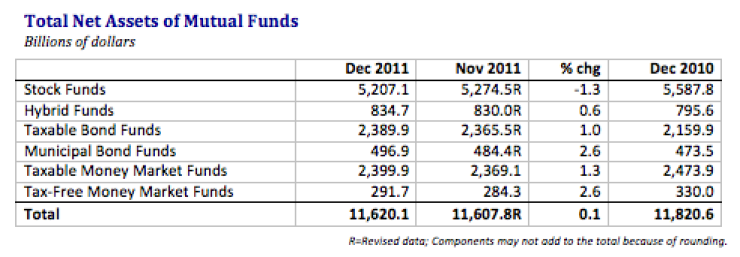

The assets of the nation’s mutual funds were flat in December, gaining $12.3 billion.

That worked out to a gain of one-tenth of a percent, for an industry that has $11.6 trillion in combined assets, according to the Investment Company Institute.

The big losers were long-term funds. Stock, bond, and hybrid funds had a net outflow of $16.48 billion in December, compared to an outflow of $4.45 billion in November.

Stock funds saw an outflow of $28.79 billion in December, compared with an outflow of $18.61 billion in November

Hybrid funds posted an inflow of $2.75 billion in December, compared with an outflow of $4.86 billion in November.

Bond funds had an inflow of $9.56 billion in December, compared with an inflow of $19.02 billion in November.

The big gainer: Money market funds, with an inflow of $38.52 billion in December, compared with an inflow of $43.13 billion in November.

Funds offered primarily to institutions had an inflow of $29.10 billion. Funds offered primarily to individuals had an inflow of $9.42 billion.

For all of 2011, $130.3 billion was pulled out of stock funds. Investors added $136.5 billion to taxable bond funds. And took $11.8 billion out of municipal bond funds.

[IMGCAP(1)]

Tom Steinert-Threlkeld writes for