Which muni funds have had the top returns?

The top municipal bond funds have posted annual returns in the 5% range. Those numbers get even better for high-net-worth clients because that equates to a tax-equivalent return of about 8% for clients in the highest bracket, says Jeff Tjornehoj, head of Americas Research at Lipper.

For clients in high-tax states -- like California, New York and Massachusetts -- muni funds can help save on state taxes as well as federal. California debt securities in particular have rallied over the past few years since the state’s budget crisis ended several years ago, Tjornehoj notes. Indeed, California-focused funds took more than a third of the top spots (six out of 15), including two of the top three.

Still, most muni investors prefer a broader national focus because they often shop for yield first, Tjornehoj says. Moreover, the variety of single-state offerings isn’t as broad as national offerings.

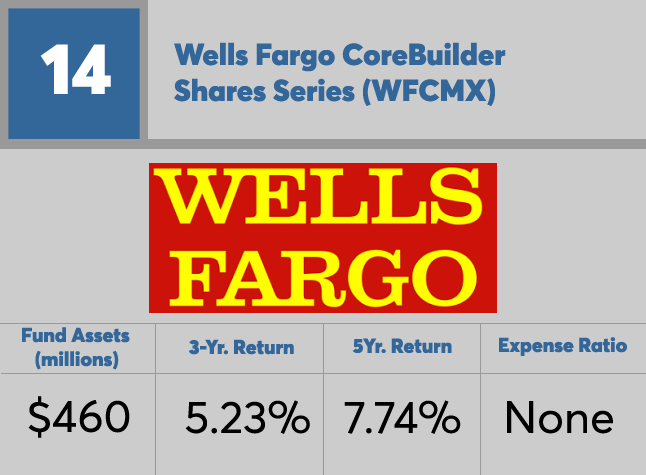

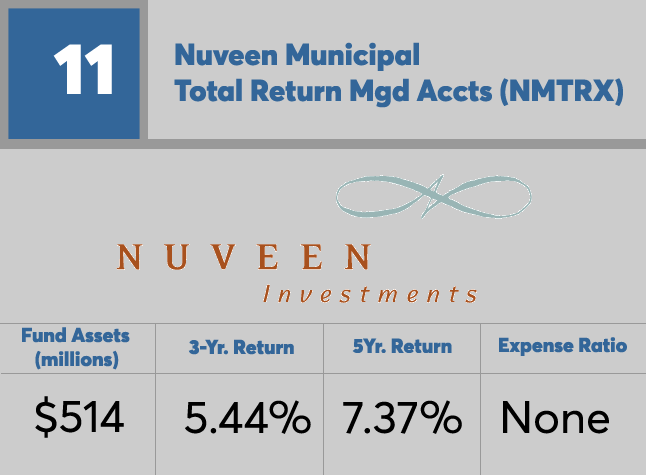

Another noteworthy trend: two of the top muni funds have no fees. The companies – Nuveen and Wells Fargo – have indefinitely eliminated the expense ratios on one fund each. Nuveen is a major player in the muni space, with four of its funds placing in the top 15, including the top three. Click through to see the full list of the muni fund world’s best performers ranked by three-year returns. Only funds with at least $100 million in assets, and three years of operating history, are listed. All data from Morningstar.

