Emerging Markets: How Do BRICs Stack Up Now?

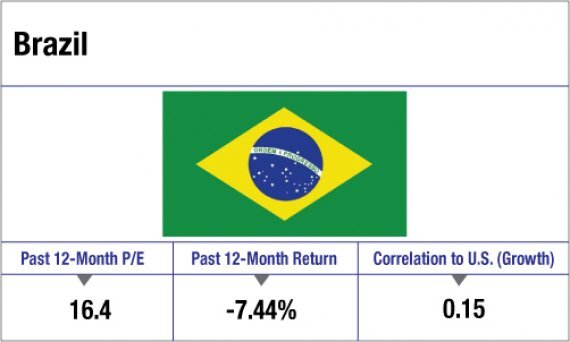

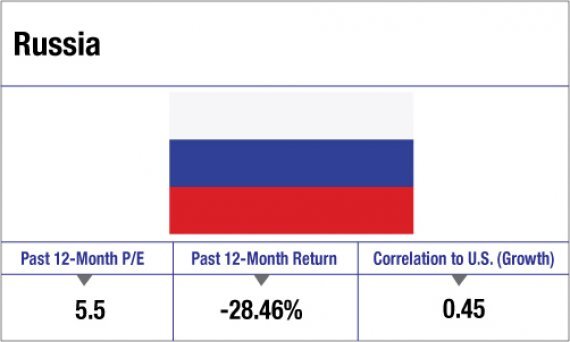

With investors increasingly looking to U.S. stocks and turning away from emerging market equities, many advisors are urging clients to rebalance into that sector. But each of the BRIC countries has its problems: Brazil and Russia have major oil operations that are suffering as crude hits a multi-year low. And Russia faces the additional problem of Western sanctions over its Ukraine stance. Indias stocks have surged recently, in part because of optimism that the new Prime Minister, Narendra Modi, will institute reforms that make it easier to do business. But the sharp run-up in Indian shares has left them more than 50% pricier than the broad emerging market. And Chinas GDP growth has slowed from 10.5% annually from 1993 through 2007, to a still respectable 7.3% in the last quarter. One underappreciated problem with the Chinese economy is that the countrys population is rapidly aging, a result of the one-child policy begun in 1979.

FactSet reports that the emerging markets as a whole had an anemic 1.4% return for the 12 months ending in November. But that underperformance and the broader diversification offered by the larger group may make emerging markets a better choice than BRICs for rebalancing. Details on the BRICs and emerging markets in general follow. -- Joseph Lisanti

View in a single-page version

here.

Sources: FactSet via T. Rowe Price, International Monetary Fund, fund websites

Data as of November 30, 2014.

Images: iStock

BRAZIL

RUSSIA

INDIA

CHINA