-

A sharp fourth-quarter decline in net new investment assets weighed on Citi's wealth division, tempering full-year growth despite revenue gains.

January 14 -

Bank of America's wealth management businesses suffered a blow last year when principals of a team that managed $130 billion in AUM left for independence. Merrill executives are now looking to the future with ambitious recruiting and cross-selling plans.

January 14 -

While AI has increased gross productivity, net gains have been eroded by the time and effort needed to review and correct AI outputs.

January 14 -

Tax-loss harvesting's overlooked cousin can pay off for clients with low-earning years, concentrated positions or UTMA accounts.

January 14 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

The FPAi Authority offers demos, guidance and insights to help planners adopt AI effectively in their practices.

January 13 -

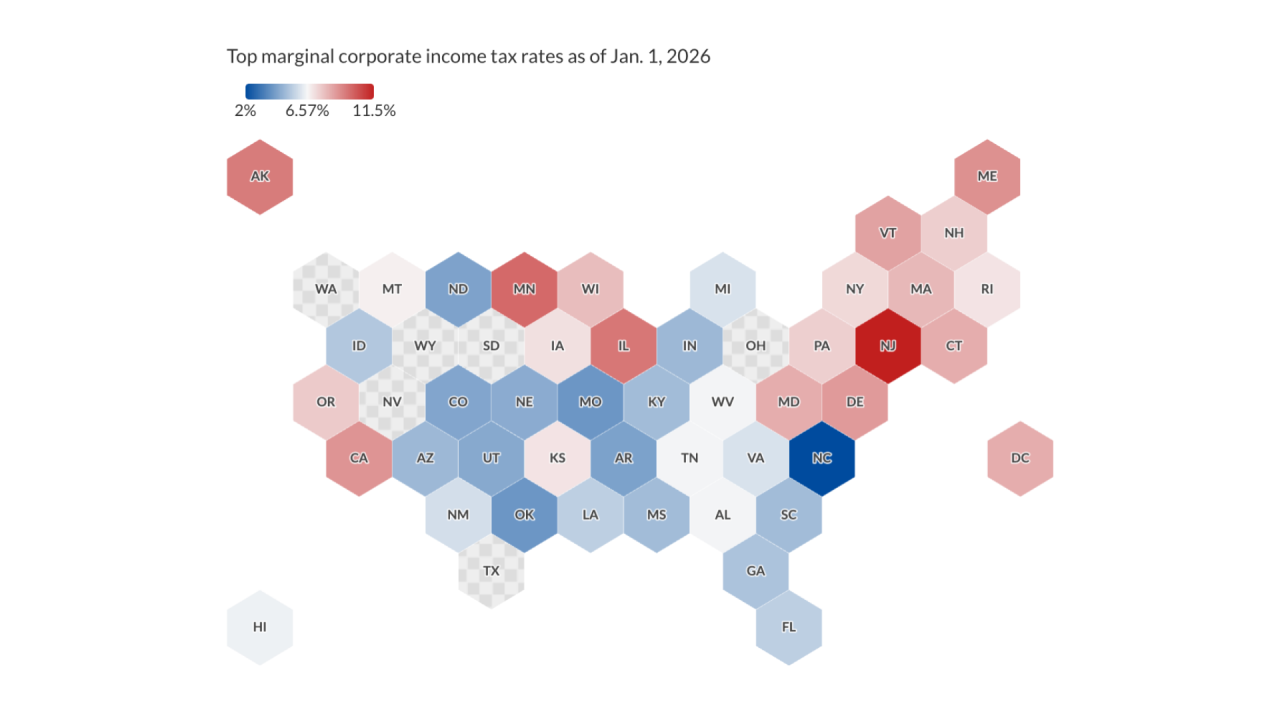

Corporate tax rates vary widely by state, affecting client business decisions around relocation, expansion and growth planning. Here's how the landscape is changing in 2026.

January 13 -

The massive intake preceded the BNY-owned custodian's rollout of a new financial advisor matchmaking service aimed at conversions from institutional clients.

