-

Three officials, the most since December 2014, dissented in favor of an immediate quarter-point hike.

September 21 -

Janet Yellen will frame a decision this week to forgo an interest rate increase as necessary to achieve the Fed’s economic goals. Donald Trump and his supporters are likely to frame it as political.

September 20 -

The bank’s president Tim Sloan has been meeting with members of Congress and their staffs in Washington, said people with knowledge of the discussions.

September 15 -

The surge of women in the workforce in the 1970s and 1980s means that they have job skills, connections and careers that they can continue to pursue, says Ben Steverman.

September 14 -

A review of the candidates’ proposals leaves Wilmington Trust execs pessimistic.

September 14 -

In the face of political uncertainty, planners are clinging to cash and reallocating client assets to short-term investments.

September 13 -

"The uncertainty is often more stressful than the reality" when it comes to planning for a change in administration.

September 2 -

Either a Clinton or Trump presidency could potentially bring changes in estate tax laws, so start preparing now.

August 29 -

The Fed chairwoman credits "the continued solid performance of the labor market and our outlook for economic activity and inflation."

August 26 -

To help identify fraudulent advertising , advisers will be required to create and maintain documents that demonstrate performance calculations or returns.

August 26 -

The country's largest independent broker-dealer says compliance with the new fiduciary rule will offer competitive advantages.

August 23 -

Clients are anticipating volatility and favoring defensive allocations no matter the outcome, say advisers who participated in a recent poll.

August 18 -

Investors will listen closely for additional clues on timing for a rate hike when Fed leaders meet at an upcoming symposium.

August 17 -

ValueAct likes Morgan Stanley’s shift to asset-light, fee-based businesses such as wealth and investment management, and said CEO James Gorman has shifted the bank to “growing fee streams that do not require much equity capital to grow.”

August 16 -

The lawsuits claim the universities failed to follow ERISA laws since retail mutual funds were among the investment choices instead of lower-cost versions.

August 10 -

Proposed changes to the standard deduction that would have benefited lower-income Americans are now being revisited. Meanwhile, the top rates and estate taxes get the ax.

August 10 -

Republican presidential candidate Donald Trump described an economic plan that he said would create “the biggest tax revolution since the Reagan tax reform” and “cut regulations massively.”

August 8 -

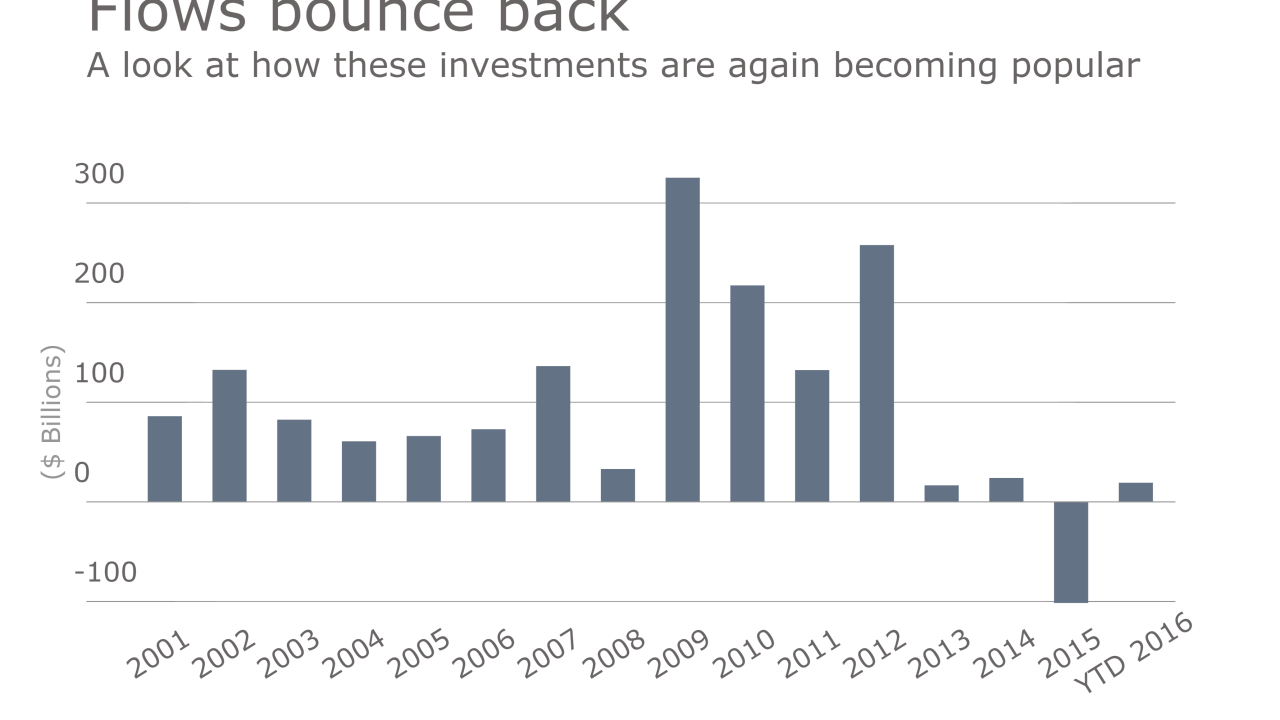

Investors have once again taken a liking to taxable bond funds — a marked difference from last year. Advisers may find that clients are taking notice, too.

August 4 -

While Chairwoman Janet Yellen has repeatedly stated that the Fed is likely to raise interest rates gradually, market volatility and the unexpected dip in job gains have delayed such plans.

July 27 -

In his underdog bid in North Carolina, Andy Millard says he's fighting big Wall Street money: "The financial consumer is not well represented in Congress."

July 26