute to the disconnect — and how to best gauge a client’s appetite for risk.

TOLERANCE VS. CAPACITY

The standard approach to determining risk tolerance is to ask investors a series of questions. This might include assessing their time horizon, available assets and need for income, along with their willingness to sustain market volatility and comfort level staying invested through a market decline.

These risk tolerance questions can be grouped into two categories. The former are questions about risk capacity: the investor’s ability to have something bad happen in the portfolio and not ruin his/her goals. The latter, regarding willingness to take on market volatility and stay invested, assess the investor’s attitudes about risk — in essence, their true tolerance for market risk.

Classically, the scores from these risk capacity and tolerance questions would then be merged together into a single score of risk tolerance, where the investor gets a lot of points for a long time horizon and a willingness to tolerate a lot of market volatility, but no points if he/she isn’t willing to stay invested in a down market or has an unusually high withdrawal spending need, such that the goal would be ruined by an ill-timed bear market.

The combined final score can then be mapped to an appropriate portfolio and associated investment policy statement, with high scores tied to an aggressive portfolio, moderate scores tied to a moderate growth portfolio and a low score tied to a conservative portfolio.

Unfortunately, though, there’s a

In particular, the

Unfortunately though, when risk tolerance and capacity scores are merged together, there’s no way to spot these discrepancies.

ALIGNMENT

Given these dynamics, what’s the alternative? Simply put, it’s not to add risk tolerance and capacity scores together to a single item, but instead to separately evaluate and score them.

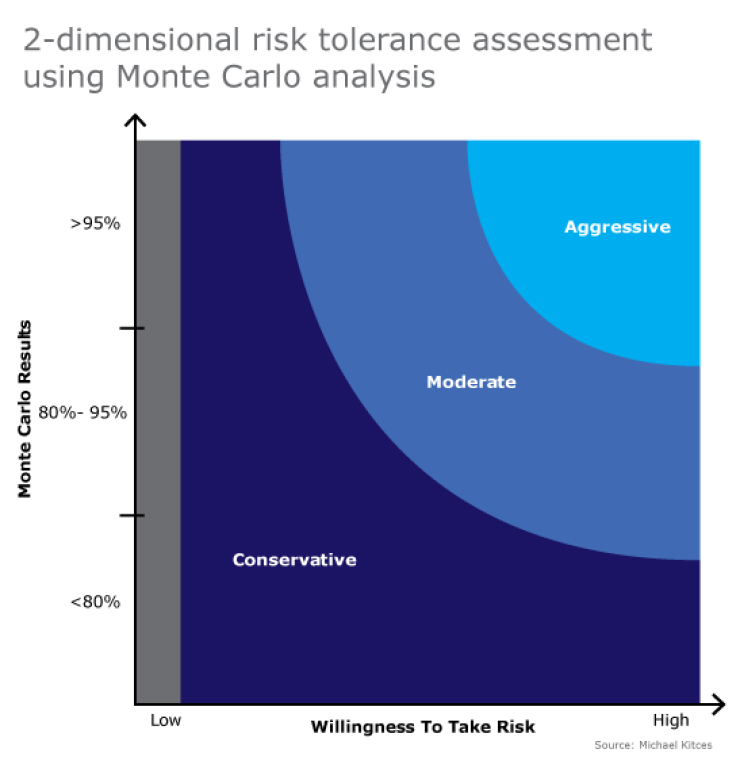

Instead of a one-dimensional risk tolerance score from conservative to aggressive, the adviser ends up with a two-dimensional perspective on how to assess the appropriate portfolio.

Of course, clients who have both a high tolerance and high capacity for risk will still get an aggressive portfolio, and those who have no tolerance nor capacity for risk will be conservative — or outright in cash.

The distinction, however, is that when investors score high on one measure but low on the other, the classic single-score approach adds the scores — which tends to skew them to at least moderate growth portfolios — while the separate approach properly recognizes low risk tolerance or low risk capacity as a constraint.

In other words, if an investor has a very long time horizon but no tolerance for risk — i.e., an ultraconservative young investor — the traditional approach would drive them into a moderate growth portfolio they could afford, but that they couldn’t tolerate. This revised approach, meanwhile, would recognize that tolerance for risk should always be a constraint. Putting a young investor into a volatile portfolio he/she truly can’t tolerate is just a lawsuit waiting to happen in the next market downturn.

While it’s called a risk tolerance score, it’s really the combination of risk tolerance and risk capacity.

Similarly, an ultra-risk-inclined investor who has no emergency savings and a near-term time horizon might get a moderate growth portfolio with a blended score because he/she is very tolerant of risk. However, the separate approach will properly recognize that the investor simply can’t afford to take that risk.

In essence, having a low willingness to take risk, and/or limited capacity to afford risk, should be viewed not just as a component of the risk score, but a constraint to the proper portfolio the investor agrees to in an Investment Policy Statement. That means investors who have low tolerance or low capacity should remain in conservative portfolios. Similarly, investors with just moderate tolerance or capacity should stay in moderate portfolios, and not drift up to aggressive just because their other score is high.

DIMENSIONS OF RISK

Ultimately, the key problem of most

The good news, however, is that there actually are a number of standalone risk tolerance assessment tools out there that do look only at measuring risk attitudes and the client’s pure willingness to take risk.

The longest-standing pure risk tolerance assessment tool is

Of course, if the adviser is going to assess pure risk tolerance on a standalone basis — without mixing in risk capacity questions regarding goals and time horizons — it’s still necessary to separately evaluate risk capacity too. On the plus side, for those who do planning, the plan itself is a measurement of risk capacity.

For instance, if the client’s

Notably, for advisers who don’t do a full plan for every client, it’s clearly still necessary to have some assessment process for risk capacity.

The starting point could simply be to use the traditional risk tolerance questionnaires — with questions on both risk tolerance and risk capacity — and just recognize that they need to be separately scored. In other words, don’t score the questions and add them up to a single result. Instead, score them separately and put the results on a grid like the one above, with the low/medium/high scores for each, to ensure the actual portfolio the client gets is appropriately matched.

Just because an investor can afford to take risk doesn’t necessarily mean he/she wants or needs to.

Fortunately, new risk assessment tools are beginning to emerge that help accomplish this. For instance,

The end result of the software is a matrix of recommended portfolios at the intersection of willingness (tolerance) and ability (capacity) to take risk.

The bottom line, though, is simply this: Beware of risk tolerance assessment tools that blend together the results of measuring risk tolerance and risk capacity into a single score/result. Instead, the two need to be measured separately and only then blended back together in a two-dimensional assessment where they operate as constraints to a portfolio — not a cumulative score to invest