-

The ballot initiative was proposed by a California union as a way to fund health care.

January 20 -

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

-

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

The initiative from the president's tax law has drawn support from corporate and financial leaders.

December 3 -

The fund manager, convicted of fraud by a New York federal jury in August 2024 and sentence to seven years, spent less than two weeks in prison before being released.

December 2 -

Borrowers who receive discharges of their student debt under the Income-Driven Repayment program could be facing tax bills as high as $10,000 next year.

November 13 -

The higher standard deduction since 2017 has dramatically reduced itemization. But the new law provides incentive for teachers to consider whether that's feasible.

November 12 -

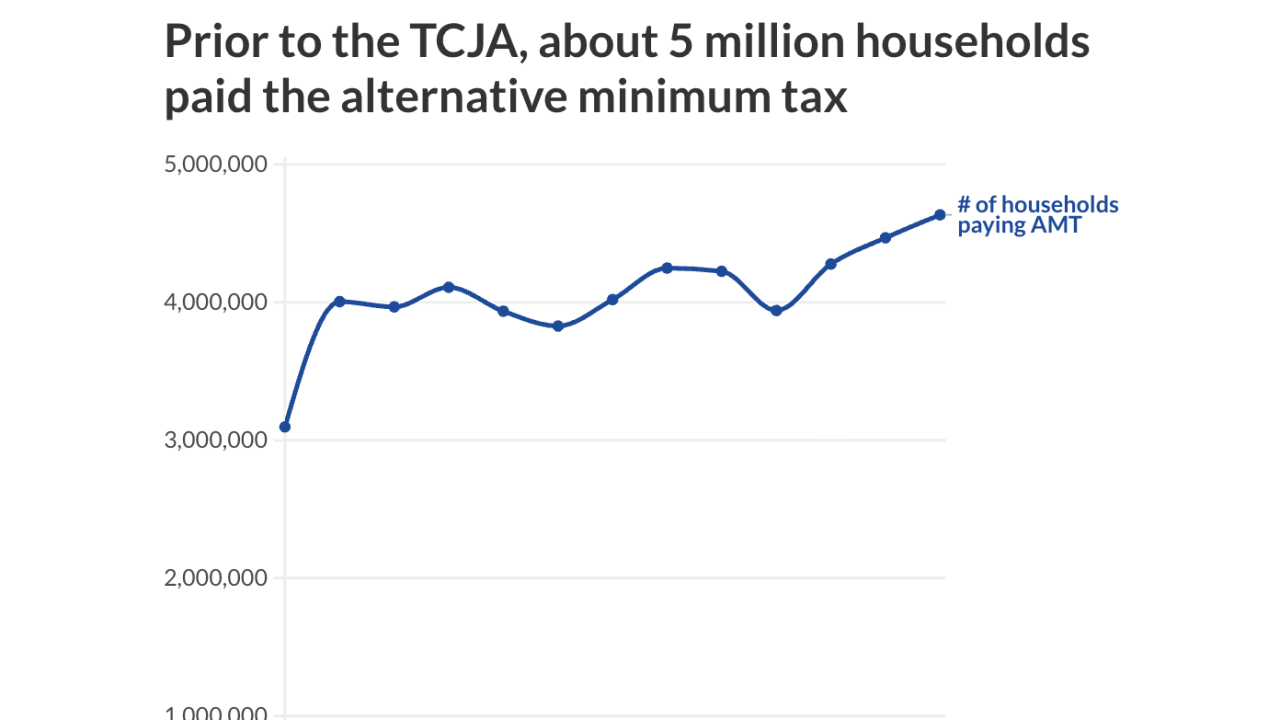

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

While stock values get the most attention after the Fed cuts rates, they affect trusts, too. Some beneficiaries of entities without flexible distribution provisions could take a big hit.

September 29 -

One of the most lucrative tax breaks corporate America won in Trump's economic legislation is hitting a roadblock in a minimum tax Congress set three years ago.

September 25 -

The use of multiple entities as a means of shifting a high net worth client's yearly income could help rack up bigger breaks, with some caveats.

August 25 -

Even the wonkiest experts are struggling to keep up with the latest macroeconomic data. Here are the key factors to watch in the coming months.

August 11 -

But the new rules for deductions, capital-gains exclusions and estate planning merit a lot of strategic discussions for financial advisors and entrepreneurial clients.

August 7 -

The top Democrat on the Senate Finance Committee wants information about whether the IRS has done any audits or investigations of Epstein's tax planning work.

July 31 -

The One Big Beautiful Bill Act presents some complexities for wealthy families, alongside its extension and expansion of provisions in the Tax Cuts and Jobs Act.

July 30 -

House Republicans are aiming to pass provisions that were removed from President Donald Trump's "one big, beautiful bill."

July 24 -

Panelists at the Morningstar conference acknowledged the difficulties, even as they pointed out the ongoing opportunities from active management.

July 11 -

Republicans will be planning a victory lap and Democrats will be thinking about their election strategy. But financial advisors and tax pros will be preparing their clients.

July 3 -

The impact of President Trump's push against diversity, equity and inclusion programs at the SEC remains murky, according to a watchdog report.

June 11