Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Several of the largest moves this year show top talent is looking beyond traditional choices.

July 20 -

With more than 15,000 advisers overseeing $1.4 trillion, the wirehouse would be one of the largest entrants into the digital advice space.

July 19 -

The number of financial advisers at the firm declines 1% to 15,042.

July 15 -

Two advisers joined Confluence Financial Partners, which is affiliated with Raymond James.

July 14 -

A search is underway to replace Mary Mack, who will transition to a different unit.

July 12 -

Advisers join the regional broker-dealer from Wells Fargo and Charles Schwab.

July 11 -

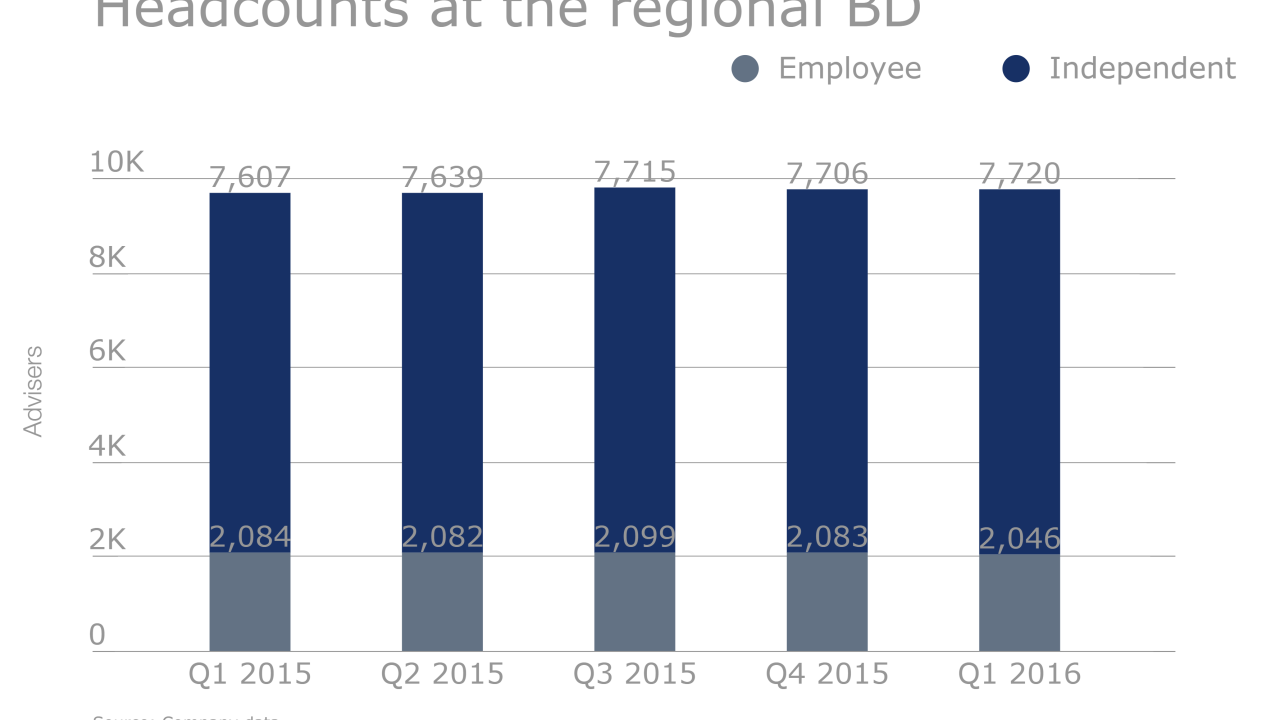

BIC took a fresh look at its top program managers and re-ranked them based solely on productivity.

July 11 -

The firm's latest hire has 25 years of industry experience and once worked at BNY Mellon.

July 1 -

U.S. banks operating in the U.K. may have to deal with new sets of financial regulations — a process that will take time and create more uncertainty.

June 24 -

Wells Fargo, Morgan Stanley, Bank of America and J.P. Morgan Chase were among the dissenters, people familiar with the matter said.

June 23 -

Eleven executives were tapped this year to lead wealth management and related investment services groups at Key Private Bank, Regions Bank, U.S. Bank, Wells Fargo Private and Wilmington Trust. Find out who they are and what their new roles entail.

June 22 -

The firm is accused of negligence, breach of contract and other misconduct, according to a copy of the award.

June 21 -

Also, J.P. Morgan saw a team managing $300 million in client assets go independent.

June 20 -

Three industry veterans – one with more than four decades of experience – oversaw more than $205 million in client assets, according to Raymond James.

June 20 -

The broker allegedly talked clients into investing $115,000 in a technology startup where his friend worked as a computer programmer.

June 17 -

Yet that wasn't Merrill's only recruiting success, as the wirehouse also picked up a team overseeing more than $500 million in client assets.

May 26 -

The recruits moved to the firm from Morgan Stanley, Wells Fargo, Stifel and Voya.

May 25 -

Funds built with these tax-advantaged bonds resulted in strong returns in recent years – and even no fees in a few cases.

May 24 -

An arbitration panel ruled in UBS' favor, after the wirehouse alleged that a former adviser stole client data before moving to Wells Fargo.

May 20 -

Information is flying at clients from TV and the Internet, and it's just too much, says Wells Fargo adviser Matt Fryar.

May 15