What Can Go Wrong?: Currency and Capital Flow Concerns Lead to Protectionist Trade Wars

What Can Go Wrong?: Currency and Capital Flow Concerns Lead to Protectionist Trade Wars

This could stifle growth in both domestic and international markets.

What Can Go Wrong?: Asset Bubbles Cause Emerging Market Authorities to Tighten

What Can Go Wrong?: Asset Bubbles Cause Emerging Market Authorities to Tighten

This could make emerging market investment opportunities less attractive.

What Can Go Wrong?: Interest Rates Rise More Than Expected

What Can Go Wrong?: Interest Rates Rise More Than Expected

If interest rates increase, given increasing economic and jobs growth and the revival of business capital investment, a big question mark will hang over bonds.

What Can Go Wrong?: Inflation Fears/Reality Strikes

What Can Go Wrong?: Inflation Fears/Reality Strikes

If worries over inflation dominate, consumers could hold tight to their wallets and investors could seek safe havens, such as cash and bonds. The era of fear that we have seen in equities in the last couple of years is in contrast to the era of greed we saw in the late 1990s, says Doll.

What Can Go Wrong?: Commodity Price Increases Cause Margin Pressure

What Can Go Wrong?: Commodity Price Increases Cause Margin Pressure

Copper, not gold, says Doll, is the best measure of global growth.

What Can Go Wrong?: Credit Problems Resurface

What Can Go Wrong?: Credit Problems Resurface

For example, more U.S. housing, sovereigns, and state/local issues.

What Can Go Right: Washington Begins to Address the Fundamental Debt and Budget Problems

What Can Go Right: Washington Begins to Address the Fundamental Debt and Budget Problems

The Democrats got walloped in the mid-term elections, President Obama is likely to continue to move toward the center, creating a more business and capital-markets friendly environment, Doll believes.

What Can Go Right: Investors Shift from Bonds to Stocks

What Can Go Right: Investors Shift from Bonds to Stocks

Stocks pulled ahead of bonds in 2010s fourth quarter, and we expect that trend to continue in 2011, he said. Interest rate risk will be to the upside, given accelerating economic and job growth, the revival of business capital investment, the likelihood that bond inflows will slow, and fading deflation fears.

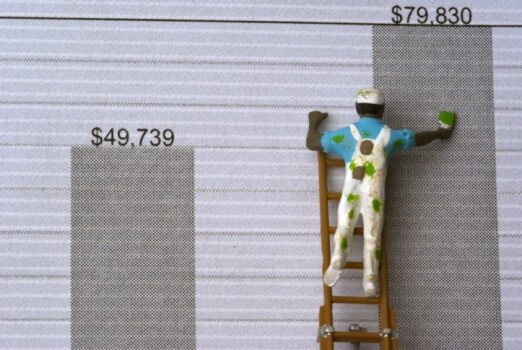

What Can Go Right: Earnings Exceed Expectations (Again)

What Can Go Right: Earnings Exceed Expectations (Again)

Stocks will outperform bonds and cash as they did in 2010.

What Can Go Right: Real GDP Surprises to the Upside

What Can Go Right: Real GDP Surprises to the Upside

In the U.S., even though the recovery will continue at a slower-than-normal pace, real GDP will hit an all-time high during the first half of 2011, says Doll.

What Can Go Right: Business and Consumer Confidence improves (And Valuation Improves)

What Can Go Right: Business and Consumer Confidence improves (And Valuation Improves)

The consumer will continue to spend, says Doll, just as we saw during the recent holiday sales.

What Can Go Right: Job Growth Improves

What Can Go Right: Job Growth Improves

Doll predicts the US economy will create two to three million jobs in 2011 as unemployment falls to 9%.

Six Things That Could Go Right (Or Wrong) in 2011

Six Things That Could Go Right (Or Wrong) in 2011

BlackRocks Bob Doll announced some pretty bullish predictions for the year ahead. With U.S. stocks hitting double digit returns for a third straight year, growing consumer confidence, an accelerating growth outlook, and deflationary credit risks shrinking, it looks like the future is bright. But Doll is cautiously optimistic, anticipating the economy will muddle through as the equity markets and risk assets in general grind higher.

But what are the potential upside and downside risks for 2011? Understanding these risks could make or break this year.

The upside possibilities could lead to stock market appreciation of 10% to 20% more than we expect, Doll said. The downside issues could result in low double-digit percentage loss.

-Ruthie Ackerman