SAN DIEGO — With private equity deals rippling across wealth management, the largest firms are curious about the industry’s burgeoning source of capital.

In a panel at FSI’s OneVoice conference, independent broker-dealer executives queried Kestra Financial CEO James Poer and Warburg Pincus Managing Director Jeffrey Stein about the recapitalization deal struck by the firms last year

Commonwealth Financial Network Managing Principal John Rooney asked Stein how PE investors view the impact to margins of new potential regulations such as Secretary of the Commonwealth William Galvin’s “fiduciary gambit”

Securities Service Network CEO Wade Wilkinson — whose parent, Ladenburg Thalmann, is set to go private in Reverence Capital Partners-backed

A third executive in the back of the room asked Poer to say “the best and the worst you saw” from the private equity suitors his team met with “back-to-back-to-back” as Kestra and its earlier PE owners, Stone Point Capital, pitched the firm to new potential majority investors in 2018.

Poer has been an

“What we've never experienced is a private equity firm coming in and telling us what they're going to do with us, and what their strategy is,” said Poer. “They buy us because of our strategy and our ability to execute. At every turn, we've been able to invest millions of dollars in talent, in technology, in process, improving the organization.”

MASSIVE DEAL FLOW

Rising PE investment has helped fuel a record level of M&A deals in wealth management each of the past seven years,

Warburg’s acquisition of Austin, Texas-based Kestra and Reverence’s deal to buy 75% of Advisor Group — which only came months before the firm

Warburg’s track record in wealth management includes investments in

“The private equity behemoth is a well-versed buyer and has the capital and resources for Kestra to conduct M&A in the IBD and RIA market (

Kestra’s

“These days, there's just so much capital and there are no really good deals to be found,” Stein said. “You're probably not going to ever feel great about any valuation these days. So, you’ve got to pick your spots. And you’ve got to feel really good about what you're going to be investing in, because you're certainly not getting anything cheap in this market environment.”

NOT EVERYONE’S FOR SALE

Climbing equity values and the sheer volume of transactions have reduced the ranks of sellers available at bargains, but IBDs are clearly hearing frequently from interested parties. Their next moves could make longtime IBDs soar to new growth or vanish into new brands.

The focus on recruiting, growth and leverage that comes with firms’ increased debt may cause some firms to balk at such a decision. Other firms like Commonwealth

One IBD that’s still privately held by management and advisors, American Portfolios Financial Services, has found a different way to tap into the PE investors, according to CFO Damon Joyner. The firm has “chatted” with roughly a dozen PE firms in the past three years, he says.

“We asked them to help us identify — for lack of a better word — holes in our strategy. And likewise, certain private equity firms have done the same things for us from a transparency perspective,” Joyner says. “We sort of look at this as a healthy partnership, not with the intent of selling, but with the intent of saying, ‘We're in this together. If we can make each other stronger, then the industry is going to be stronger.’”

Q&A TIME

The audience didn’t pursue any further questions about American Portfolios’ approach at the end of the panel. Instead, they reserved the time for asking about how to consider potential capital partners and key factors in the Kestra-Warburg deal.

To Rooney’s question, Stein replied that Warburg is always “spending a lot of time” assessing regulatory risk. Poer also cited less concern now than in 2016 before the Department of Labor’s fiduciary rule, along with the share of client assets at Kestra already held in advisory accounts.

He also told Wilkinson that the ability to execute and think long-term have been “far more successful” under PE owners than under a publicly traded parent. Still, Poer said in response to the other executive that a few PE suitors were “really arrogant” when they met with Kestra.

One firm turned into a “quick nix” after executives were looking at their phones the entire time Poer and his team told the firm’s story, he said. Another was “just overly commercial” toward a firm that seeks organic growth first before considering acquisition opportunities, he said.

“We really had a pretty high-tuned radar around those that seek financial engineering, and, in PE, you see a measure of financial engineering,” Poer said, calling it a way to “stuff a bunch of stuff in a bag and sell it before anyone really knows if it's going to be worth something or not.”

He added that Kestra has successfully avoided that kind of perspective. "We want to make sure that we have a partner that's aligned on that organic view.”

KESTRA’S OUTLOOK

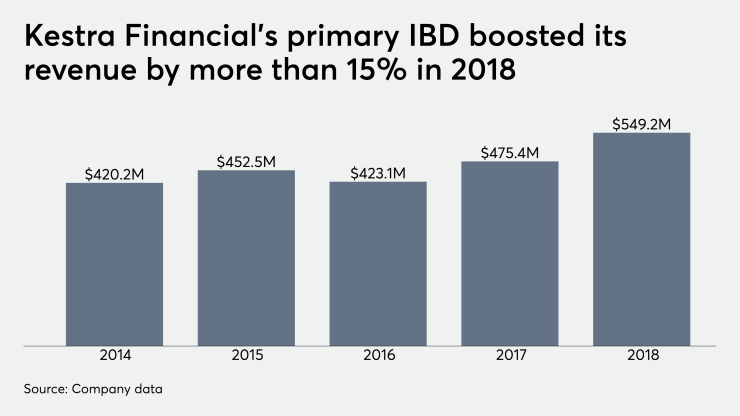

About 2,500 advisors are affiliated with Kestra, a hybrid RIA for wirehouse breakaways called Kestra Private Wealth Services and a subsidiary IBD named H. Beck. The firms generated more than $660 million in revenue in 2018, according to

Poer made the case at the FSI conference that Kestra should be referred to simply as a “wealth management firm” rather than by its regulatory classifications as an IBD and RIA. Despite the $268.5 million worth of commissions at Kestra and H. Beck

In an interview after the panel, Poer declined to share any details about the price, two other finalists to buy the company or any specific 2019 metrics. He says the firm’s annual revenue is nearly $1 billion when taking all five businesses and their growth into account. In the expansion vein, Bluespring

Kestra’s adjusted debt-to-EBITDA of

Warburg views Kestra as insulated against equity downturns and too much negative impact from falling interest rates, Stein said. While PE firms “can generate a nice return” by putting a lot of leverage on portfolio companies, he says Warburg aims to ensure Kestra’s capital flexibility.

“We're growth investors,” Stein said. “And, in order to maximize growth, we felt like for this investment you wanted to keep leverage at a sufficiently low level where you felt like you had enough to feel comfortable making those critical investments for growth, for investments in the business, for investments in acquisitions.”

Kestra last purchased another IBD in 2017, when it acquired Rockville, Maryland-based H. Beck and

“If there's another RIA, IBD, wealth management platform that we could buy and let stand alone or it would make sense to consolidate into another business, we're an opportunistic and thoughtful investor,” he says.

“Culture and fit are unbelievably important to us,” Poer adds. “We've looked at just about everything that's come up out there and didn't see the right fit for us. That doesn't mean there aren't some deals out there that are the right fit for us, and so we'll stay active in that space.”