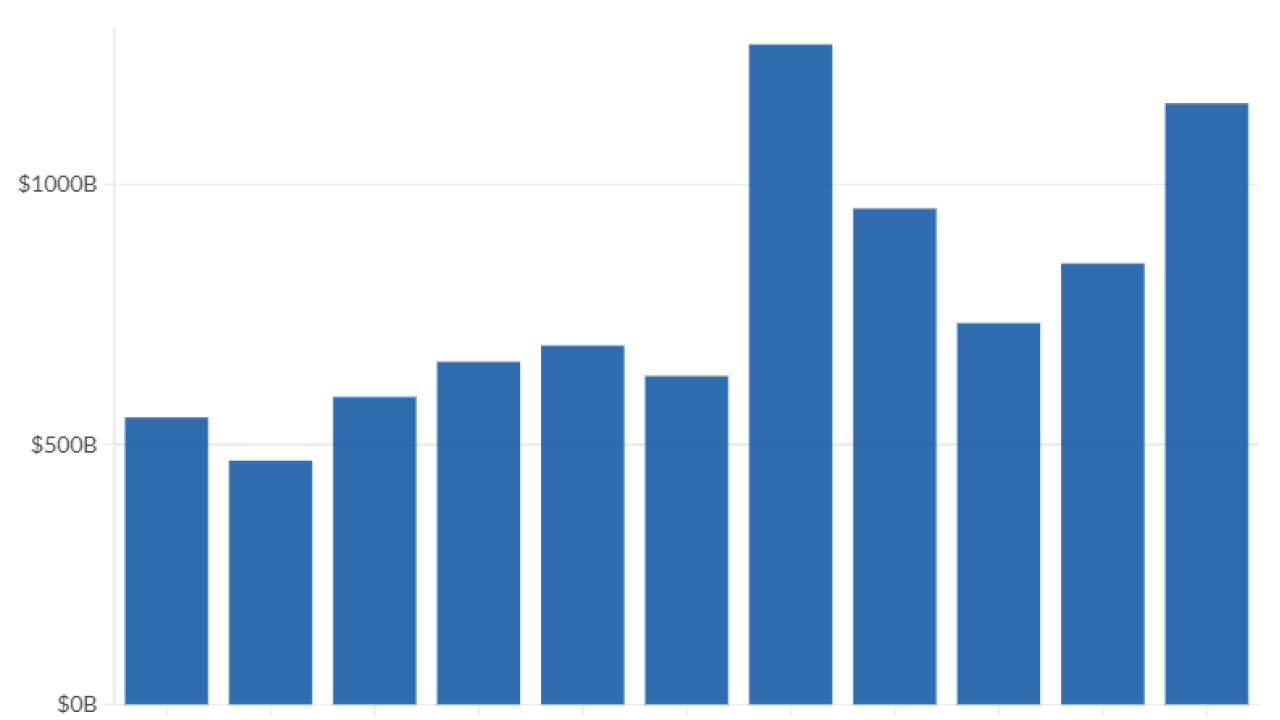

While markets ended the third quarter more or less even with where they were at the end of the second, Charles Schwab continued growing at a rapid pace.

The brokerage opened more than 1 million new brokerage accounts for the fourth consecutive quarter and has opened 6 million new accounts so far in 2021, according the company’s quarterly earnings statement. Schwab generated $139 billion in net new assets over the three-month period ending on Sept. 30, bringing its total net new assets to $396 billion over the first nine months of the year.

The company now manages a total $7.61 trillion client assets. At $3.476 trillion, the RIA custody business, Schwab Advisor Services, trails the retail Investor Services unit but is growing faster. RIAs brought in $81 billion in new assets, while the retail side grew by $58 billion (to a total of $4.137 trillion).

Improvements to Schwab’s technology for independent advisors — such as digital account onboarding — have minimized the potential for error and delays, giving advisors more time to find new clients, Schwab CEO Walt Bettinger said in a statement.

Retail clients are increasingly seeking financial advice, Bettinger said. Assets in Schwab’s advisory offerings reached $437 billion, a 24% increase from one year ago.

Schwab did not provide an update on the status of an SEC probe regarding its digital advisor, Schwab Intelligent Portfolios. In July, the company announced it was