-

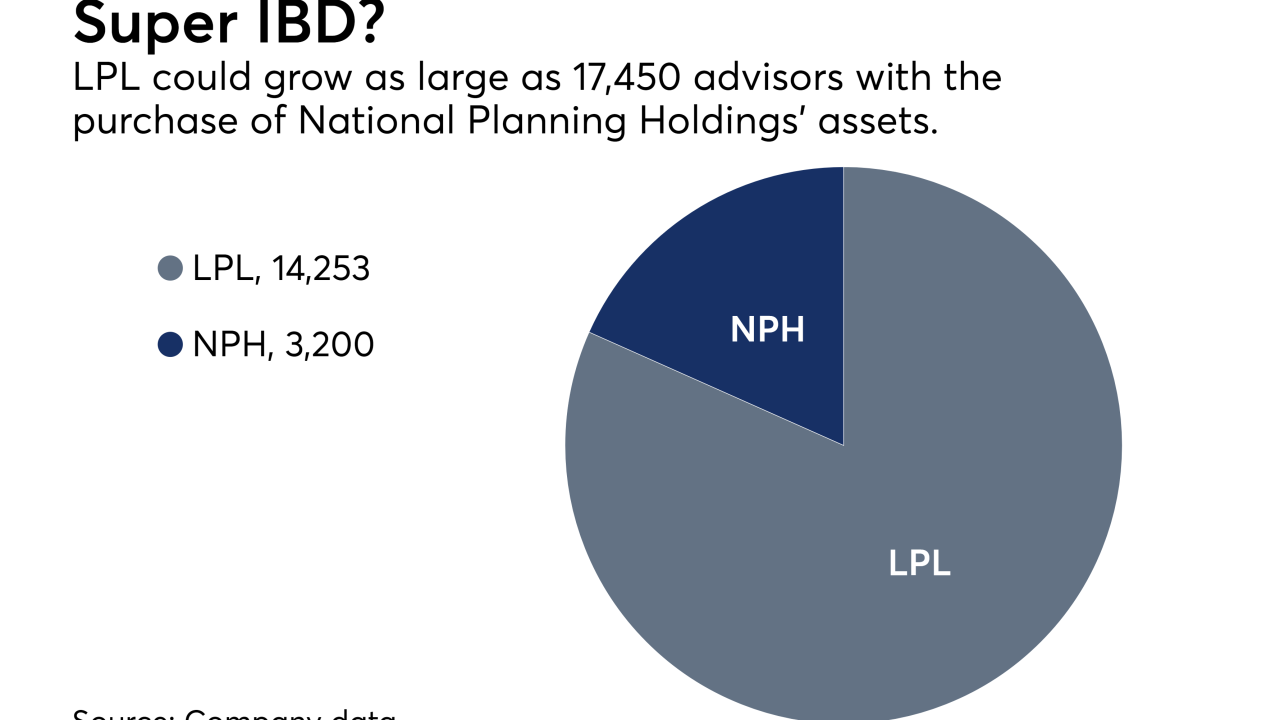

The No. 1 IBD has completed the NPH acquisition, but CEO Dan Arnold unveiled further growth initiatives amid challenges to its dominance.

May 4 -

Dan Arnold received a 155% raise in his first year atop the nation’s largest independent broker-dealer.

April 2 -

At least three dual practices with nearly $1.5 billion in client assets have left since the No. 1 IBD unveiled the new guidelines.

March 8 -

After acquiring four firms’ assets, the industry giant still faces big challenges ahead.

March 2 -

Funds managed by Marco “Mick” Hellman sold most of their holdings, while CEO Dan Arnold received options worth $5 million.

February 28 -

Pole-vaulting advisor Mark Cortazzo’s practice marked at least the second hybrid in three months to leave the firm for Mutual Securities.

February 6 -

More than $34 billion in client assets moved into the No. 1 IBD’s fold in the first part of the acquisition.

February 2 -

Team of 9 advisors is latest to depart amid transition to LPL.

December 12 -

The No. 1 IBD unveiled a $1.1 billion firm that is part of the first incoming wave of NPH’s assets.

December 4 -

The firm aims to maximize its value to advisors, but observers caution that it faces big challenges.

November 8