January 13 -

The megabank sees its asset inflows swell by 14% while reporting greater numbers of client advisors and private bank advisors.

January 13 -

Wells Fargo stands out among wirehouses with FiNet, its dedicated channel for independent advisors. Wells Fargo Advisors head Sol Gindi says this structure gives the firm a competitive advantage rivals will find difficult to replicate.

January 13 -

The justices are scheduled to resolve disagreement among lower courts over whether market regulators can order fraudsters to repay ill-gotten gains to victims.

January 12 -

A Financial Planning survey found that advisors believe AI will continue to transform wealth management. But experts say human oversight is still essential.

January 12 -

Kyle Busch's lawsuit against Pacific Life and his former insurance agent provides a window into potential issues around complexity, suitability and more in indexed universal life policies.

January 12 -

Systems still don't talk to each other as well as they should in 2026, so advisors are finding their own solutions.

January 12 -

Wells Fargo lands big teams from Merrill and Citi, while Cerity Partners and Mercer Advisors continue their aggressive M&A streaks.

January 9 -

A new proposal would allow firms to tack three additional months onto the amount of time they can place holds on the accounts of clients 65 and older in cases of suspected financial exploitation.

January 9 -

Last January, one of the deadliest and costliest wildfires in modern U.S. History struck, leaving those who survived with hard-won wisdom about how to prepare clients for the next disaster.

January 9 -

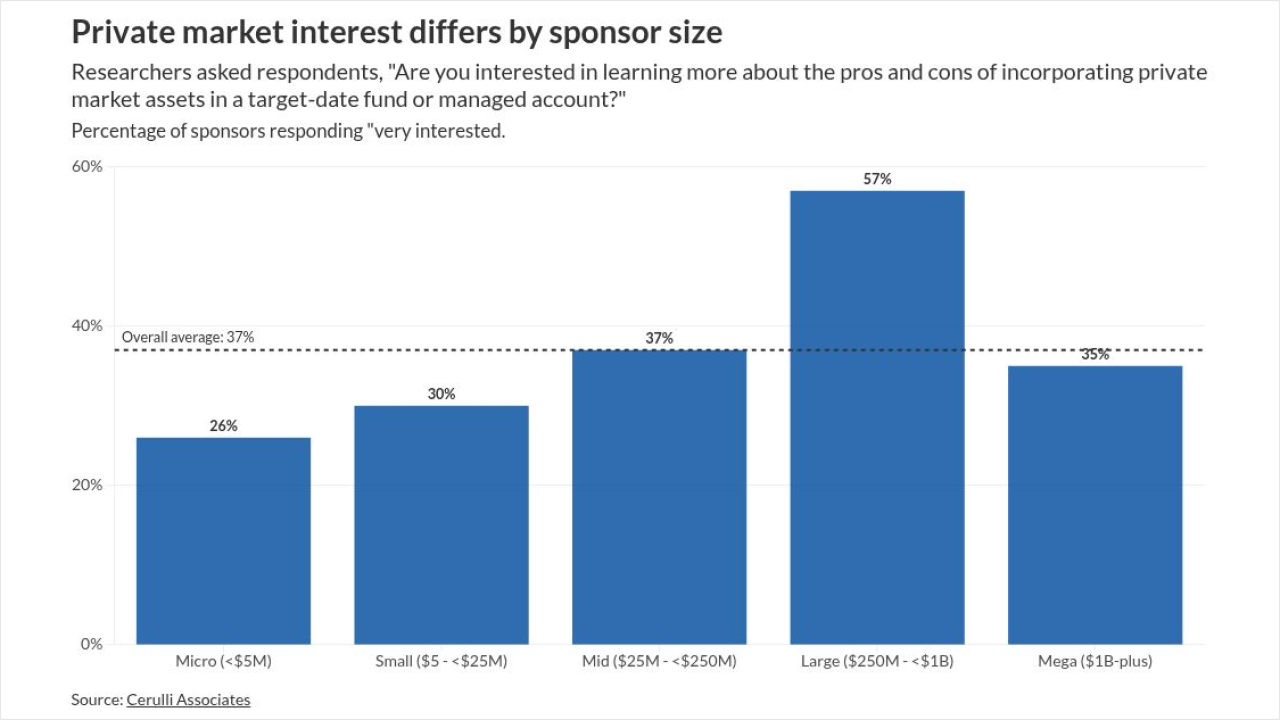

Plan sponsors show growing interest in private market investments for 401(k) plans, but regulatory uncertainty, fees and litigation risk continue to slow adoption, a Cerulli study found.

