Clients saving for retirement are concerned about long-term inflation and markets falling back from all-time highs, but those worries didn't translate into a flight from equities or heightened aversion to risk, according to the latest Retirement Advisor Confidence Index, Financial Planning's monthly barometer of business conditions for wealth managers.

Many advisors surveyed said that despite those concerns, along with lingering uncertainties related to tax changes and the stubborn persistence of the COVID-19 pandemic, clients were feeling better in October than they were just a month earlier.

One advisor seemed to express the sentiments of many, simply saying, "after a rocky September, more confidence."

One of the surest measures of client confidence in the markets — investments in equities — saw an uptick in October.

The component of RACI that tracks equity investments in retirement accounts posted a score of 62.9 in October, up nearly eight points from September and 12.1 points from the same period a year ago. October's mark was well off from the mid-year equities scores, which topped 69 in April, but represented a healthy bounce back from the prior month when confidence in equities had fallen off considerably from August.

"September was a down month. October was a good month," one advisor said.

For perspective, RACI scores above 50 signify an increase in confidence, and scores below that mark indicate a decline. RACI's equities benchmark hasn't been under water—below 50—since May 2020.

Across all categories, RACI checked in with a composite score of 53.9 in October, a rebound of 3.2 points from September, and up 6.4 points from October 2020.

Risk tolerance — another key RACI metric gauging client sentiment — also bounced back in October, checking in at 51.5, up 8.5 points from September, which was the first month risk tolerance was under water since October 2020.

"My clients are still wanting to capture the upside of the market and don't want to miss out on the bull run," one advisor said.

That's not to say that clients are worry-free. Advisors polled in the RACI survey relayed numerous concerns weighing on the minds of clients, ranging from inflation to tax-policy changes in Washington to market valuations.

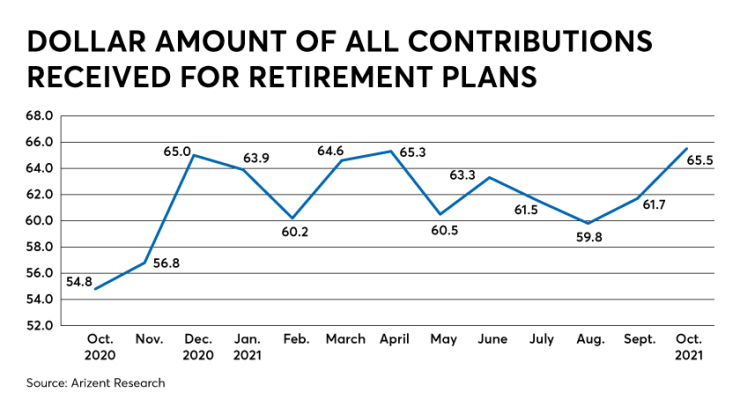

But one advisor noted that those uncertainties are weighing more heavily on the allocation of other client funds than they are on their retirement strategies, and, in fact, the RACI component that measures retirement contributions by dollar ticked up in October, posting a score of 65.5 for the month, up 3.8 points from September and 10.7 points from the year-earlier period. October's mark was the highest score seen in retirement contributions since December 2019.

"Clients are concerned about inflation and the market peaking," the advisor said. "This is affecting non-qualified dollars but not retirement dollars. As far as retirement assets, most clients are happy to stay the course, and several have actually increased their equity exposure."