-

Retirement investors should still put their money to work despite uncertainties due to recent events worldwide, says Vanguard's founder.

June 24 -

It is expected that Medicare’s hospital-insurance trust fund will have depleted reserves by 2028 or two years earlier than last year's estimates, according to report.

June 23 -

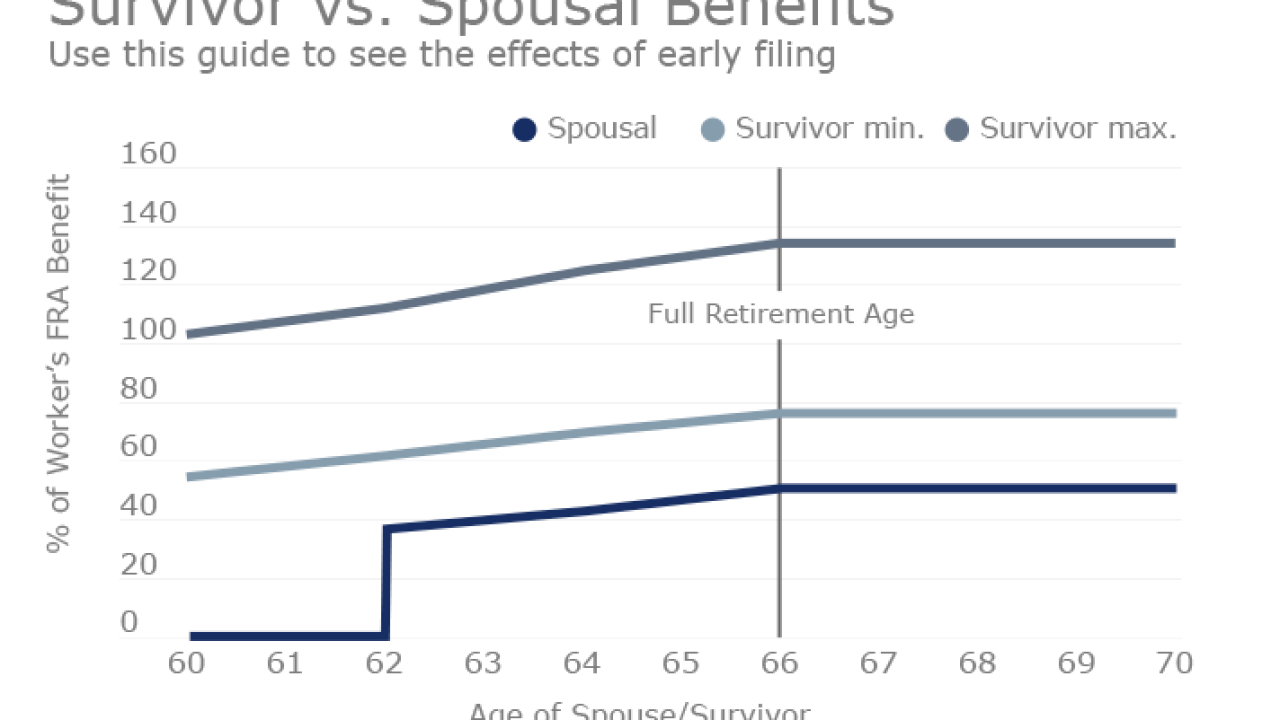

Spousal benefits and survivor benefits appear very similar, but scratch a little deeper you’ll find a tangle of regulations and features. Here’s how to unwind them.

June 22 -

Clients who are currently investing for retirement should anticipate a paltry long-term return given today's market conditions, says BlackRock Chairman and CEO Larry Fink.

June 21 -

The proposals would enhance retirement security for those who depend most on the program; plus, three ways to lower long-term-care insurance premiums.

June 20 -

Retirement savers can ward off the risk of succeeding periods of bad returns during the early part of their golden years with the right asset allocation.

June 14 -

Spouses are generally entitled to Part A hospital coverage from the government program if the worker meets certain requirements.

June 13 -

A new company allows Baby Boomers looking for cheap accommodation to connect with homeowners looking for trustworthy people to watch their house and pets.

June 10 -

One recommendation takes aim at the home loan tax deduction — in some cases.

June 9 -

As clients get into their fifties, they need to start looking at where they are and start ramping up their retirement and investing planning.

June 9 -

The decline could be attributed to poor market returns and the plans' auto enrollment feature.

June 8 -

Clients in their 50s need to save aggressively, pay off their mortgage and other debt, downsize and make the most of the tax breaks they deserve.

June 7 -

Clients may pay taxes on their Social Security Disability Insurance benefits if 50% of the benefits and their other income exceed certain thresholds.

June 6 -

A client says if he had been told he was eligible for a lump-sum payment for back benefits, he would gladly have taken it, even if it meant a reduced monthly benefit for life.

June 2 -

Many Americans stop working before age 70 for health reasons. In one study, nearly 80% of workers who stop working before age 65 do so for their own health or to care for a family member.

May 31 -

Be careful with Social Security and Medicare. Missteps can hurt client relationships.

May 31 -

Modifying popular claiming strategies opens up new client opportunities.

May 31 -

Clients really can spend more now and have more later by delaying when they begin payments.

May 31 -

Clients really can spend more now and have more later by delaying when they begin payments.

May 31 -

Modifying popular claiming strategies opens up new client opportunities.

May 31