-

The custodian expects the business to grow quicker in different hands, according to an internal memo.

April 17 -

Tapping into these plans is one method used to prevent bankruptcy.

April 16 -

-

The strategy only applies to investments held in taxable, not tax-favored, retirement accounts.

April 16 -

Advisors are ensuring that multibillion dollar estates go exactly where HNW clients want them to go.

April 12 -

Retirees who use a smaller withdrawal rate may amass significant excess wealth. That can mean trouble for advisors.

April 11 -

The number of health savings accounts has topped 25 million, and employer contributions also have increased after several years of decline.

April 11 -

Just over half of clients expect it will be harder for the next generation in their family to feel comfortable financially.

April 10 -

Advisors who once oversaw portfolios for clients anxious to save a dollar now work more frequently with investors saving to see the world.

April 9 -

New survey reveals low savings rates and poor financial literacy on retirement planning, but advisors can help.

April 9 -

Clients who owe the IRS should pay their taxes by April 15 even if they have already secured an extension.

April 9 -

Grandchildren won't be able to have their own accounts until they are earning their own income, but they can be named beneficiaries.

April 8 -

Picking up on a client's unspoken wishes led an advisor to an unexpected asset allocation — one that benefited the client's daughter.

April 4 Mercer Advisors

Mercer Advisors -

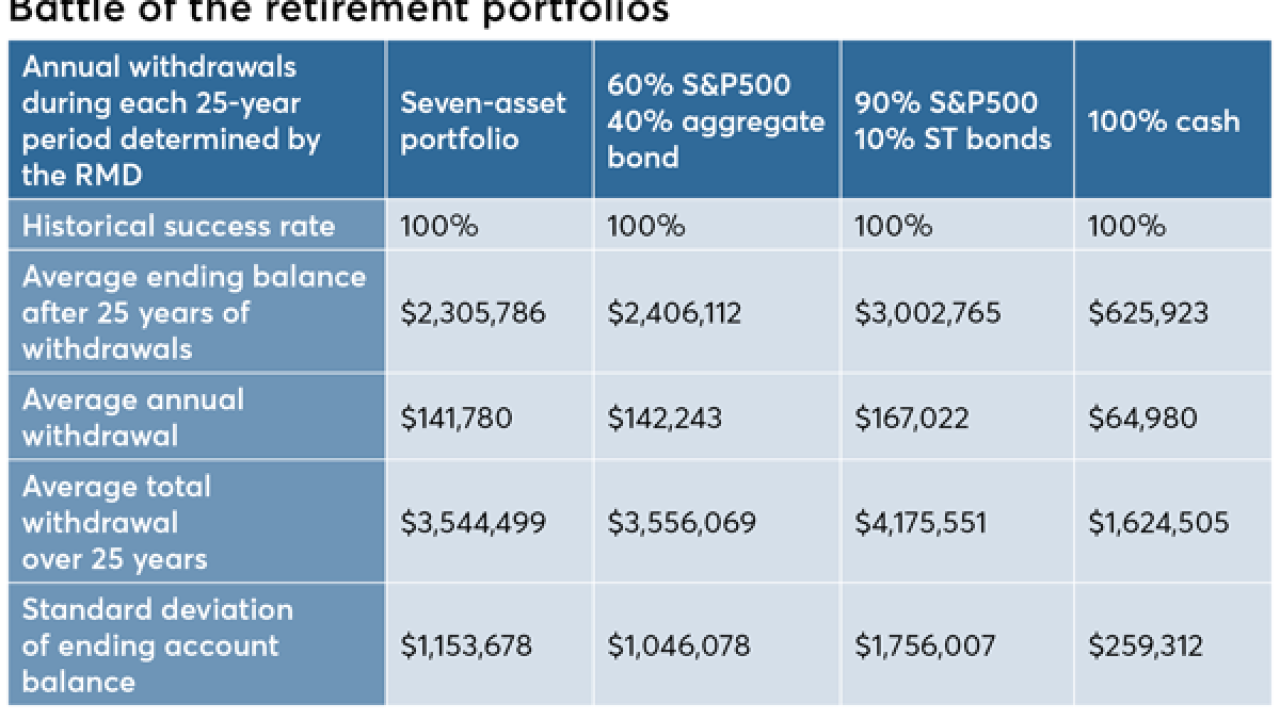

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3 -

Annuities with guaranteed lifetime withdrawal benefits tout longevity protection, but naysayers warn of added complexity on an already confusing instrument.

April 3 -

After 30 years and a monster merger with Financial Engines, the firm is doubling down on its AUM fee structure.

April 3 -

The bill has bipartisan support in the House and Senate.

April 3 -

Those who fail to meet the cutoff face a penalty equivalent to 50% of their required minimum distribution.

March 29 -

This interactive tool challenges conventional wisdom about planning for retirement and offers a smart and streamlined way to plan for your future.

-

As an alternative to placing restrictions on lump sum withdrawals, clients could provide retirees more distribution flexibility.

March 28 October Three Consulting

October Three Consulting