RIAs with less than $250 million in AUM remain highly prized in the red-hot M&A market.

Just days after three former Affiliated Managers Group executives formed

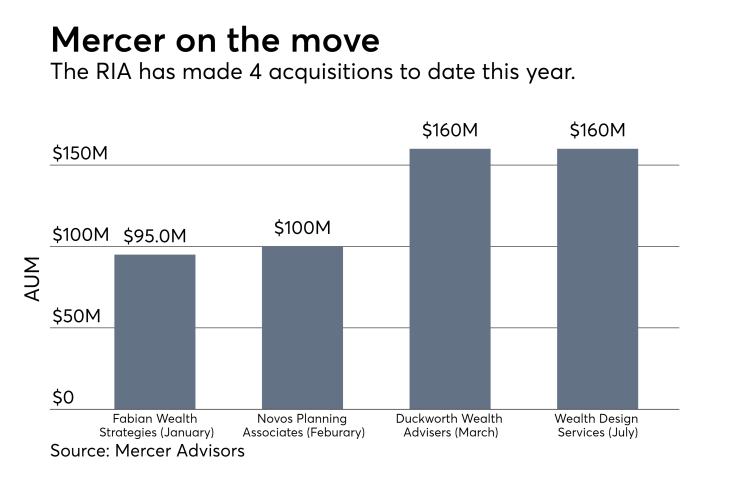

Mercer’s latest acquisition is Wealth Design Services, a Rochester, New York-based firm with approximately $160 million in assets under management. Steven Schwartz, the RIA’s founder and president, will stay on as Mercer seeks to expand its footprint in New York State and the Northeast, and build on the company’s existing presence in New York City.

Mercer’s most recent transaction underscores the

Research by M&A consultant David DeVoe shows that 60% of industry transactions last year, and half of this year’s deals, involved firms with less than $1 billion in AUM.

DURAN SKEPTICAL

Rich Gill, co-founder of the newly formed Wealth Partners Capital Group, said that there’s less demand for smaller RIAs in the current seller’s market.

“There are fewer bidders for firms between $200 million and $1 billion in AUM, and even less for those below $200 million,” Gill said. “United Capital has been successful acquiring firms in that market, but not many others. It’s hard to manage an $80 million office.”

United CEO Joe Duran, however, expressed skepticism about the wisdom of the increased activity in that segment of the M&A market.

“It’s a crowded market,” Duran said. “The only way to get in is to overpay, and it’s very difficult to improve the underlying business. It’s really expensive to run an RIA. Our administrative costs alone last year were $35 million.”

Industry consultant Jamie McLaughlin takes exception to Duran’s analysis.

“Joe’s a smart guy, but he’s dead wrong,” McLaughlin says. “There’s a big pond out there and plenty of fish.”

MERCER: STAYING ‘AGGRESSIVE’

Not surprisingly, David Barton, Mercer’s vice chairman and M&A head, is siding with McLaughlin.

The Wealth Design deal was Mercer’s seventh acquisition in 16 months, Barton noted in a statement that also reiterated the firm’s commitment to “aggressive growth.”

“Integrating highly attractive acquisitions like Wealth Design Services into our portfolio is a key aspect of building our national platform business,” he said, citing the Rochester firm’s tax specialty and ability to increase Mercer’s branch footprint in New York State. Terms of the deal were not disclosed.

Mercer began its buying spree in January 2016 when it bought Spruce Hill Capital, an RIA with $112M in AUM, and made its big splash last summer with the acquisition of Kanaly Trust and its $2.1 billion in assets.