Raymond James set a personal company best for advisor headcount and CEO Paul Reilly expects more big teams and producers to sign on in the coming months.

“I can’t remember seeing so many $5 million to $10 million [advisors] in the pipeline,” he told analysts during an earnings call Thursday.

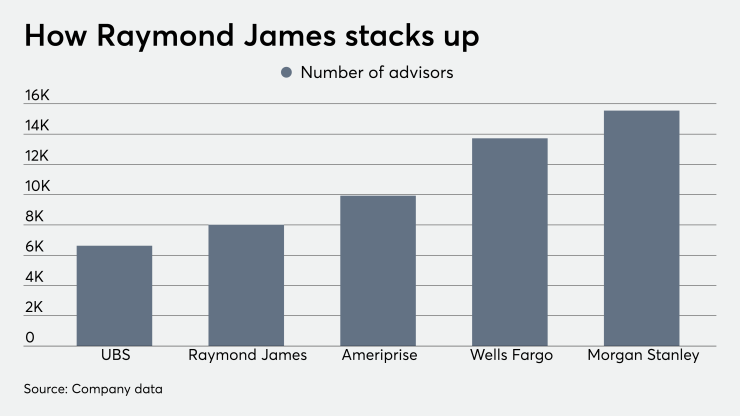

The firm notched 8,011 advisors for the period ending Sept. 30. That’s up a net 198 from the same period a year ago.

Raymond James has been on an aggressive recruiting campaign, declaring earlier this year that it was pumping out recruiting loans in the search for fresh talent.

As of June 30, the firm had issued formal hiring offers totaling approximately $214 million, up from $132 million from the year-ago period, according to the company’s earnings reports filed with the SEC.

Recruiter Mark Elzweig says that it’s the firm’s emphasis on advisors owning the client relationship that resonates. “It’s worth noting that while they do offer a deal, it’s not why they attract advisors,” he says.

Among the most recent hires was a former UBS team that managed $990 million in client assets.

In addition to boosting headcount, such hires have upped assets for Raymond James’ wealth management unit by 6% year-over-year to $798 million, according to the company. Assets in fee-based accounts jumped 12% to $409 million.

But while headcount and AUM surged, Raymond James’ net income growth was more tepid due to rising expenses. Profits rose 1% year-over-year to $265 million. Noninterest expenses of $1.7 billion increased 8%, slightly outpacing revenue growth of 7%, which reached $2 billion.

Among the firm’s fastest-growing line items were business development and equipment costs. Compensation of $1.3 billion still comprises the biggest line item.

Although Reilly said management is striving to be disciplined on expenses, cutting back on recruiting efforts — which he sees as key to the firm’s long-term health — is not on the table.

“I don’t want to hand over the business one day to a successor and it’s not a growing business,” he said.