Digital wealth management: Breaching barriers

But increasingly, research suggests the wealthiest are interested in digital wealth management, and that advisers quickest to adopt digital advice tools into their practice are getting an edge over non-digital competitors.

UBS' surprise May announcement that it was investing in robo provider SigFig was seen by observers as a sign of Wall Street acceptance of digital advice’s future potential.

Also changing attitudes are the dividends gained by early adopters. BlackRock's acquisition of FutureAdvisor has earned it megadeals this year as a digital provider to BBVA, RBC and LPL.

A number of early predictions have also been upended, including one which foresaw the independent robo model quickly dying off. In 2016, over $200 million in funding has made its way to robo advice platforms. The DoL's fiduciary rule is also providing new prospects for digital-first advice firms.

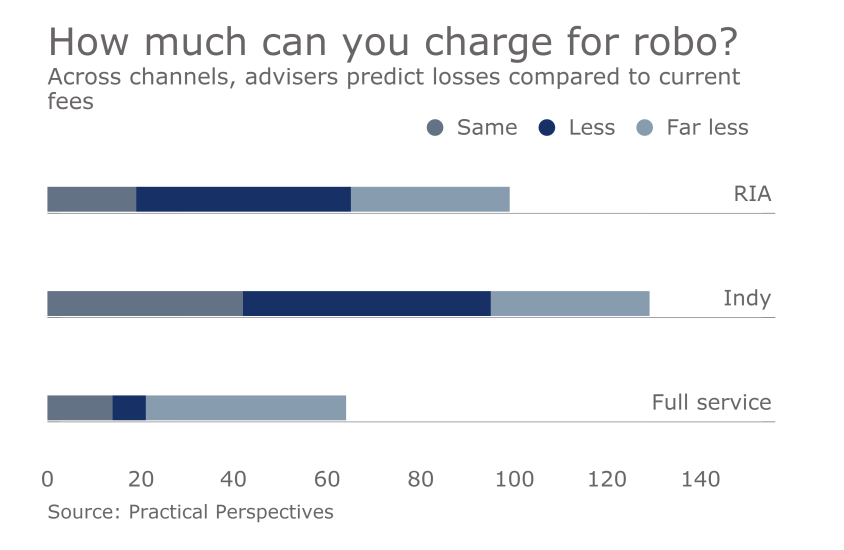

Advisers, in turn, have begun asking themselves hard questions: How much will robos affect the cost of advice? Can they be fiduciaries? And who should adopt the fastest?

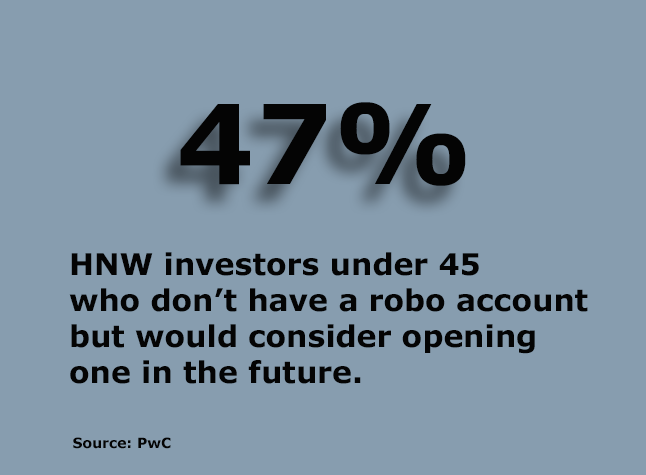

Wealthy considering robos

Wealth allows for curiosity

Not so fast

Big brands go digital

Money in hand

Incumbent advantage

Benefits in change

Fee concerns persist

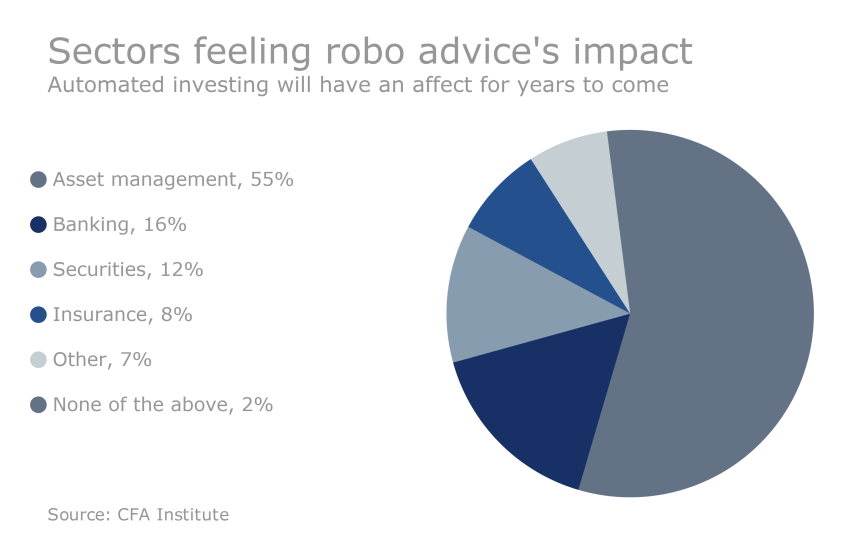

Most susceptible to disruption?