PIEtech recently launched the fifth generation of MoneyGuidePro software, an update that includes improved forecasting calculation tools that will benefit an aging client population.

Any advisor using MoneyGuidePro received access to the new update, dubbed G5, about a week-and-a-half ago, says Kevin Hughes, executive vice president of sales at PIEtech. The company started introducing the features to financial planners and gauging reactions three or four months ago, he says.

Advisors have been responsive to the new health care planning tools, he says.

“That’s an area of advice that can really help advisors differentiate themselves in the market,” Hughes says.

The software creates estimates by looking at variables such as client adjusted gross income, age and marital status. It estimates costs by comparing supplemental health plans.

Those estimations are not readily available elsewhere, Hughes says. “It’s up to the advisor to go and find out that information.”

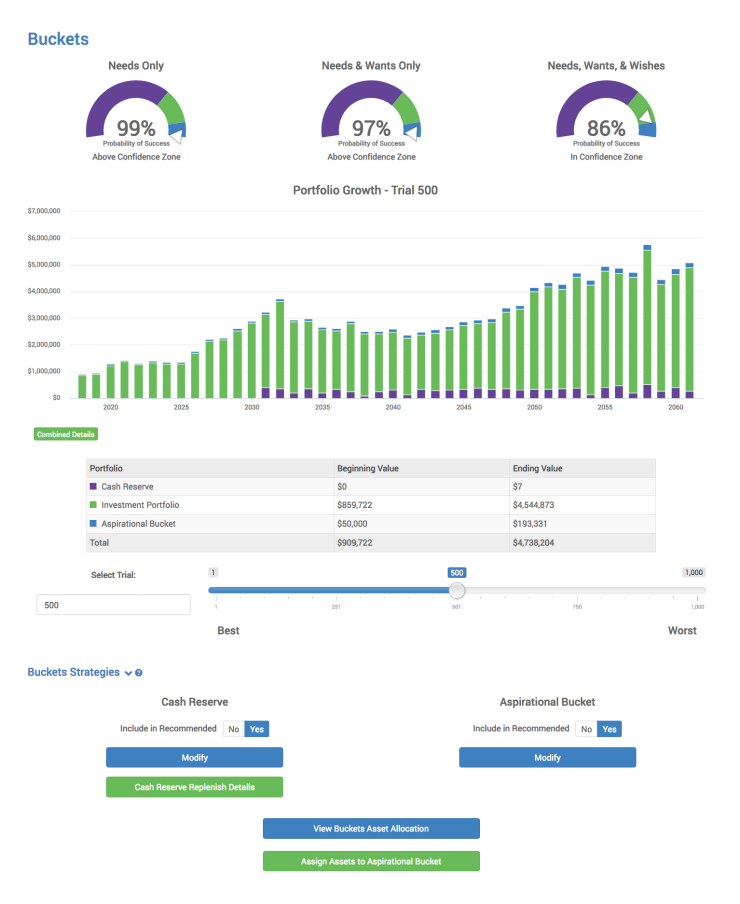

Additionally, advisors have taken to two other features, according to Hughes. G5 has more flexible forecasting than before, as annuities and more complex investments are now included in the calculations. A new cash reserve bucket strategy allows clients to set aside money that will replenish, even when the market is down.

Some of the G5 updates took about two years to build, Hughes says.

MoneyGuidePro was a pioneer in the planning software space in 2002. But over the past few years, rising fintech competitors have released their own products to simplify client relationships and improve the planning process.

Tools like

-

Startups are applying AI and big data to determine how advisory clients make investment decisions in real time.

September 11 -

A new entrant from Singapore vies for attention in a market that already includes offerings from robo advisors and custodians.

August 8 -

To convince advisors to try its platform, Capitect took a number of steps, including partnering with XY Planning Network to provide its tools to members without cost.

July 18

But despite increasing fintech competition, MoneyGuidePro remains the number one planning software for financial advisors. It was ranked the most-used tool in the latest Financial Planning

As PIEtech releases new updates, it aims to continue that trajectory.

MoneyGuidePro G5 follows the

PIEtech has sold MoneyGuidePro to about 10,000 advisors in the independent channel. Additionally, there are about 75 enterprise users, who vary in head count size from 100 to 15,000 advisors. All these advisors now have access to G5, at the same price as the fourth generation.

In early October the software company plans to release a new feature related to income planning. Another update will come out in 2019, Hughes says, although the company is not yet releasing details.