Market headwinds dampened wealth management growth

Click through our slideshow to view our analysis of these firms' performance this quarter.

Higher income except at Ameriprise

Raymond James' small uptick in revenue was due to rising account and service fee incomes. Fees associated with the firm's multi-bank cash sweep program rose due to an increase in short-term interest rates. Revenues also got a boost from clients upping cash balances.

Revenues at Ameriprise fell. The company blamed this on lower average equity markets and a reduction in average client asset levels due to market headwinds.

Acquisition bills pile up for Stifel

Expenses at Raymond James increased a modest 0.24%, due to higher administrative and incentive compensation and benefits expenses. This was due to a rise in employee benefit plan costs and additional staffing levels, primarily in their Private Client Group operations and information technology functions.

Ameriprise was the only firm to see its wealth management expenses decline. Distribution expenses reflecting lower adviser compensation caused by equity market depreciation and lower client activity were the main drivers of Ameriprise's lower costs.

Net income falls at Ameriprise and Stifel

Increases in expenses at both Ameriprise and Stifel offset revenues.

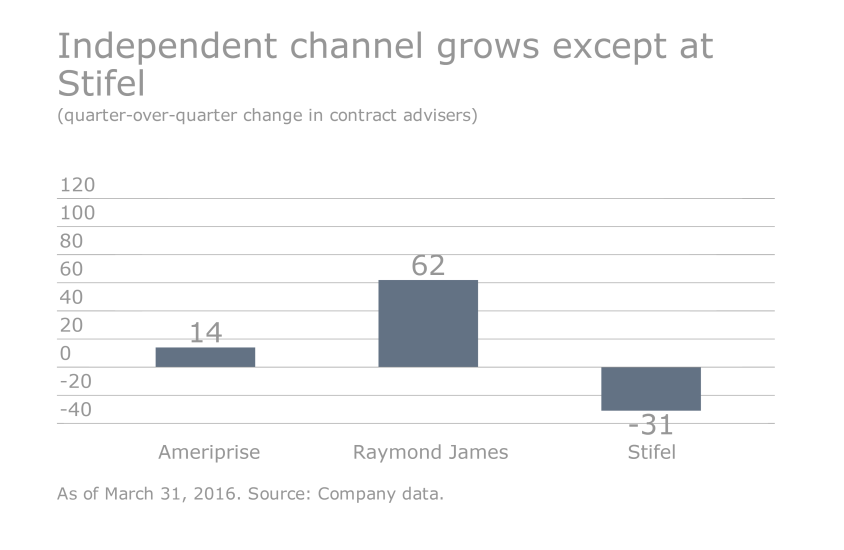

Quarterly decline but yearly increase adviser numbers for Stifel

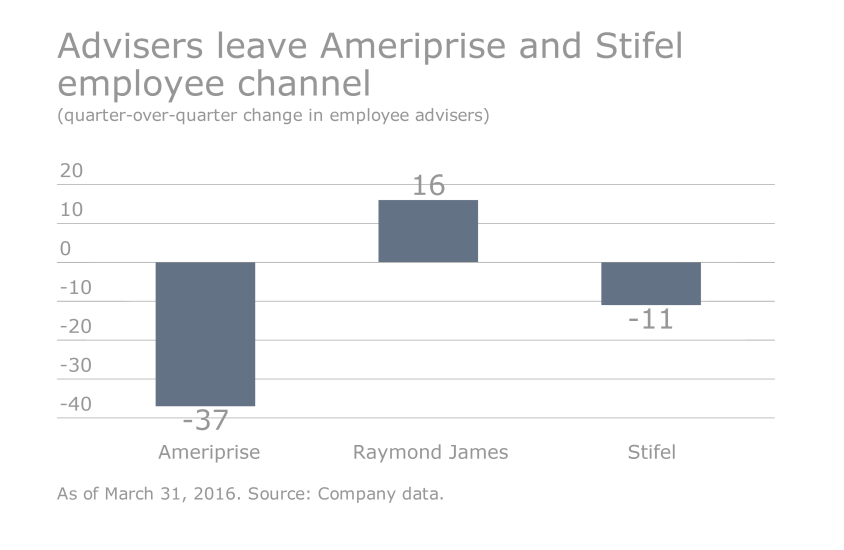

Employee ranks shrink at Stifel and Ameriprise