-

Many advisors overlook held-away workplace retirement accounts, unaware that a rollover isn't a prerequisite for professional management.

April 2 Absolute Capital Management

Absolute Capital Management -

A video producer in New York has a new job and a new retirement plan. Can, and should, he consolidate his savings?

February 23 -

There’s a significant opportunity for advisors to help their non-business clients, earn some new ones — and it can be taken advantage of right now.

October 27 American Tax and Business Planning

American Tax and Business Planning -

The firm allegedly didn't disclose its parent company paid a teacher union entity $10,000 a month “for its exclusive endorsement” as its preferred financial services partner, according to the regulator.

July 29 -

A recent study found American workers would face better retirement prospects if the federal government adopts certain public policy changes.

January 16 -

Failing to pay taxes on side-gig earnings and keeping faulty records of business-related expenses must avoided to prevent an excessive tax burden.

January 14 -

Financial planners should at least consider modeling early retirement to prepare clients for the possibility of uncertainty, says Morningstar.

December 31 -

Clients should understand Medicare, Social Security and 401(k) changes that will impact on their retirement savings and income.

December 27 -

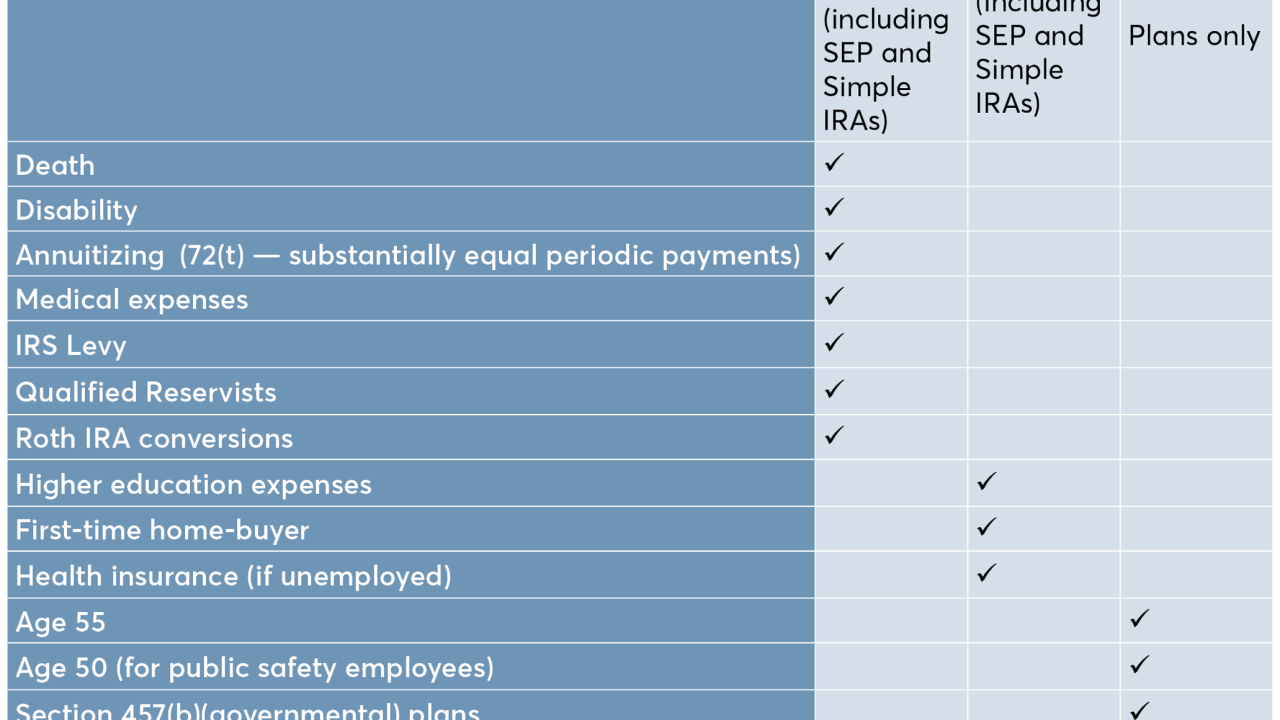

When financial emergencies compel early withdrawals from clients' retirement accounts, they face income tax and often an additional 10% penalty.

April 29 -

When leaving heirlooms and other illiquid assets to loved ones, seniors should allow the heirs to inherit the items instead of liquidating them

November 6 -

The IRS announced upward adjustments for 401(k), 403(b)s and other plans.

November 5 -

While tax reform has been a mixed bag for muni bonds, a few factors working in their favor include constrained supply this year, as well as historically low defaults.

October 19 -

Trying to time the market is a “fool’s game,” but preparing for a possible downturn as retirement approaches can be a smart move.

October 1 -

While proceeds from life insurance are not subject to income tax, there are other taxes that will apply. But there are steps to take to avoid those liabilities too.

August 29 -

Plan design features like automatic enrollment and automatic increases are having a positive impact. Such steps are designed to increase participation even from people who may be suffering from inertia, says a researcher.

August 24 -

Although the cost of living adjustment increased 2% this year, half of retirees cannot expect a substantial increase in their benefits.

July 6 -

These funds can be expensive and may not be accurate in determining investors' risk tolerance, among other potentail downfalls.

March 23 -

In addition to redesigning its business lines, the $48 billion firm is considering a robo, the president of its broker-dealer said.

August 8 -

Despite the projected increase in health care expenses, clients can expect their total living costs to decline after they retire, as they will owe lower or no income taxes and have fewer items on their budget.

March 7 -

Advisers and clients may think it doesn't matter which account makes the distribution, as long as the total calculated amount is taken from some account. They are wrong.

November 29