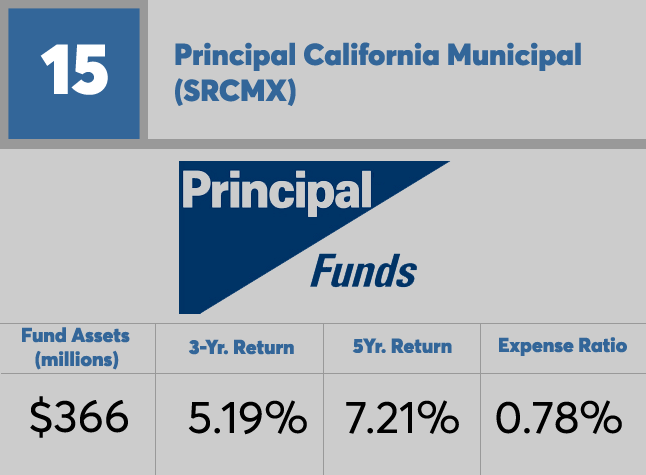

15. Principal California Municipal

3-Yr. Return: 5.19%

5-Yr. Return: 7.21%

Expense Ratio: 0.78%

14. Wells Fargo CoreBuilder Shares Series

3-Yr. Return: 5.23%

5-Yr. Return: 7.74%

Expense Ratio: None

13. AMG GW&K Municipal Enhanced Yield Instl

3-Yr. Return: 5.26%

5-Yr. Return: 8.48%

Expense Ratio: 0.64%

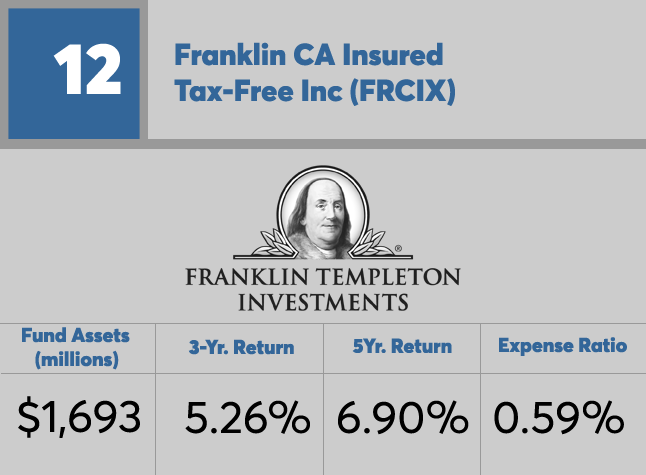

12. Franklin CA Insured Tax-Free Inc

3-Yr. Return: 5.26%

5-Yr. Return: 6.90%

Expense Ratio: 0.59%

11. Nuveen Municipal Total Return Mgd Accts

3-Yr. Return: 5.44%

5-Yr. Return: 7.37%

Expense Ratio: None

10. AB Municipal Income

3-Yr. Return: 5.62%

5-Yr. Return: 8.89%

Expense Ratio: 0.01%

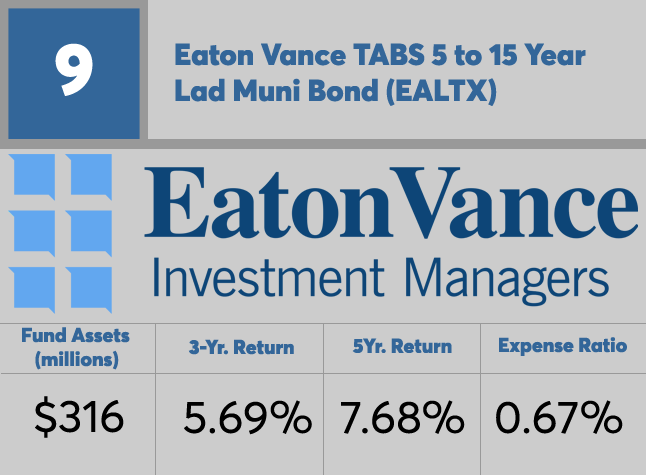

9. Eaton Vance TABS 5 to15 Yr Lad Muni Bd

3-Yr. Return: 5.69%

5-Yr. Return: 7.68%

Expense Ratio: 0.67%

8. Franklin CA High Yield Municipal

3-Yr. Return: 5.70%

