As part of our annual Banks Stars on the Rise section, we asked a short list of questions to all our nominees and their banks. Our editorial team used these answers to help gauge which advisers would make the cut.

Unlike some of our other rankings, this one was subjective. The only real requirement was that the nominees had to be under 30, or in the industry less than five years (this was to give recent career changers a chance, even if they were older.)

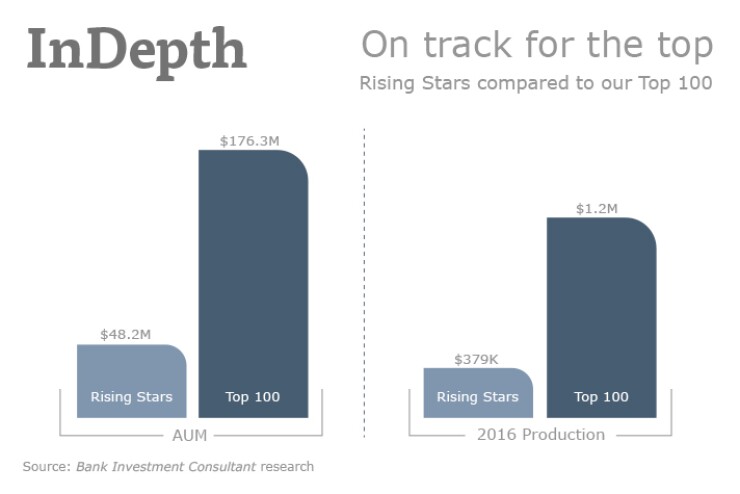

The one overriding criteria we kept in mind was whether they seemed like they were on track to become the type of successful adviser who could make our Top 100 list one day.

We asked for AUM and production figures, and while we didn’t use those numbers as part of our judging process, we calculated the averages and compared them to the averages of our most recent Top 100 Bank Advisers (see data graphic.) The young stars’ averages are for all the nominees, not just the final 8 winners.

The answers from the advisers, however, were the most important factor in our decisions so we wanted to give them their full due. We picked two of the questions and compiled the best responses from all the nominees.

-

A well-rounded approach wins the day with the annual advisor ranking. No one-trick ponies allowed, as multiple metrics count toward advisors' scores, including AUM, production, growth and fee business.

December 7 - Here is the second segment of the expanded Top 100 Bank Advisors. The top 25, as well as those who ranked 51-100, are included in the corresponding slideshows.Sponsored by LPL Financial

- Here is the third segment of the expanded Top 100 Bank Advisors. You can see the top 50, as well as those who ranked 76-100, in our corresponding slideshows.Sponsored by LPL Financial

- Here is the fourth and final segment of the expanded Top 100 Bank Advisors. You can see all the others (1-75) in our corresponding slideshows.Sponsored by LPL Financial

The two questions we picked to highlight are: 1) What are the most important issues your clients are facing and how are you able to help; and 2) What's the best piece of advice an older adviser has ever given you?

Their responses are below, lightly edited. The responses to the first question gravitated around a few common topics (namely, retirement, information overload and the markets) so we grouped them likewise.

Question: What are the most important issues your clients are facing and how are you able to help?

A. Retirement

Unfortunately, we are seeing more people than ever retiring without pension benefits and the responsibility of retirement income falls squarely on them. But they haven’t been provided the proper education during their careers for that tremendous responsibility. Plus, many people have an unrealistic idea of what their retirement should be like and the benefits they are “entitled to.” It’s a rough conversation. Even for those clients who have the great retirement they always wanted are sometimes facing the unfortunate costs of long-term care and they are facing them at a time when it’s really too late to prepare for those events. It’s another instance of lack of education that leads to lack of preparation.

Common concerns of my clients include the changes with social security benefits, lack of employers offering pensions, and the increasing healthcare expenses in retirement. This has caused a sense of fear that they will outlive their income. With the use of both one-on-one appointments and educational seminars, I can address their concerns and provide personalized advice based on their financial situation.

B. Information overload

One of the most important issues facing our clients right now is having little or no financial knowledge to decipher the information overload. I believe it is our job as financial advisers to make it seem less daunting.

The most important issues clients are facing now is having thousands of news sources telling them thousands of different things regarding financial markets, the economy and politics. This does more harm than good for most clients and I always reinforce that we should pay no attention to forecasts or predictions, and not let political beliefs influence investment behavior.

Headlines about low interest rates, all-time market highs and a new administration are all valid issues clients react to. I help by reminding them of their long-term goals. I try to educate them and reaffirm their strategy to keep them on track.

