Large-cap stocks yield more than their small-cap cousins. That's a general truism, but is also borne out by recent yield statistics from S&P Dow Jones Indices. At the end of February, the large-cap S&P 500 yielded 1.99%, the S&P MidCap 400 furnished 1.44% and the S&P SmallCap 600 provided a mere 1.33%.

But in one sector, the pecking order was reversed. Among financials, the small-cap stocks yielded 2.88% and the midcap stocks in the group 2.80% -- both besting the 1.82% yield of the larger financial stocks in the S&P 500. This was the only sector to show such a reversal of traditional yield distribution by capitalization size.

BLAME THE FINANCIAL CRISIS

If you want a reason, look no further than the financial crisis, when the large-cap banks at the heart of the meltdown were bailed out by the federal government.

Before the crisis, financials constituted the biggest dividend-paying sector of the market. Back in 2004, they contributed more than 29% of the total dividend of the S&P 500. After the crisis, however, major banks had to increase their capital, leaving less money to distribute to shareholders. In addition, many large

Yet although smaller banks also tanked in the crisis, they now seem to have fewer problems than the "too big to fail" group. Critics are still demanding that the biggest banks downsize and split off potentially troubling trading operations, but aren't pressing smaller banks for similar moves. In addition, regional banks may start to see increased lending activity as the economy slowly gains strength.

FINDING FUNDS

Advisors have several choices in the regional bank/small-cap financials space.

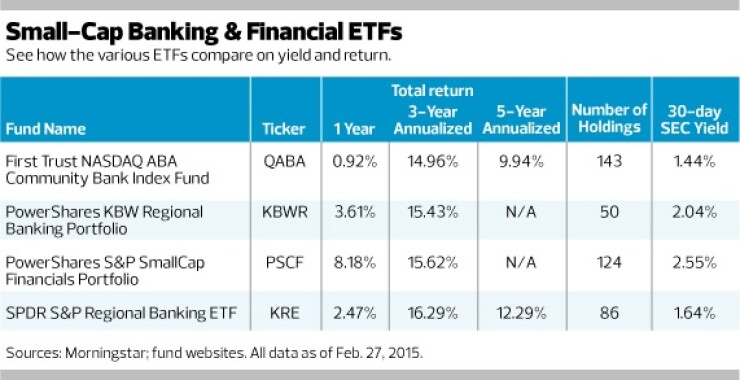

One of the older portfolios is the SPDR S&P Regional Banking ETF (KRE), launched in 2006.

The equal weighted portfolio now tracks the S&P Regional Banks Select Industry Index, although it was based on the KBW Regional Banking Index before Oct. 24, 2011. It held 86 positions as of the end of February.

And since it was around during the crisis, we can compare its performance to a broad swath of financials, represented by the S&P 1500 financials sector.

In 2008, the ETF lost 18.6%, compared with a decline of 46.68% for the financials index, Morningstar reports. That sounds like great outperformance -- but before you rush out to place orders, note that in 2009, the broader index gained 19.1% while the SPDR fund fell another 21.92%. The net result was virtually a dead heat over the two years.

Here's what happened: The broader financial index declined sharply in 2008 when it looked like the big banks were going under. When they were rescued, shares began to rebound in 2009. Since most community banks weren't deeply involved in credit default swaps and other esoteric financial engineering, they didn't fall in price as much as the big banks did in 2008. But the recession also affected local loan demand throughout the country; that's why smaller banks slid in 2009.

Here are some other choices for clients who want exposure to financials, but not the big banks:

- The First Trust Nasdaq ABA Community Bank Index Fund (QABA) is a capitalization-weighted portfolio that screens Nasdaq-listed banks to exclude the 50 largest as well as banks that are specialized, such as credit card businesses. The fund recently owned 143 issues.

- PowerShares KBW Regional Banking Portfolio (KBWR) is an ETF tracking the regional bank benchmark created by the boutique investment bank Keefe, Bruyette & Woods. The 50 stocks in the fund are equal weighted.

- The PowerShares S&P SmallCap Financials ETF (PSCF) takes a somewhat broader approach, including REITs, insurers and other industry groups as well as banks. The capitalization-weighted fund recently held 124 issues.

Read more:

-

Big Risks in Bank Dividends? -

Best- & Worst-Performing Dow Stocks -

Which Sectors Are Best for Dividend Investors? -

How to Screen for Dividend Growth