Long-Term Care: What Advisors Should Know

A new study from Merrill Lynch shows that near-retirees are more concerned about the unknown costs of health care than anything else, regarding it as the biggest threat to their retirement plans. However, key changes in the LTC insurance industry have had a profound impact on advisors options for helping clients plan for this unknown expense.

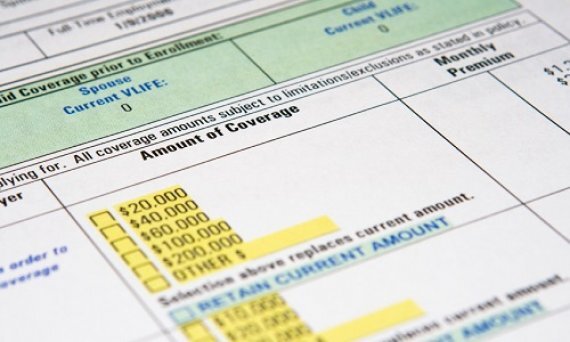

The number of providers offering LTC coverage has shrunk, as have benefits, while the cost of premiums continues to rise. Still, there are options available for advisors seeking a level of coverage that could protect clients if the need for home care arises.

Here are some of the most critical factors advisors must keep in mind. Financial Planning Staff

Read the full story

Image: iStock

WHAT IT WILL COST

Read the full story

TOP CONCERN

Read the full story

Image: iStock

LTC STATS

Image: iStock

RISING COSTS

Image: iStock

DISAPPEARING BENEFITS

Most LTC carriers no longer offer what had once been an industry standard: 5% compound inflation protection. Another common benefit now extinct is the refund of premium benefit that allowed heirs to collect premiums the client already made if the insured died before a certain age, minus any benefits already paid against the policy.

Read the full story

Image: iStock

NURSING HOME vs. HOME CARE

Read the full story

Image: iStock

SPOUSAL-SHARING RIDERS

Read the full story

Image: iStock

INDUSTRY DOWNSIZE

Read the full story

BIGGEST PROVIDER

Read the full story