Instead, they will get much stronger, expected to collectively top $1 trillion in assets under management in fewer than five years.

The booming popularity of micro-investing firms will partly feed such growth. With over 60% of millennials already subscribed to apps like Acorns, the sector will expand as they devote more money to investing, reports Boston-based consulting firm Aite Group.

“Digital advising will become less focused on Generation Y and begin to resemble the traditional investor,” says Javier Paz, a senior analyst with Aite and the author of “U.S. Digital Advice,” a study released in September.

Robos will become the norm within a decade, he suggests, joined by virtual assistants like Amazon’s Alexa and Apple’s Siri, as comfort with automated investing increases.

The research estimates AUM from robo advisors will hit the $1 trillion milestone by 2020 and will rise to $1.5 trillion the following year. Taking a conservative approach, the research did not account for AUM on upcoming digital platforms by Morgan Stanley, Wells Fargo, and UBS expected later in 2017.

“We’re being bombarded with digitization,” Paz says. “This is just one more form.”

The firm conducted a year-long study that wrapped up in July. As part of their research Aite interviewed industry executives from some of the industry’s largest firms and analyzed public filings. (The study projected its 2017 data).

Click through the slideshow to see how mobile-first investing will change the investment landscape in the coming years.

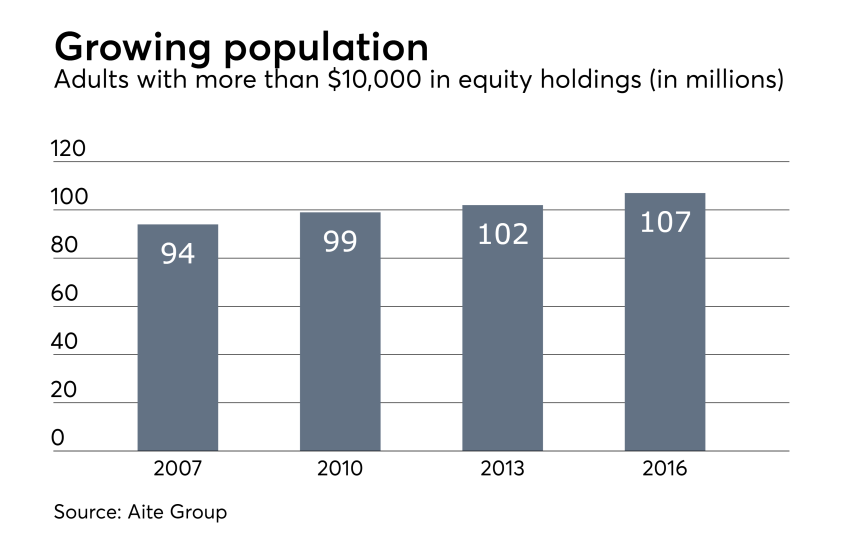

Almost 110 million adults held equities worth more than $10,000 in 2016, an increase of 5 million Americans since 2013. In addition, 20 million adults held less than $10,000 in stocks.

But there were almost 130,000 million adults who didn’t own any equity holdings in 2016, the report notes, and they might be interested in a platform offering cheap investment vehicles with no minimums.

The number of advisors in the U.S. has hovered around 325,000 for the better part of a decade, the research finds. It topped 330,000 advisors nationwide in 2016 — its highest level since 2008, but still short of pre-crisis levels.

“The numbers show there is significant constraint in the labor force,” Paz says.

The aging advisor workforce could also start to slow down in the coming years, he says, as advisors near retirement age. The average advisor was 50 years old in 2014, according to the research.

“With a growth in population, it stands to reason that there will be a growing imbalance between a qualified workforce and the needs of a younger population,” Paz says.

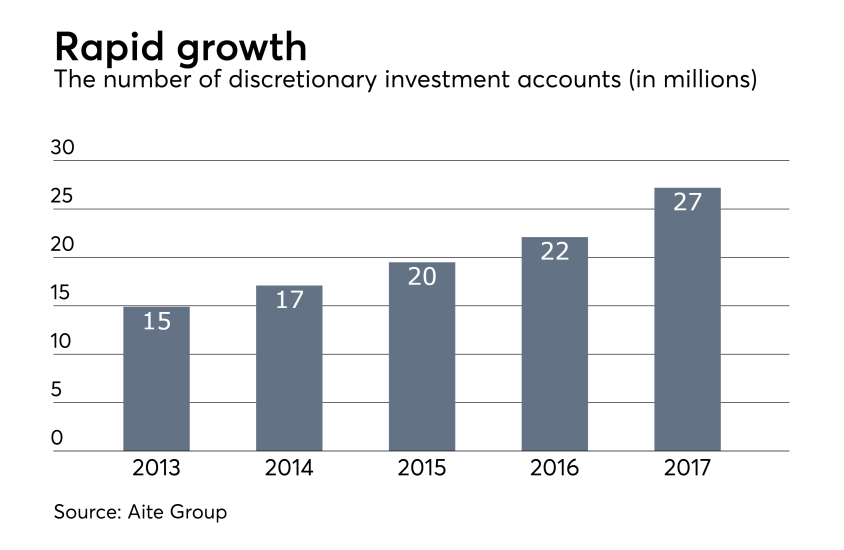

Robo advisor firms have been behind the massive increase in discretionary investment accounts beginning in 2014, says Paz.