January 9 -

The regulator considers raising the AUM threshold it uses when considering how newly proposed rules are likely to affect small RIAs.

January 8 -

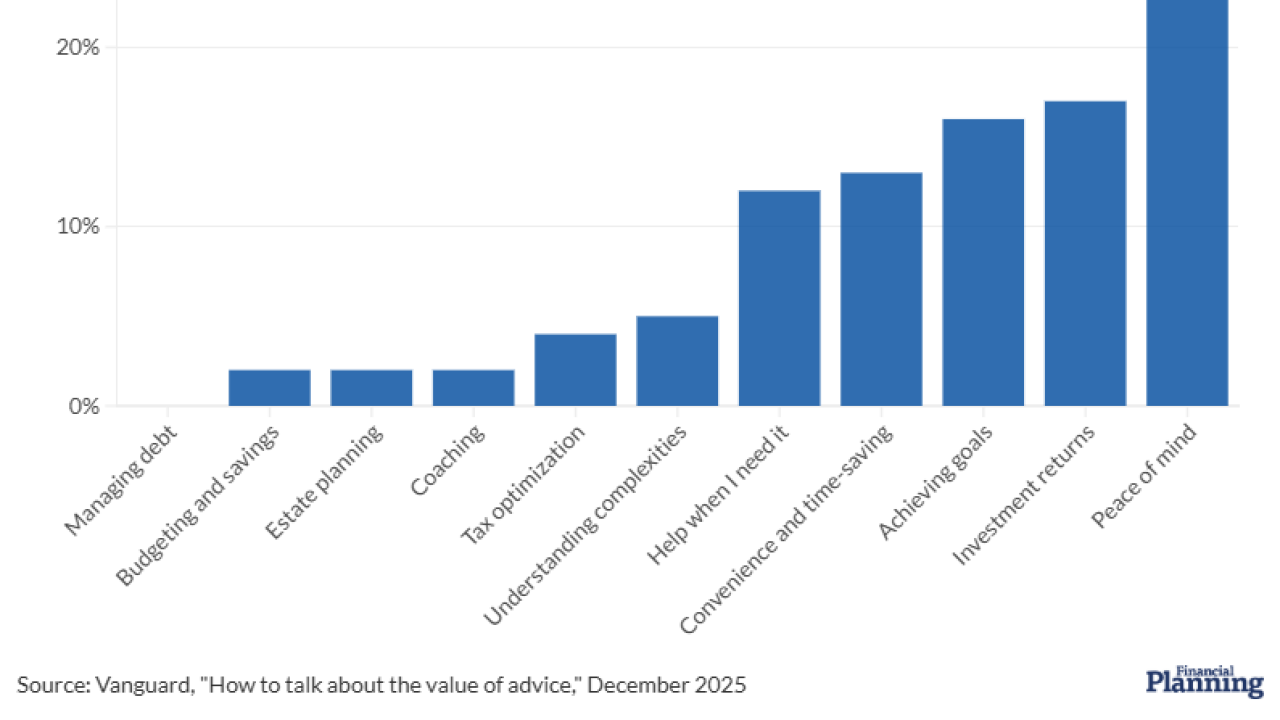

Vanguard's latest poll and analysis offers a multifaceted explanation into how financial advisors should talk about their value to clients and prospective customers.

January 8 -

The platform can offer a wide audience, but with serious content moderation and other concerns, is remaining active worth it?

January 8