When stock prices fell for 20 minutes on May 6, 2010, several computerized trading systems did what they were programmed to do: halt executions due to violent market volatility. Soon after, the Dow Jones Industrial Average plunged 998.5 points, erasing $862 billion in a matter of minutes, due to computers at other exchanges misinterpreting the freeze as a rapid bidding down of stocks.

While market “glitches” like these have received ample media coverage, they are largely ignored by investors, according to the latest Investor Sentiment Poll released by TD Ameritrade Holding Corporation.

Ninety-two percent of those surveyed did not consider market glitches as their first, second, or even third biggest concern as the election approach. Instead, the economy, market performance, and fiscal spending were the issues weighing the heaviest on retail investors’ confidence in the stock market today, according to the poll.

“There is a great deal of uncertainty in the macroeconomic environment today, and retail investors have chosen to take a step back and wait for some of it to clear,” said Tom Bradley, president of retail distribution at TD Ameritrade. “Once we start to see some clarity, we believe investor confidence will build and they will return to the markets.”

The poll drew from a random sample of 1,089 investors selected from a consumer panel of individuals nationally who have access to the Internet. It was conducted by Research Now, a global online sampling and online data collection company, on behalf of TD Ameritrade.

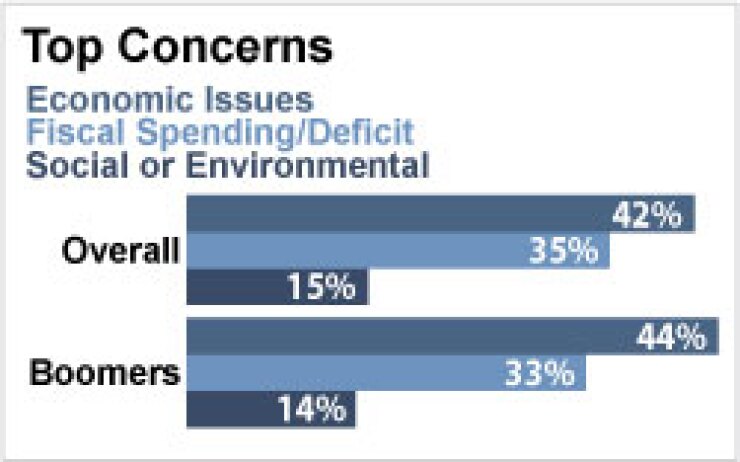

Macroeconomic concerns also carried the most weight when it came to the issues most influencing investors’ voting decisions in this year’s presidential election. Economic issues were considered most influential overall (42%), followed by fiscal spending/deficit (35%) and social or environmental issues (15%).

“Regardless of the outcome, the hope is that the election will result in our leaders coming together to make critical decisions that provide clarity on key issues,” says Bradley. “Ultimately, this could lift some of the uncertainty that has been weighing on investors and the markets since the onset of the financial crisis.”