“The rapid growth in discretionary investment accounts is hard to explain outside of the robo trend,” Paz says. After settling around 15 million accounts per year in 2010, discretionary accounts hit 22 million in 2016.

Many of the new accounts are fairly smaller in size, Paz says, citing the launch of the mobile-first investing platform Acorns in 2014 as a likely cause. “It’s not a normal event.”

Discretionary investment accounts are estimated to hit 27.2 million by the end of 2017.

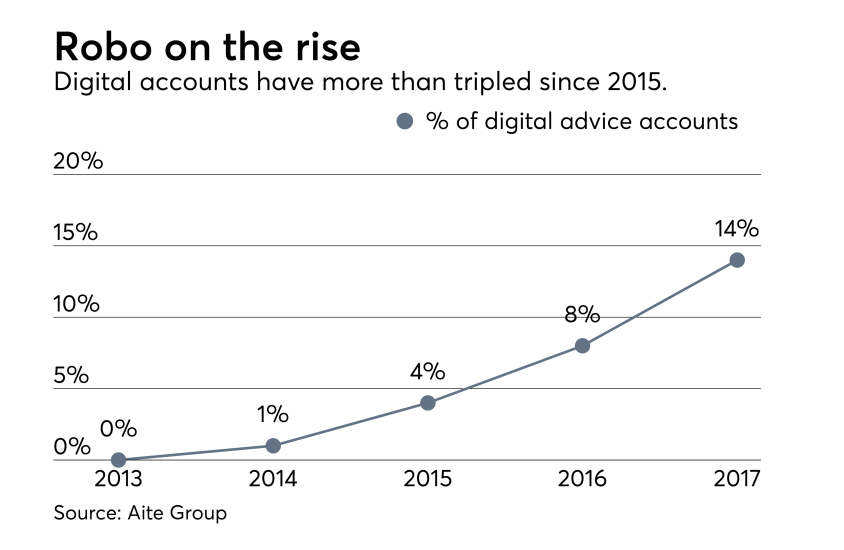

Not only did digital firms help bolster the number of discretionary accounts in 2016, but also grabbed a larger share of that business than in previous years.

Eight percent of discretionary accounts came from robo advisor firms in 2016 — up from only 1% in 2014. However, 14% of all discretionary investing will likely be on digital platforms by the end of 2017, according to the research.

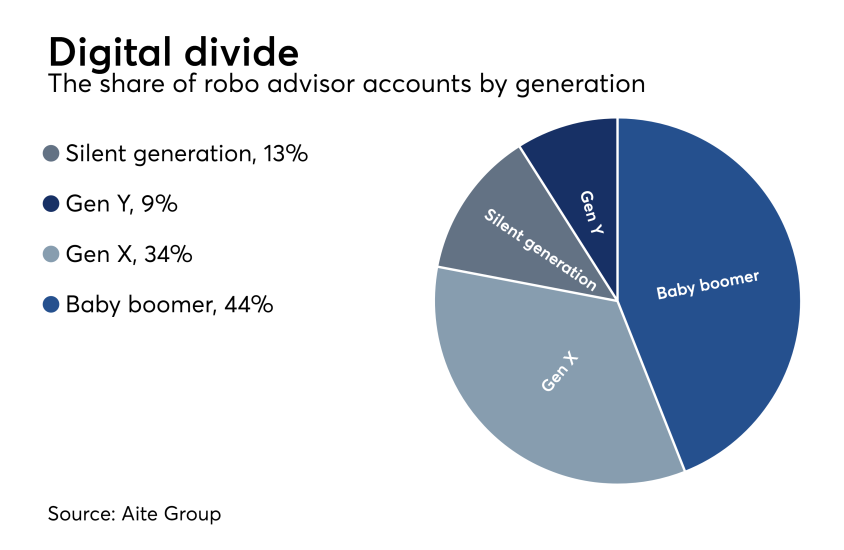

“The [digital] investing landscape is going to resemble the average U.S. investor more and more over time,” Paz says.

A surprise finding, researchers said, is that baby boomers are more avid users of digital advice than Generation X investors.

“It’s surprising that the boomers were ahead of the Gen Xers,” Paz says. After years of investing, Paz suggests, boomers have become seasoned investors, used to getting the most efficient investment vehicles at the lowest cost.

“They’re keen on maximizing the life of their investments,” Paz says, “and every little bit counts. Boomers have become very astute at finding bargains.”

The research estimates AUM from robo advisors will hit the $1 trillion milestone by 2020. Taking a conservative approach, the research did not account for AUM on upcoming digital platforms by Morgan Stanley, Wells Fargo and UBS expected later in the year.

Wealth management’s total digital transformation will probably take more than a decade, Paz says. As virtual assistants — like Amazon’s Alexa and Apple’s Siri — become more commonplace, so will digital advising platforms.

“We’re being bombarded with digitization,” Paz says. “This is just one more form.”