Are you experiencing an unusually high response rate for annual year-end planning meeting requests?

This is likely due to speculation about 2017 tax reform, and changes the Trump administration and Congress might bring. But are the potential changes the most prudent things to focus on? Faced with the unknown, it might be wise for advisers to shift their clients’ focus back to smart and evergreen year-end financial planning, taking full advantage of the current tax rules.

Once a client’s basic year-end strategy is in place, then, and only then, does it make sense to consider additional year-end strategies that factor in potential changes in taxation. That’s when a meaningful conversation can take place – one that contemplates the client’s income, financial expectations for 2017 and beyond, as well as longer-term, big-picture wealth management goals like philanthropic and legacy planning.

ADDING VALUE: STRATEGIC CHARITABLE CONTRIBUTION DEDUCTIONS

A key year-end planning discussion always focuses on charitable contribution deductions. Not only because it is a tax-smart strategy, but, more importantly, because having the charitable conversation with clients allows advisers to differentiate themselves and their practice.

-

Tax-wise strategies for charitable contributions can take a 180-degree turn when it comes time to create an estate plan.

December 2 -

Why advisers shouldn't leave this aspect of planning on the back burner.

November 23 -

Fidelity practice management program includes planning, funding and research aids.

July 27

For instance, advisers should consider whether the client has gone through a liquidity event, taken value off the table in a secondary offering or received a large private fund distribution throughout the year. An adviser can then guide the client on whether they should consider making a more significant charitable gift in 2016 compared with the year before or after.

Advisers might also consider recommending alternatives to checkbook giving at year-end. A client’s publicly traded asset portfolio might have significant appreciation this year due to post-election market gains and, therefore, donating appreciated assets might be more tax advantageous.

With the combination of the Trump administration and the Republican House proposals year-to-date, stock market gains, higher interest rates and noting that charitable deductions can be carried forward for up to five years, a larger-than-usual charitable contribution of the right asset might provide valuable federal and state tax benefits. This could allow a client to afford to give more, benefiting their chosen charities now and in the future. This is the sort of understanding and supporting of values that clients crave from their advisers.

DONOR-ADVISED FUNDS

Time is running out to help clients make strategic planning decisions. Suggesting a strategic giving vehicle like a Donor Advised Fund, or a private foundation might be the best way for advisers to respond to the possibility of the new administration’s tax proposals and enable their clients to be most effective in their charitable giving plans.

Both vehicles offer greater flexibility than choosing the end charities all at once – especially where a client might be considering outsized gifts in 2016 but isn’t completely clear on which causes to support at these higher granting levels.

Also, utilizing DAFs makes donating long-term appreciated assets — including non-publicly traded assets of private or restricted stock, venture capital or private equity interests, and real estate — easy and efficient. At the time of donation, we make sure to have an appraised fair market value of the donated assets, and we often work alongside Fidelity Charitable to open DAF accounts for our clients. Clients get the charitable deduction and capital gains taxes (topping out at 23.8% federal plus additional state taxes) are minimized for contributions, especially when composed of long-term holdings.

EVERGREEN YEAR-END CHECKLIST

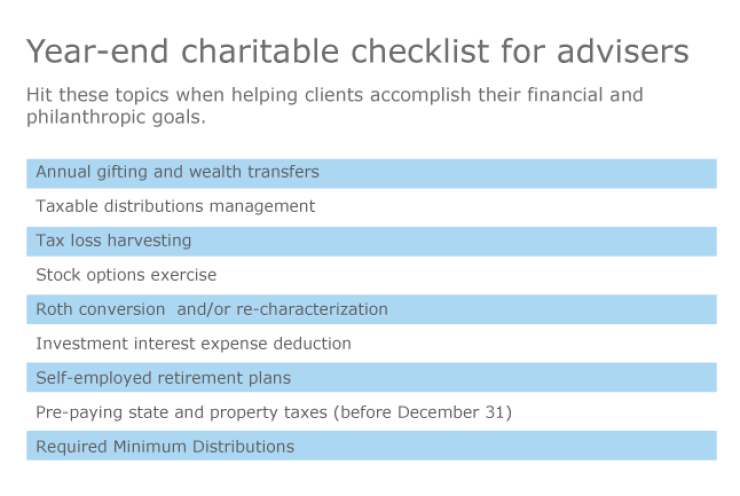

A typical year-end checklist should generally also include:

- Annual gifting and wealth transfers

- Taxable distributions management

- Tax-loss harvesting

- Stock options exercise

- Roth conversion and/or re-characterization

- Investment interest expense deduction

- Self-employed retirement plans

- Pre-paying state and property taxes (before Dec. 31)

- Required minimum distributions

As we await potential tax reform, it will take work to synchronize the usual year-end approach with smart modifications aimed at the future unknowns. That being said, this is the year where an adviser can really shine and add value to the overall relationship.