A hybrid RIA practice with $270 million in client assets left LPL Financial for Kestra Financial. It’s at least the third such departure from LPL in a three-month period after changes to its RIA policies.

Steve Crawford’s practice, The Main Street Group, brought eight advisors in three offices to the No. 13 independent broker-dealer, Kestra announced this week. Crawford, a painter who is also working on a master’s degree in theology, launched the Glen Allen, Virginia-based firm’s RIA in 2015.

LPL

Hybrids make up a major portion of LPL. The roughly 420 hybrid RIAs affiliated with the nation’s largest IBD have about 5,200 advisors — roughly a third of its 15,210 — and $113 billion in non-corporate assets, which is more than 40% of its $273 billion in advisory assets,

Hybrid practices

The hybrid policies would have limited Crawford’s firm to approaching only “monster producers” on the recruiting trail, he says.

“The company had changed management when Casady retired,” says Crawford, 67. “The new guy, he had to get the budget balanced and the stock up. I don’t begrudge him that, but it meant that they couldn’t be as lenient and friendly as they had been in the past.”

-

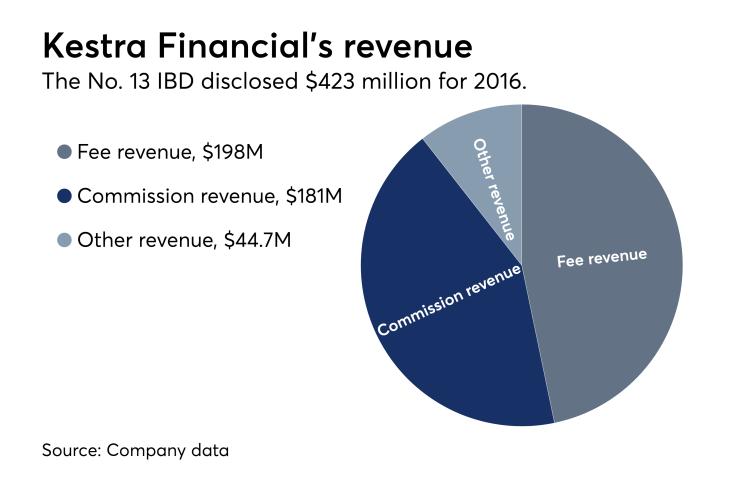

The No. 13 IBD’s hybrid RIA subsidiary also unveiled the results of its record recruiting push.

March 1 -

Cetera, Advisor Group and Securities America are unveiling upgrades they hope will help advisors save time while growing their businesses.

February 12 -

Kris Chester led two major business reorganizations in her time at Wells Fargo Bank.

January 23

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

LPL spokeswoman Lauren Hoyt-Williams said in an emailed statement that the company “remains committed to the support of enterprise firms” and saw a retention rate of 95% for 2017. The lower fees and new technology on the corporate RIA have received praise from both existing and prospective advisors,

“Based on that dialogue, we feel that we’re on the right course and right trajectory with that,” he said. “At the same time, we’ve got to continue to ensure that our hybrid program is competitive, and we will continue to invest in that hybrid program.”

Three or four advisors from Crawford’s practice elected to remain with LPL rather than make the BD switch, he notes. Crawford had spent 11 years with LPL after a decade with Jefferson Pilot Securities, according to FINRA BrokerCheck. The painting enthusiast formally aligned with Kestra in late November.

Main Street’s RIA reported $84.3 million in assets under management on its latest SEC Form ADV, and brokerage and other commissionable assets make up the rest, Crawford says. The firm has 22 total staff members in its headquarters in the Richmond area and two other offices in Lexington and Fairfax.

“To support Steve’s goal to ramp up growth in 2018 and beyond, Kestra Financial is already equipping his team with the many resources we have at our disposal,” CEO James Poer said in a statement. The IBD has 1,339 producing representatives with $76 billion in assets under administration.

In the past two years, the Austin, Texas-based Kestra has recruited 183 advisors with roughly $5.9 billion in client assets, according to the firm. The firm’s hybrid practices keep assets on their outside RIAs while using Kestra’s integrated platform under Fidelity Clearing & Custody Solutions, according to Kestra.

Main Street has nearly completed the transfer of assets to its new platform, Crawford says. He displays some of his paintings, many of which are nautical-themed, in the firm’s offices. He also gives out prints to clients around the holidays, Crawford says, noting with a laugh that some employees may withhold their actual opinions.

“Everybody says it looks good, but they really don’t have an option. So who knows?” he says. “They appreciate that more than a ham or something else you would send for Christmas.”