5-Yr. Return: 8.89%

Expense Ratio: 0.63%

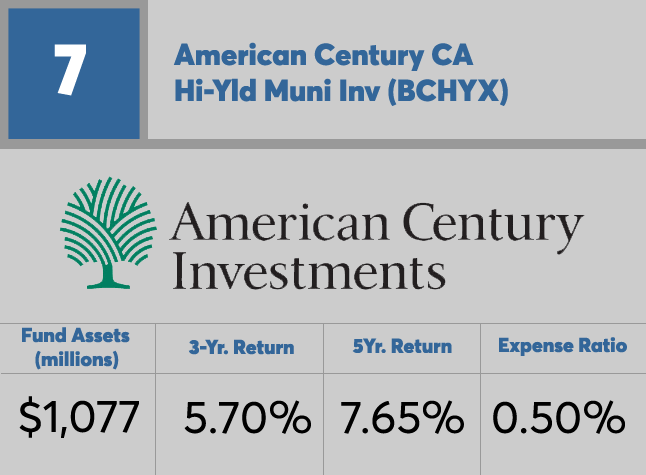

7. American Century CA Hi-Yld Muni Inv

3-Yr. Return: 5.70%

5-Yr. Return: 7.65%

Expense Ratio: 0.50%

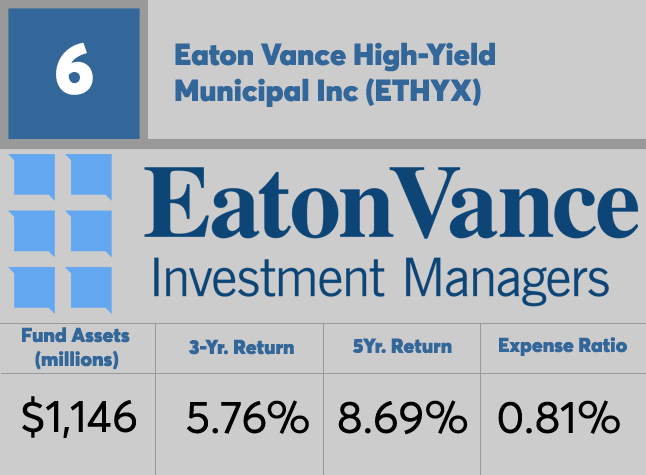

6. Eaton Vance High-Yield Municipal Inc

3-Yr. Return: 5.76%

5-Yr. Return: 8.69%

Expense Ratio: 0.81%

5. MainStay High Yield Municipal Bond

3-Yr. Return: 5.82%

5-Yr. Return: 9.21%

Expense Ratio: 0.87%

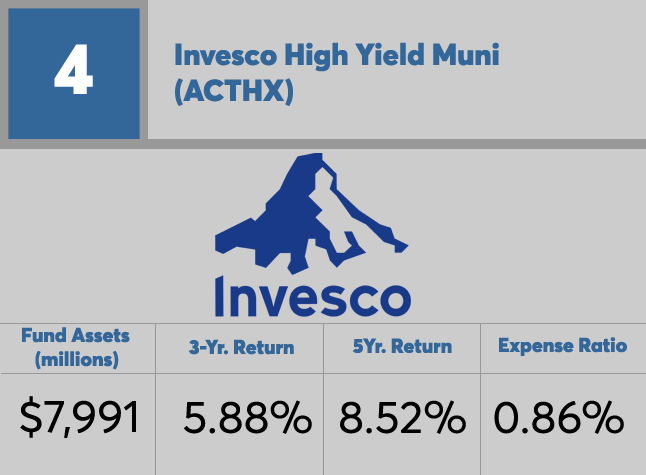

4. Invesco High Yield Muni

3-Yr. Return: 5.88%

5-Yr. Return: 8.52%

Expense Ratio: 0.86%

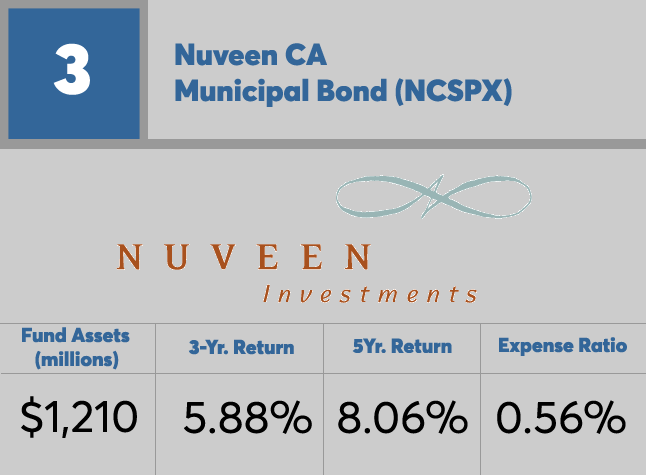

3. Nuveen CA Municipal Bond

3-Yr. Return: 5.88%

5-Yr. Return: 8.06%

Expense Ratio: 0.56%

2. Nuveen High Yield Municipal Bond

3-Yr. Return: 6.40%

5-Yr. Return: 10.37%

Expense Ratio: 0.78%

1. Nuveen CA High Yield Municipal Bond

3-Yr. Return: 7.01%

5-Yr. Return: 11.00%

Expense Ratio: 0.85%