As I meet with clients, I realize they often don’t understand the financial jargon so I try to use everyday terms. I try to make sure they really understand what we are discussing. By doing this, I help them make sense of what seems overwhelming and, in turn, earn their trust.

C. Markets/investments

Getting money off the sideline and invested into equities. The market is hitting all-time highs and people are underinvested and underexposed. If they don’t invest properly, inflation will take its toll over time and damage their retirement plans and erode their assets.

Many of my clients are nervous about taking risks. Whether they have lost money in the past, or just appreciate the comfort of knowing that their money is safe, taking risks is uncomfortable for many…..They would often prefer leaving their money in savings or CDs, but that hardly keeps up with inflation. My first conversation with a client revolves around eliminating that emotional resistance. I want them to feel confident that not only can I offer conservative ideas, but that I will not try to “push” them into doing something outside their risk profile.

If it isn’t broken, don’t fix it. Advisers sometimes suggest changes to a portfolio in order to gather as many assets as they can, but if an investment is performing well elsewhere, I don’t pressuring them to transfer those assets to my control.

Debt is a big issue, and an easy trap to fall into. There is a lot of societal pressure telling us we need to be doing certain things or obtaining certain possessions; otherwise, we have somehow “fallen short.” Our jobs as advisers is to assist people in helping them quantify their goals, desires and objectives so we can then truly advise them on how to implement steps to help achieve them.

Most of the struggles my clients face today are related to becoming educated about their own money and understanding that money is about more than what it can buy. Getting clients to understand concepts like purchasing power, compounding returns and income streams is the first step to helping them build wealth. By enlightening clients and shifting their perspective, I am able to attain a new level of trust and am better able to guide them while working through the planning process.

D. Other

There are many challenges facing clients today: low interest rates, rising health care costs combined with longevity, etc. But the biggest issue is, and always will be, time. Time is the only asset no one can ever get back. The best way I help my clients is by educating them to help them make good decisions with their money that take advantage of the time they have left to reach their goals.

This year, the elections were front and center during many client meetings, with their concerns focused on what the next four years might bring for the markets. I was able to put several misconceptions, fears and insecurities to rest by compiling a retrospective analysis of market performance for elections in the past. We reviewed the possible outcomes for each portfolio and mitigated risk wherever possible. By listening to their concerns and spending the one-on-one time with them to discuss and ease their fears, each client was able to leave my office feeling educated about the possibilities in a time of uncertainty.

Uncertainty and fear are two key issues. Recently I had a 77-year-old client walk into my office, concerned that if Social Security ended tomorrow, she could not remain retired. I also have clients who want to move their entire portfolio to cash because of the political environment. I see my role as a calm reassurance.

Each client’s financial situation is different, yet one common issue is the absence of a financial plan, along with a review process in place to monitor goals and objectives.

Question: What's the best piece of advice an older adviser has ever given you?

Ignore the noise. Focus of what is in front of you and on what you can control rather then what’s in the news.

You can't be all things to all people….and when clients call to sell or get on the sidelines is exactly when they need you to connect with them.

Always consider yourself a teacher rather than a salesperson. Never assume that a client understands investing as well as you do. Teach the client slowly and really make sure that they understand what they are investing in.

The day you can’t admit your mistake, or think you know it all, is the day you should no longer be an adviser.

Invest in yourself. Take the time and resources you have available to grow professionally and personally.

You have two ears and one mouth. Listen to your clients, ask good questions, and educate them and amazing things will happen.

You never lose money taking a profit.

Always look out for the best interest of your clients. I have seen the advantage of satisfied clients time and time again, passing on the word to family and friends about my services. Once at an educational seminar, a prospect approached me who had over 20 years left until retirement. I worked with her one-on-one, knowing that there were no immediate assets to be moved, but after our conversation, she referred me to a close friend who invested over $4.5 million with me.

If it isn’t broken, don’t fix it. Advisers sometimes suggest changes to a portfolio in order to gather as many assets as they can, but if an investment is performing well elsewhere, I don’t pressuring them to transfer those assets to my control. That goes a long way to build a trustworthy relationship.

It doesn’t matter if you don’t know the answers, what matters is that your clients can count on you to find the right answers when they need it.

Never stop learning. I’ll finish studying form my CFP by the end of 2017.

Tell the clients what they need to hear, not what they want to hear. You are not being helpful to the clients as an order taker. They pay you for your advice.

Treat others how you want to be treated.

Don’t try to hit home runs. Just hit doubles; slow and steady wins the race.

Ask lots of questions, then shut up and listen.