WASHINGTON — Digital investment services aren’t just reshaping wealth management, they’re trimming it down.

Robo advisory clients can open a discretionary account in less than five minutes and move money into new accounts in under five clicks, according to Jared Shaw, consultant at Ernst & Young. By making it easier for clients to sign up, firms can now onboard more clients faster and operate at scale with much less staff.

“It’s rapidly cutting out the fat to get an account opened in a compliant manner,” Shaw told a room of roughly 100 advisors at the Schwab Impact 2018 conference. For example, a single staffer at an online robo advisor can support 10,000 clients, he said. In fact, 1 in 3 consumers use fintech solutions because it is easy to open an account, according to the EY FinTech Adoption Index.

Many digital-first investment firms have shrunk the number of forms clients need to fill out to get onboard — from 65 fields at a wirehouse to under 25. One of the biggest draws to developing timesaving techniques is how it can appeal to millennial clients, Shaw said. “The time they get to spend on their financial life is just not as much as someone later in their career,” he said.

That’s not to say younger clients don’t want to work with human advisors. Shaw cited a survey from the fintech provider Broadridge that found two thirds of millennial respondents said face-to-face interaction is necessary for earning and build trust. “That’s something that’s not going to go away anytime soon,” Shaw says.

Incumbents are also looking to offer digital tools to clients. For example,

“Fintech is not just startups,” said Matthew Hatch, partner with Ernst & Young. “It’s led by a lot of startups that gain all the attention, but also the incumbent financial institutions — and in a lot of cases, partnerships that are beginning to happen.”

Robo advice has fueled

“Financial innovation today is changing the way companies think about their strategy,” Hatch says. “It’s changing the culture of companies and the way they operate.”

The largest independent digital advice platforms profited significantly from a strong M&A market last year.

Some independent robos added staff to provide advice to digital-first clients.

While larger firms are making headlines, the smaller ones are touting significant funding rounds, Hatch says.

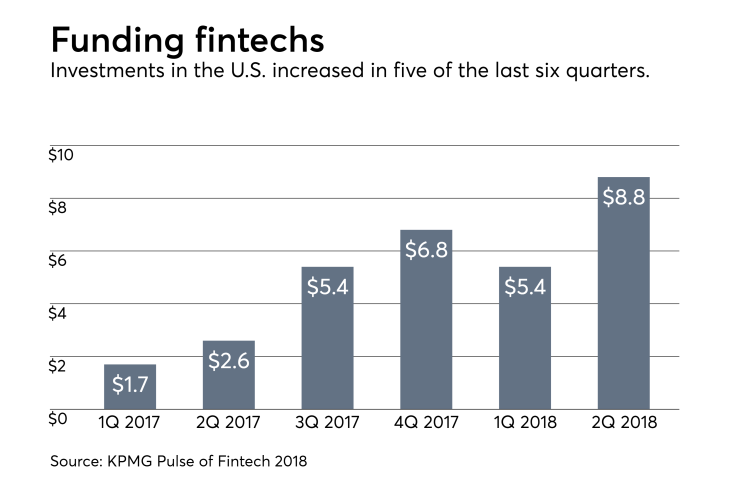

In the first half of 2018, global fintech investing topped $39 billion in 800 different investments, according to Hatch. Total investments in U.S. companies hit $8.8 billion in the second quarter of 2018, up from just $2.8 billion over the year-ago period, according to

The big winners included a $363 million Series D investment in the personal finance firm Robinhood and a $250 million Series E investment in the business network Tradeshift, according to the study.

“The amount of funding coming into this space is just staggering,” Hatch says.