7 Top-Rated Investing Advice Books<br><br>

How to sort through it all? One way is to look at what the readers themselves think.

Financial Planning looked at the top seven investing advice books on Amazon, sorted by average reader reviews.

At the top of the list: a book about investing in yourself (your business or brand, that is) via social media network LinkedIn, written by Wayne Breitbarth.

The authors background (prior to developing social media expertise) is in the office furniture business.

But not all the advice is new-fangled in second place is a classic book from the 1930s.

1. The Power Formula for LinkedIn Success: Kickstart Your Business, Brand and Job Search<br><br>

The book is a guide for the popular social media site, with instructions on how to get the most mileage out of using LinkedIn, including how to develop a personal brand and make useful, lasting business contacts.

From an Amazon reader review:

I found this book to be informative, witty and motivating. And who would have thought that a furniture sales guy would be the writer?

Since reading Waynes book I have set up my LinkedIn profile with all the whistles and bells and successful it has been.

I cant believe all the new contacts Ive already made and its been loads of fun to boot.

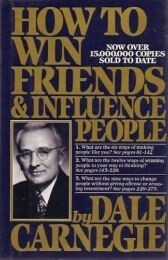

2. How to Win Friends and Influence People<br><br>

American author and lecturer Dale Carnegies mid-1930s business classic.

Its sold more than 15 million copies to date, according to recent editions, and apparently readers still think its a go-to reference for business survival skills.

From a reader review:

Carnegies book is a classic. It teaches one lessons in life that are not taught at any school or university.

He focuses purely on the psychology of people and how we interact and respond to one another.

He has studied people such as Lincoln, Roosevelt and Charles Schwab in great depth and draws from them the very essence of what made them legendary leaders of our time.

3. Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School<br><br>

Hallam, a schoolteacher, explains how he built a million-dollar investment account, and offers straightforward advice on investing dos and donts so readers can emulate his investing success.

From a reader review:

Most of all, this a guy we can relate to.

As a teacher, hes lived most of his life with a salary of less than $50K, but he was a millionaire before the age of 40.

How many of us can say the same?

4. Rich Dads Advisors: Guide to Investing in Gold and Silver: Protect Your Financial Future<br><br>

The book covers economic cycles, the relationship between inflation and the money supply, and how to maximize returns when investing in precious metals.

From a reader review:

I was very impressed with the amount of original research and information I found in this book it covers all the bases from the historical trends and cycles.

Of all the books Ive read on the subject this year (about 10 so far) this is by far the best overall coverage and was the most fun to read.

5. Double Double: How to Double Your Revenue and Profit in 3 Years or Less<br><br>

The author provides a roadmap for growing a business fast.

Advice ranges from how to create a vision for the future of a company to how to generate free public relations, and includes practical tips.

From a reader review:

Favorite takeaway: Theres a dramatic difference between doing things right and doing the right things.

Quality doesnt matter if the outcome has no impact on your deliverables.

How well you organize your filing cabinet is pretty much irrelevant.

It feels good to get it done, but oftentimes some of the smaller tasks or some of the less scary tasks are simply avoidance of doing what matters.

6. The Little Book of Big Profits From Small Stocks<br><br>

The author, an expert in small-stock investing, explains what potential breakout stocks have in common: they are all mostly under $10, are undervalued, and are subject to forces that will likely drive them to much higher prices in the near future.

From a reader review:

I devote a very precise amount of my income into investments in this sector.

I downloaded Hilary Kramers book immediately and am rethinking several of my small stock positions.

Nobody who actively manages their own portfolio has time to read everything, but you need to make time to read this little book.

7. Real Estate: The Sustainable InvestmentStrategies for the Next Generation<br><br>

It’s possible to do well — very well — investing in real estate, if you understand the ins and outs, the potential pitfalls, and can analyze numbers in a dispassionate, clear-sighted way.

The authors of this guide talk about their own journey — and missteps — in this area.

From a reader review:

“This book holds great knowledge of frequent problems that occur while managing properties.

This information is easy to process and understand as the authors give great insight from their own experiences.

Not only do the authors let you know about what may happen, but they also go in-depth about how to cut down on a variety of problems and what may happen if you allow the problems to persist.”