The bedrock of trust clients place with their adviser is embedded in the services the custodian provides: protecting assets, servicing accounts and ensuring compliance with government regulations.

And a custodian's expertise is equally indispensable for advisers in helping them support their business and run their back office.

But it's been surprisingly difficult to see how exactly the major industry custodians compare when it comes to key RIA metrics. Some of the asset flows may not be going where you expect.

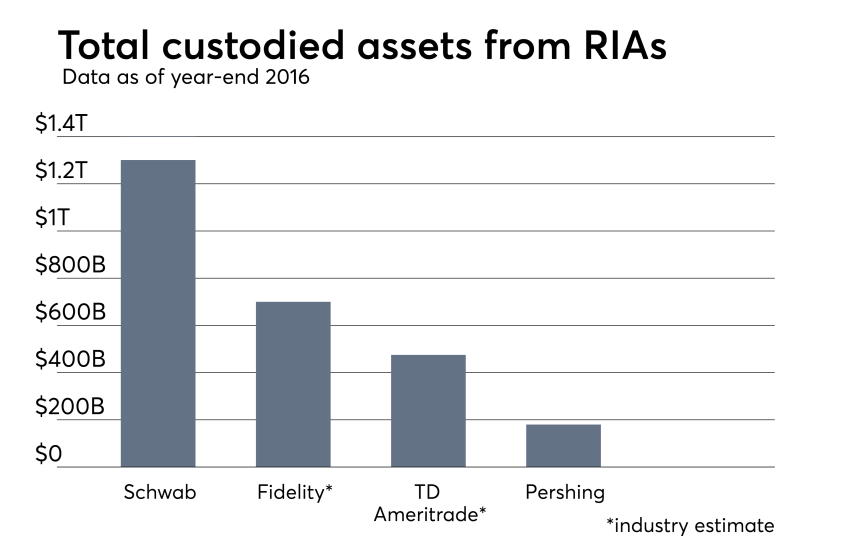

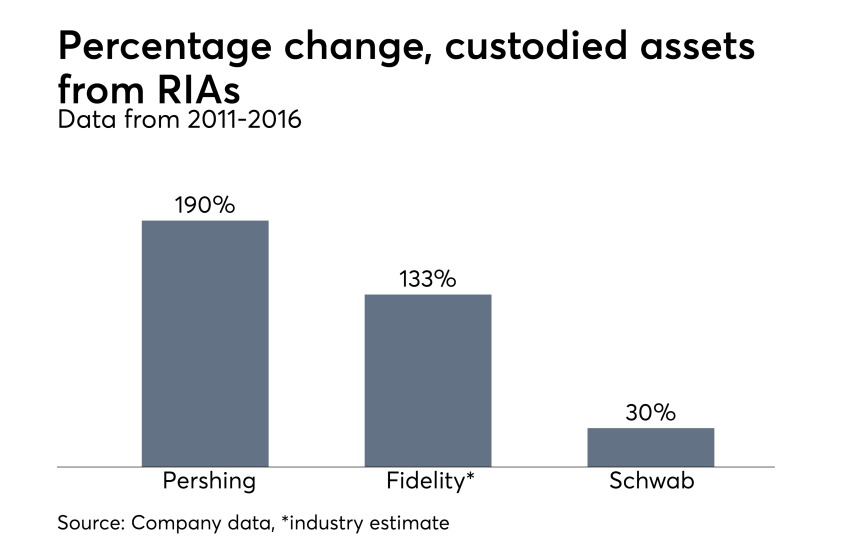

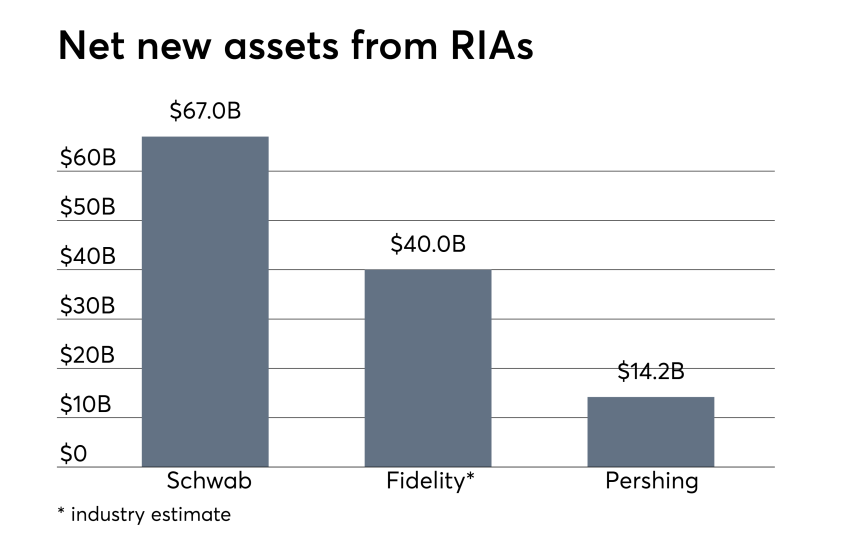

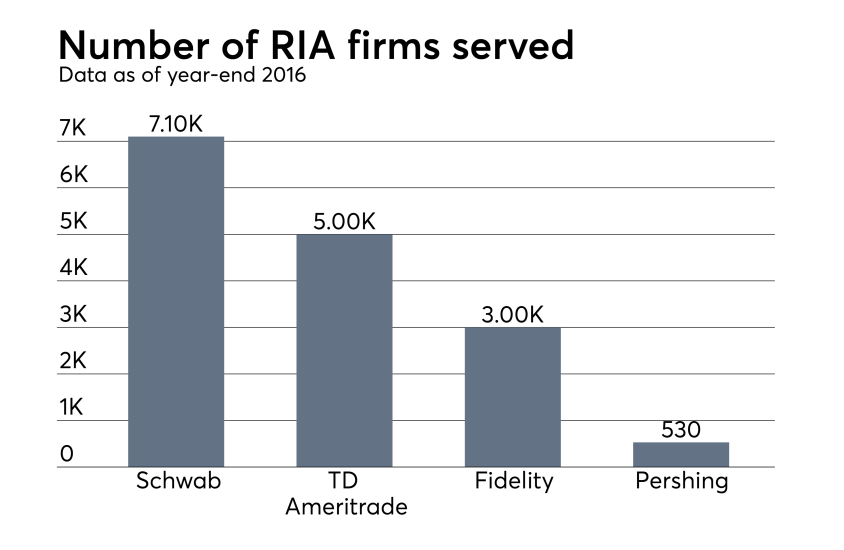

Here's an exclusive look at how Charles Schwab, Fidelity Clearing & Custody Solutions, Pershing Adviser Solutions and TD Ameritrade are faring in the RIA market.

All data provided by the companies, except where noted by an asterisk as an industry estimate.