Most people in this country believe that Social Security is in a great deal of trouble, even on the brink of bankruptcy. They worry about its ability to make benefit payments for as long as they live in retirement. Younger people, who are decades away from retirement, worry whether Social Security will even exist when it is time for them to retire.

Reading the latest Social Security Trustees Report should put most of those worries to rest. One of its main focuses of the report, published annually, is on the ability of Social Security to meet all of its financial obligations over the next 75 years.

Social Security is going to be around in one form or another for a long time, probably well into the next century. Indeed, the solution to fixing its long-term funding issue is really quite simple. But just because it’s simple doesn’t mean it’s easy.

The worst-case scenario would entail a cut in benefits for everybody, but that won’t happen for at least another 18 years. If nothing is done to fix the system, then in the year 2034 everybody’s benefits would have to be cut by about 25%. In other words, taxpayers would receive 75% of what they should have been paid. Once these benefit cuts are made, Social Security would be able to make all benefit payments going forward until the year 2090. So over the next 75 years, the worst thing that could happen is a 25% cut in benefits 18 years from now.

Increasing the FICA tax to 7% from 6.2%, for employers and employees alike, would extend the time before benefit cuts become necessary until the year 2052.

There are other options. The Trustees Report highlights a number of options that could fix the funding shortfall with no benefit cuts. The total deficit or funding shortfall is 2.66 % of taxable payroll. The simplest way to erase that deficit is to increase the payroll tax or FICA tax by a total of 2.66%. That tax increase could be split evenly between employers (1.33%) and employees (1.33%). The current FICA tax for employees stands at 6.2% of earnings. Employers also pay the same rate of 6.2%. Increasing the FICA tax for both employers and employees by 1.33%, would bring it up to 7.53% and completely eliminate the need for any benefit cuts through the year 2090.

RAISING THE CAP EVEN FURTHER

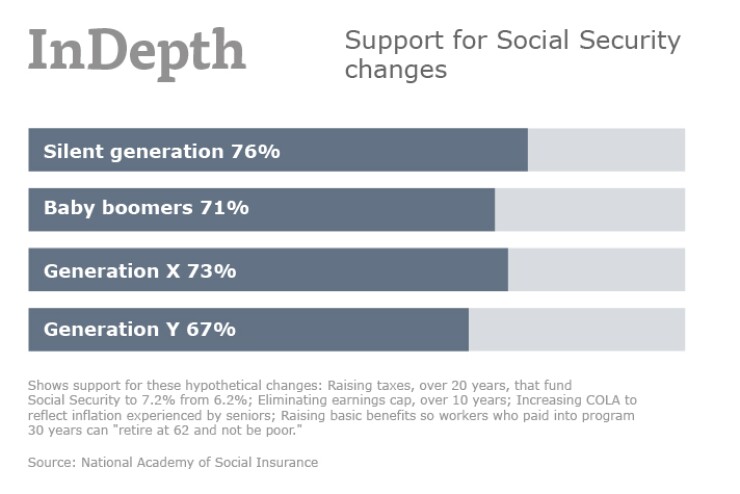

In the current political environment, increasing taxes by this amount does not seem like a viable option. The other option that would have the biggest impact on reducing the Social Security funding shortfall involves the earnings cap.

To be sure, the Social Security Administration announced in October that this cap will increase next year to $127,200 from the current level of $118,500. If clients earn less than this threshold, wherever it's set, they would pay the 6.2% FICA tax on all of their income. If their earnings exceed the threshold, anything above that level would not be subject to the tax.

Approximately 6% of all wage earners in this country have earnings that exceed the current level of $118,500. And increasing the cap to $127,200 will make more taxpayers subject to the tax (about 12 million more people, according to the Social Security Administration). But simply eliminating the earnings cap, so that everybody pays FICA taxes on all of their earned wages, would resolve 70% to 90% of the program funding issue with no benefit cuts.

Completely eliminating the earnings cap does not appear to be a viable political option either. But a combination of the two, raising FICA taxes a little bit along with a raise in the earnings cap, could be more palatable politically and could accomplish the goal of eliminating the funding deficit with no benefit cuts for the next 75 years.

In addition to a tax increase of four-fifths of a percentage point, if the earnings cap is increased again to, say, $350,000, it would eliminate the deficit with no benefit cuts for the next 75 years.

Here is how it could work. Increasing the FICA tax by, say, four-fifths of a percentage point, for both employers and employees, from 6.2% up to 7.0%, would resolve about 60% of the long term funding issue. It is less than a one percentage point increase for individuals, and for companies, and hopefully more acceptable to politicians and voters. Just doing this by itself would extend the time before benefits would have to be cut until the year 2052 instead of 2034, or by an additional 18 years. In addition to the small FICA tax increase, if the earnings cap is increased again to, say, $350,000 going forward, that should completely eliminate the deficit with no benefit cuts for the next 75 years.

This is just one potential solution. With this option everybody plays a part in the solution, but wealthy people play a bigger part. Everybody is affected because FICA taxes would be increased by .8% for everyone. Wealthy people will experience a higher tax increase measured in dollars because much more of their earned income will be subject to FICA taxes when the earnings cap is raised to $350,000.

Compromise has always been a major part of our political system, although recently compromise has been hard to come by. A good compromise involves both sides making a sacrifice and both sides receiving a benefit. That is exactly what happens with this proposed fix. The people who are not considered wealthy make the sacrifice of paying more FICA taxes with the .8% tax increase but they also gain because their retirement benefits will not be cut. A benefit cut for many of these people could be especially harmful, making it much harder for them to maintain a decent standard of living in retirement. The wealthy also make the sacrifice of paying the higher FICA tax (as well as paying that higher tax on more of their earned income). But they also will benefit because when it comes time for them to claim Social Security, their retirement benefits are going to be bigger because of the additional FICA taxes they had to pay.

The longer we wait, the more expensive it becomes to fix the system. Politicians need to compromise and fix the system now. In this case, it does not pay to wait.