If you’re like many financial advisors I talk to, you can’t wait for 2020 to end.

But if you are an advisor 55 or younger and committed to growth, or a practice owner looking to retire but without a formal succession plan in place, this could be the opportunity you’ve been waiting on.

The ownership transformation

Financial advisor practices are being reshaped as the reins of ownership are handed off to the next generation. Retiring advisors creating ownership opportunities for next-in-line advisors in their firm — Generation X advisors, those born between the mid-1960s to mid-1980s who are mature enough to run a practice but young enough to have a long runway to retirement — are the driving force behind the industry change, as illustrated in a 2019

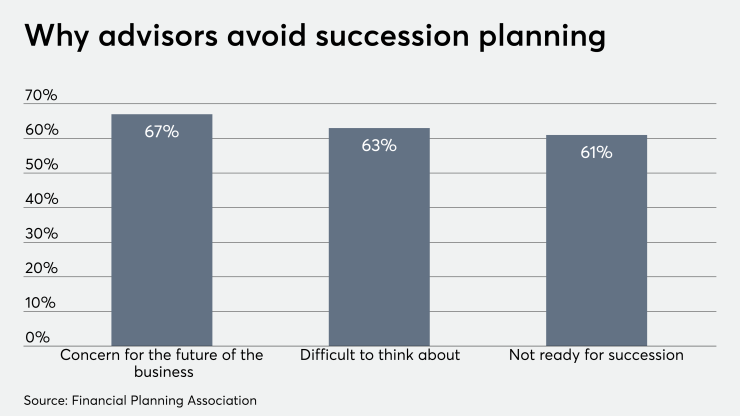

But firms looking to take advantage of the attractive, and indeed critical, nature of this opportunity require a succession plan.Even though the very nature of our business is planning, 73% of firms do not have a written succession plan in place,

Indeed, the downsides of running a financial planning practice without a succession plan are immense. But retiring advisors can carry out a strategy that enables a transition to retirement. Gen X advisors can make acquisitions or form partnerships to grow their businesses. The opportunity benefits both the selling and acquiring financial planner and, more importantly the clients they serve.

Acquisition tips

For Gen Xers looking to buy, here are my top five pearls of wisdom gained from my experience acquiring financial planning practices.

1. A Matter of Trust

When in the process of buying a practice, it is essential that you convince the retiring advisor of your unwavering ability and commitment to take care of the clients you aim to acquire. It was the essential foundation of trust on which the practice was built, and the practice must continue in the hands of a trustworthy, capable leader. After all, it is the selling advisor’s legacy that you will be entrusted to shoulder and carry forward.

2. Why you?

Before you approach an advisor proposing to acquire their practice, develop a persuasive, tailored pitch that explains why you are the best match for new ownership. You may be vying with multiple qualified suitors. Be prepared.

3. Know what you’re getting

The benefits of buying an existing practice include more than gaining the obvious acquisition of clients. There are also the merits of the advisor’s brand in the community, staff, technology systems and cash flow, among others. These essential components should be thoroughly and professionally evaluated before carrying out an acquisition.

4. Shop discriminately

You can maximize the outcome of the acquisition by finding practice candidates that best match the culture of your current practice. Keep in mind the seller likely has the same idea about matching a potential buyer to the culture of their practice. Develop a shopping list of acquisition targets so that if you’re knocked out of the running, or walk away on your own, you have others ready to consider.

5. The investor mindset

Once you’ve acquired a practice, a growth-oriented mindset will help yield the most fruit from your investment. Remember, the retiring advisor’s business took years to develop and grow;building your vision will take time, too.

Successful transfers of ownership are accomplished with skillful preparation and prudent selection from both sides of the table. The outcome of which is a “better together” situation for both retiring andacquiring financial advisors.