The Ladenburg Thalmann network of five independent broker-dealers with 4,400 financial advisors is reportedly weighing whether to be the next major wealth management firm to go up for sale.

Ladenburg has tapped an advisory team to seek bids for the Miami-based firm, but company executives haven’t made a final decision, people familiar with the matter told Bloomberg News on Oct. 29. Representatives for the firm didn’t respond to requests for comment.

"Ladenburg has shown strong performance on a standalone basis," Ladenburg CEO Dick Lampen said in an email blast to advisors that was obtained by Financial Planning. The message went out after Bloomberg published the story.

"Rest assured we remain committed to our financial advisors and their clients, as well as to our open architecture platform and our multiple clearing and custody partners," Lampen told advisors. "Everyone at Ladenburg remains focused on running the business and continuing to serve your needs. If you are asked about this news by your clients, you can assure them that it is business as usual."

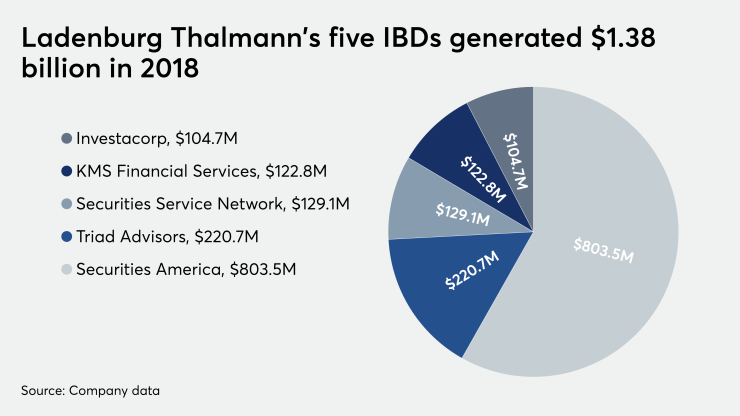

The network consists of Securities America, Triad Advisors, Securities Service Network, KMS Financial Services and Investacorp. Together, they boosted Ladenburg’s revenue by 21% year-over-year in 2018 to $1.38 billion,

It wasn’t immediately clear how the publicly traded firm would make such a sale, though insiders own about one-third of the company’s stock. Its value surged by 12% to $2.26 per share after the report, a price that would make the company worth $336 million, Bloomberg reported.

Any transaction would follow two by

Ladenburg’s former primary shareholder, billionaire pharmaceutical entrepreneur Phillip Frost,