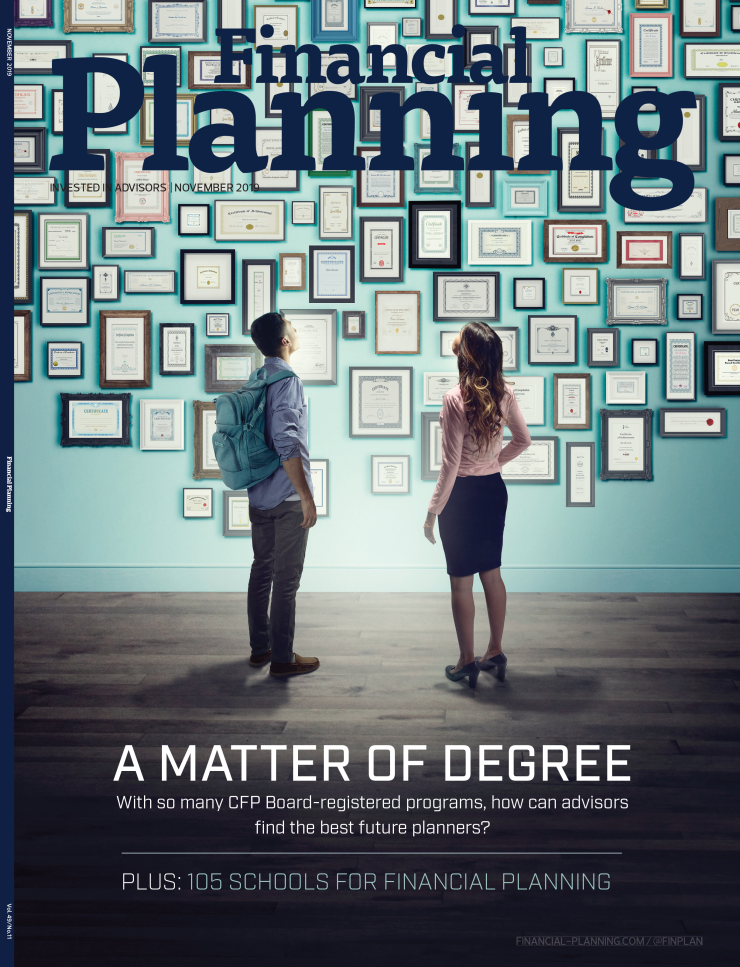

How many is too many? Students considering a financial planning career have a pick of about 145 different baccalaureate CFP Board-registered programs, Maddy Perkins, Financial Planning’s assistant managing editor, found while reporting this year’s annual special report on planning schools.

“In the five years I’ve worked on the schools list, I’ve noticed there are many different types of degrees available to prospective planners,” Perkins tells me. “I wondered if having so many choices was detrimental or helpful to the growth of the profession. Is it confusing that there are so many ways to study planning academically?”

I had my own answer immediately when she posed the question: Of course there should be fewer degrees. Less choice means less confusion for students, firms and clients alike. Right? But Perkins’ reporting softened my hard stance.

For one, different pathways means more students can find their way to this uniquely interdisciplinary career. Prospective advisors who want to focus on technology, finance and entrepreneurship can graduate with a B.B.A. in financial services from Berkeley College in New York. Or, if they want to build a holistic planning practice, they can seek an M.S. in human development and family science with an emphasis in family financial planning from North Dakota State University in Fargo. (Learn more in Perkins' feature,

“Students who want to study other subjects in college — but still want the option of becoming planners — may want to opt for programs that offer minors,” Perkins says. “Those who are already committed to planning might want to opt for a bachelor’s degree in the subject. It all depends on what they want to do and learn.”

The number of degrees will likely consolidate over time, Perkins says. “Do I think a single degree will emerge at some point? Probably,” she tells me, akin to other professions. “But I’d be surprised if we saw it happen in the next decade. There’s too much work to be done first.”

Industry leaders first need to establish guidelines on how the profession should evolve and grow. Hiring managers and educators alike should conduct research, speak with students and listen to clients and other advisors. Hard stances crumble in the face of hard evidence.