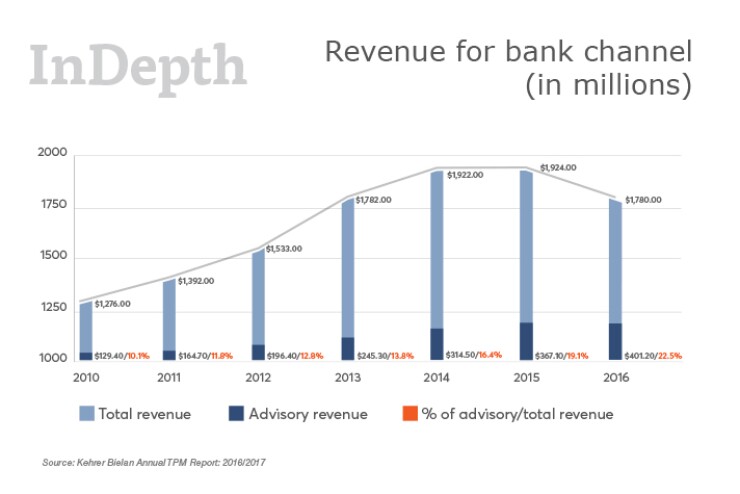

Fee revenue in the bank channel has been increasing over the years, and now stands at 23% of total revenue industrywide. In theory, banks could boast about the increase in this metric, as it stood at just 12% five years earlier, according to the annual Kehrer Bielan TPM Report.

That’s an impressive increase in most situations, but it may not be enough to deal with the situation at hand. The fiduciary rule is set to go into effect in a few days, which does not bode well for transactional business to say the least. First the caveats, and to be sure, there are two big ones. The most recent numbers in the Kehrer Bielan report (which we relied on heavily for this InDepth series) are for 2016, and there has been a flurry of activity this year in preparation for the rule. Plus, there’s the BIC exemption, which could indeed pave the way for transactional business.

Still, I feel like that’s counting on a lot from those two caveats. The fact remains that substantive, cultural change is slow. And the shifts that it causes do not always feel equitable when new business priorities emerge (not to mention new necessary skills). Unlike some cultural shifts, this particular change is being pushed along by regulation. But a fast, mandated change doesn’t alter the unequitable aspect.

For months, bankers and analysts have described this rule as “landscape changing.” They’ve also talked freely about how top-tier advisers will adapt and thrive, while the second and third tier (those who can’t change to a fee-based world) likely will be the ones who find themselves on the firing line. So you have to ask yourself a question: Are you an A-level adviser? Be honest with yourself. Be harsh even. And then contemplate the full ramifications of “landscape changing.”

For the record, Raymond James has the highest fee business per adviser at 41%, according to the TPM report. LPL came in second at 28%. More stats from the report can be seen in two separate slideshows

We also have a Q&A feature on CUNA Brokerage Services, which ranked as the top TPM in terms of revenue per adviser, according to Kehrer Bielan’s research. Mary Wong-Young from CUNA told us about the firm's uncommon position of serving the mass market and mass-affluent segments. See our interview with CUNA

And finally, not being content with simply using the Kehrer Bielan report, we also asked them to write an analysis of the growth potential in the TPM market. They obliged. Ken and Tim Kehrer explained why the previously hot area of growth (M&A) is coming to an end; why some areas may never be hot (signing up the thousands of small banks that don’t have investment programs); and, finally, where the best bet for growth will come from in the future. See their in-depth analysis

For other help, we’ve had a good bit of coverage on how to thrive in the new world: how to