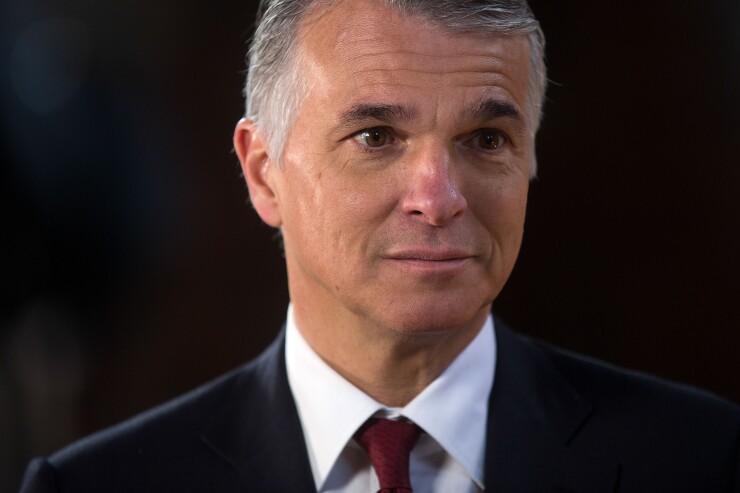

(Bloomberg) -- UBS CEO Sergio Ermotti said the bank may pass on the cost of holding cash to its very wealthy clients and raise charges on borrowings, the strongest indication yet that it may stop shielding individuals from the impact of negative rates.

The bank will consider the measures if “conditions remain as they are or grow worse,” Ermotti told shareholders at the company’s annual general meeting in Basel. “Or we will have to demand payment for services that were previously free - with the possibility that additional fee adjustments in the future will also be necessary.”

European banks are feeling the squeeze from record-low interest rates, which are eroding profit margins at a time when market volatility and declining energy costs are prompting investors to pull funds. UBS earlier this month said first-quarter profit fell by 64%, partly hurt by the “lowest transaction volumes” ever recorded in that period at the wealth management unit.

WEALTH MANAGEMENT PROFITS SINK

The wealth-management division, led by Juerg Zeltner,

The Swiss National Bank has held its deposit rate at minus 0.75% for more than year to help weaken the Swiss franc. While UBS and other banks in Switzerland have passed on the cost of negative franc rates to institutional and corporate clients, they’ve generally held back from charging private banking and retail banking customers.

The SNB can take its deposit rate -- already at a record low -- to minus 1.25%, according to Bloomberg’s most recent survey of economists, published on April 20.

Economists have speculated that the central bank could also reduce the exemption threshold, meaning lenders would have to pay the charge on a larger portion of their reserves than they are now. Currently, that limit is set at 20 times an institutions’ minimum reserves, which according to calculations from Credit Suisse, means 73% of domestic sight deposits are excluded from the deposit rate.